Why plan for CS capacity?

Capacity planning is a strategic undertaking to realistically determine what resources to hire or acquire to efficiently scale growth. For Customer Success the imperative is to ensure there’s no leaky bucket: by securing high gross retention, all new bookings expand the top line rather than fill the hole left by customer churn.

This article is intended to help customer success leaders accurately forecast headcount for the next twelve months to drive strong customer and employee retention performance. We offer actionable guidance on how to approach customer success forecasting by presenting example inputs and models.

Current Backdrop: Pandemic Planning

‘Tis the season of planning…virtually. For many of us, this is the first time we’re collaborating in Zoom rooms with our finance and operations teams using digital whiteboards like Mural rather than crowding into a conference room with colorful markers and Post-It notes. With so many macroeconomic unknowns, this year’s fiscal planning cycle is playing out a little differently.

While Covid abruptly thrust us into a remote reality, the good news is that we’ve been trending towards this tipping point anyway. According to Mercer's recent survey of 793 U.S. employers, 1 in 30 companies already offered remote work flexibility pre-Covid and 1 in 3 companies project that 50% or more of their workforce will remain remote post-Covid. Mercer reports that a whopping “94% of employers say productivity has remained the same or improved since employees began working remotely.”

With so many virtual productivity and collaboration solutions to choose from, many companies no longer need to deal with the requirements of a physical office or local recruitment constraints. We have a unique opportunity to challenge business decisions that would have likely remained unquestioned otherwise. Should we renew our office lease and assume a return to “normal” sometime in 2021 once a vaccine is widely available? Or should we transition to an all-remote, decentralized organization and begin hiring talent where talent lives? Or do we adopt a hybrid path to accommodate varying team needs?

Your customers are likely asking similar questions and facing the same pandemic challenges, making it critical to take a pause this year and to plan empathetically.

Reevaluate your customer journey

How has Covid impacted your business? Have you been hard hit or inundated with customers that you don’t have the resources or infrastructure to support?

Start by re-examining your customer journey through the lens of your customers who might require a different type of support model right now. We challenge you to call at least 20 customers across your various product lines and segments to listen and learn so you can validate what’s working and what’s not. At the very minimum listen to a handful of customer call recordings or review recent escalations and support tickets. Compare 2020 churn (downsells and terminations) to 2019 and 2018 to differentiate consistent patterns from anomalies. Analyze your Voice of the Customer (VoC), customer satisfaction (CSAT), and net promoter score (NPS) data to understand where your users might be getting stuck, realizing value, or starving for more.

With your newly acquired knowledge, go back to the digital drawing board with a cross-functional group to determine how to drive high impact incremental adaptations without boiling the ocean. Get to the “why” so you can address root cause issues and avoid falling into the symptomatic analysis trap.

Gather feedback and data from your teams

While benchmarks are valuable sanity checks, we don’t recommend capacity planning from an ivory tower. Gather feedback from your onboarding, customer success, and customer support teams to evaluate whether your current org structure will sustain future growth and stand the test of time.

