As the COVID-19 crisis develops, uncertainty remains about the impact on demand throughout the sales funnel. In a recent survey of 140 software companies within Insight’s portfolio, companies are expecting to see greater impact in the future on both new and existing customers: 56% of companies expect reduced sales to new customers, 40% expect a reduction in planned up-sell, and 29% expect to see increased churn as a result of the crisis. In an economic downturn, renewals are oxygen.

This article provides guidance on the right approach to renewal negotiations in this difficult environment, helping ensure you can close the necessary deals while minimizing churn and downsell. An overarching principle is to put your customers first. Concessions to customers experiencing financial hardships today will be remembered and can help you build and strengthen lasting relationships.

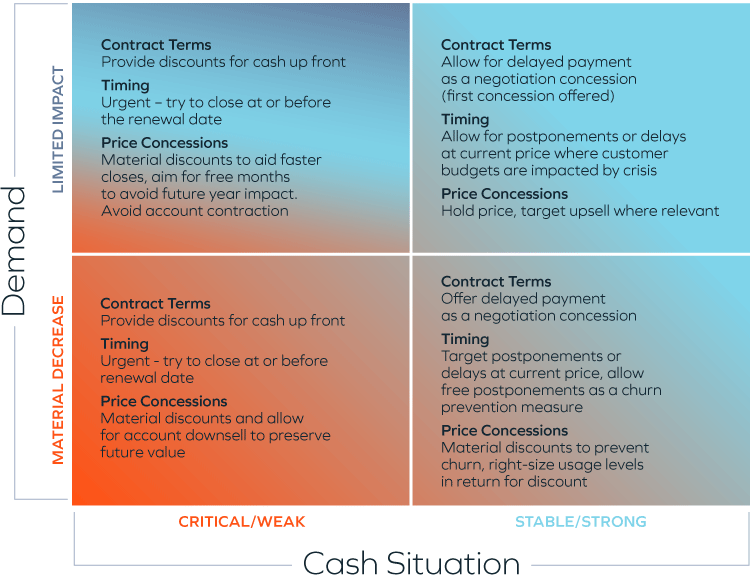

The discount guidance framework

There are three levers that can be used to improve renewal success rate: contract terms, timing, and price concessions. In the current crisis, businesses are not affected equally, and as such we have how and when to use each lever differs based on:

Cash position

- Companies in a stable / strong cash position (more than 12-18 months runway at planned / reduced burn rates) can offer more flexibility in terms of timing and contract terms to optimize the value of their renewal.

- Companies in weaker cash positions need to prioritize time-to-close and up-front cash.

Demand

- Companies who have seen limited impact on overall demand for their product, or even improvement (e.g. many solutions which assist remote working or security have seen increased demand) will be in a stronger negotiating position with customers and need to make fewer concessions.

- Those who have seen a material decrease in demand for their products will need to make greater concessions to customers in order to successfully close renewals.

Contract Terms

Many companies are currently seeing aged payables increase as a result of issues with customers paying on time, due to budget freezes following the crisis. For customers willing to commit but unwilling or unable to pay at this stage, a relaxation of typical payment terms can ensure that you can close renewals. Some of our portfolio companies have reported they are seeing an increase in customers’ ability to commit after offering 90+ day payment term extensions.

- Weak cash position – Companies in a weak cash position will need to expedite payment wherever possible. As such, we would recommend targeting discounts to encourage payment-up-front for customers who are able to do so.

- Strong cash position – Delayed payment terms (90 or up to 180 days) may be beneficial to expedite deal closes and should typically be the first concession offered on the table for customers who are experiencing budget difficulties.

Timing

With the current level of market uncertainty peaking, Q2 renewals may be under pressure and customer’s willingness to sign up for longer term commitments When the market stabilizes, we will likely see some confidence return. In many cases it may make sense to allow customers to renew on shorter term contracts to ‘ride out’ the crisis and return to the negotiating table once the situation is clearer.

- Weak cash position – Companies in a weak cash position are unlikely to have the luxury of delaying their renewal date. Focus on expediting payment terms and using price concessions as noted above.

- Strong cash position / Limited impact – With limited impact on demand, companies in this quadrant should attempt to renew customers on time wherever possible. However, in cases where customers are going through a short-term budget squeeze it might be best to allow negotiation of a 90-day renewal at their current rate in order to prevent contraction or excessive discounting.

- Strong cash position / Material decrease – Companies in this quadrant can proactively offer a delay at the current rate to customers whose renewals are likely to be particularly impacted, so that the renewal negotiations can take place where customers are more able to commit. As a last measure to prevent regrettable churn, offering a no-cost extension to their current contract for a limited period (e.g. 90 days) can ensure that the relationship continues and offers hope for a future renewal.

Price Concessions

Offering discounts on the price paid is a powerful way to incentivize renewals and can help your relationship with customers in these trying times. As per our prior general discounting guidance, we would recommend central control of the level and messaging behind discounting to ensure that it is consistent and most effective. As a guiding principle, where possible, trade off value for the lower price (e.g. offer customers a lower package that will still fulfill their needs, or a lower usage allowance if you have usage-based pricing). In most cases, we recommend waiving contractual price escalators and planned price increases on like-for-like renewals as a gesture of good-will. Ensure that this action is clearly communicated to the customer.

- Weak cash position / Limited impact – With the impact of your value proposition unchanged overall, ensure that discounts are messaged around the impact of the crisis on budgets and target discounts that will disappear in future years of the contract (e.g. free months). Avoid contracting customers or shifting them to a lower plan (unless they actively request it) to allow for that customer’s continued growth in future years. In return for additional discounting above this, target improved contract terms (e.g. cash payment up front).

- Weak cash position / Material decrease – It is likely you will need to make significant price concessions (30%+). Where possible, right-size customers onto lower plans or usage to match their budget, which will preserve upsell in future years if they grow their