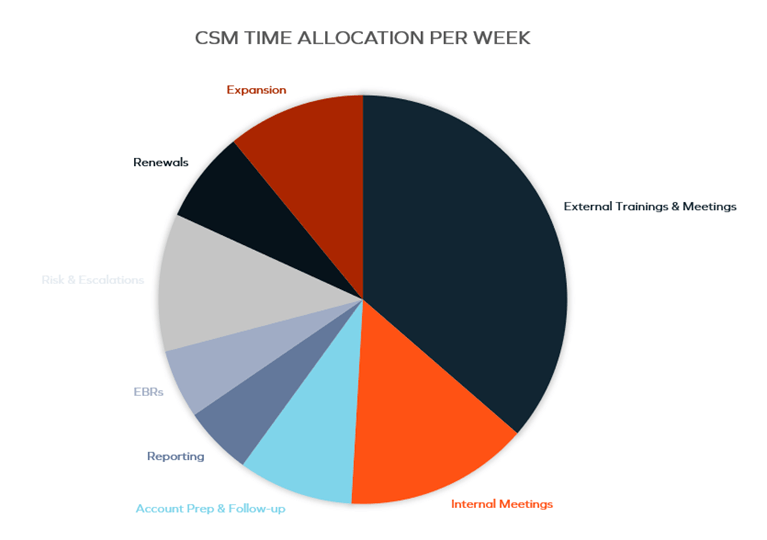

There are easy ways to do this. One is a task analysis analyzing how your teams are currently spending their time. We recommend doing this bi-annually to ensure your model reflects the current state. While the task analysis is unlikely to represent the ideal state of your business, this exercise ensures that your headcount forecasts are rooted in some semblance of reality. This data also comes in handy when you need to defend your assumptions or assertions with finance or the C-suite.

Here is an example of how CSMs at a real B2B SaaS company are currently spending their time. Due to Covid, no time is being allocated to customer-related travel.

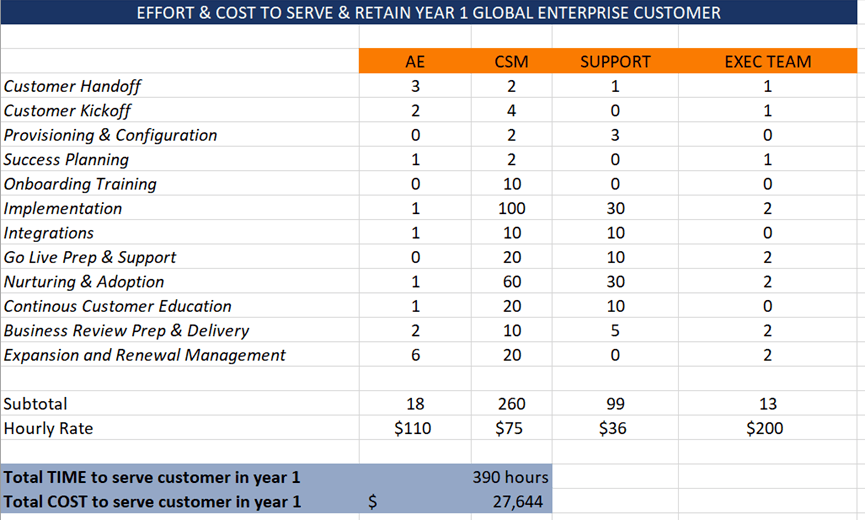

Another method involves outlining exactly what it takes to service and retain a customer. Again, if your current service model leaves a lot to be desired, that’s okay. Going through this exercise might prompt some healthy discussion, debate, process change, or investment.

Here is an example of what it takes to serve and retain the average global enterprise customer at the same B2B SaaS company in year 1.

Other Model Considerations

There are six other factors or dependencies you might want to account for:

- CSM Span of Control

- What are CSMs responsible for at your company? Are they full lifecycle CSMs or do they manage specific aspects of the customer journey?

- Percentage of Customers and Revenue in Each Tier

- What percentage of customers fall into a given tier? (i.e., Enterprise, Growth/Midmarket, SMB) How much recurring revenue (ARR) do they represent?

- Resource Availability

- Don’t make the mistake of assuming that 100% of a given resource’s time is available to service customers. Remember CSMs need time to attend internal meetings and get actual work done. Assume 80-85% of a CSM’s available hours can realistically be dedicated to directly servicing customers.

- Expected Customer Count

- How many deals do you expect to close over the next fiscal year? It is critical that you have a realistic estimate of the number of new customers you plan on adding per annum or quarter.

- Percentage of Customers Onboarding vs Launched

- Onboarding tends to require a significant level of effort and engagement compared to the post-launch phase of the customer journey. Some solutions take more than six months to launch or fully deploy across an enterprise, particularly if integrations or legacy system migration support are required.

- Once a customer launches, the level of service and support required tends to taper down as users become increasingly more proficient on the product. We recommend differentiating between onboarding and launched customers to ensure your forecasts are representative of customer lifecycle stage.

- Team Attrition

- Keep in mind that Customer Success is one of the fastest growing professions. According to Gainsight’s most recent State of Customer Success Profession Report, the number of CSM job postings has exploded on LinkedIn globally. Yet there is a dearth of talent to go around.

- The average CSM’s tenure is less than two years. Factor in the possibility that you might lose at least 10% of your team every quarter.

Example Customer Success Capacity Model

It’s finally time to build our model.

Let’s use the fictitious example of DentalBank to run through this exercise. DentalBank is a subscription software business that helps dental offices around the world manage their clinical supply inventory.

Here are some things you need to know about DentalBank:

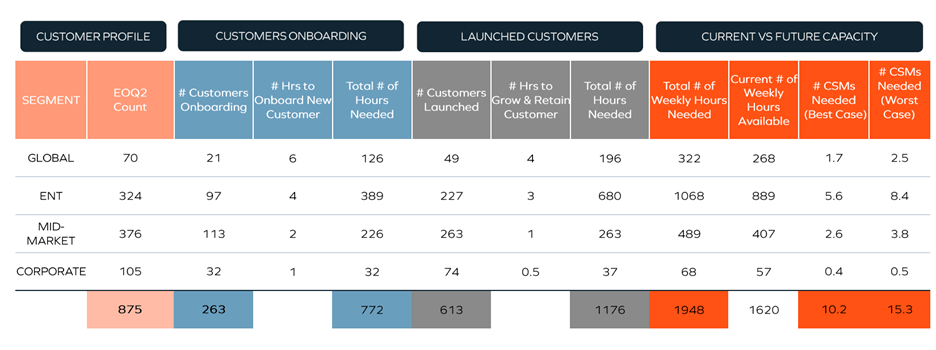

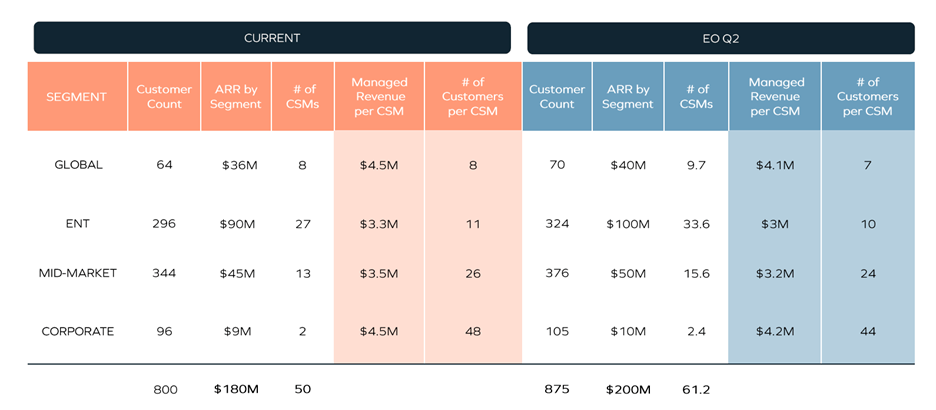

- The company is at $180M ARR today and expects to grow to $200M by the end of Q2-2021

- They have 800 customers split out by four tiers and plan to grow to 875 customers in the same period

- 100% of their revenue is managed by a post-sales CSM. They have 50 full lifecycle CSMs right now and need to figure out how many more to hire. We're assuming for the purposes of this example that each resource has 32 customer hours available per week

- At any given time 30% of their customers are onboarding

- In a best-case scenario, DentalBank assumes no one on the team leaves. In a worst-case scenario, 10% of the team walks out the door

In this model, we use CSM hours as our unit of measure. As you can see below, in a best-case scenario DentalBank needs 10 new CSMs and in a worst-case scenario, they need 15.

If you’re feeling ambitious, you might wish to account for the average amount of revenue or customer volume each of your resources currently manages today. This approach will make it easier to compare your CS model to other companies’.

We also recommend accounting for hiring and ramp times (a topic covered in our article on sales capacity planning), renewal and expansion quotas, and essential roles such as managers, technical support, customer training, and customer operations. Finally, don’t forget to consider tech automation where appropriate as well as other scalable growth levers to manage your cost to retain a customer (CRC).

Conclusion

It’s critical that customer success leaders continue to challenge the status quo and evolve their customer success and service models to meet the trending needs of customers. By leveraging data and gathering customer and employee feedback, companies can optimize the customer lifecycle and effectively forecast headcount to both sustain and accelerate growth.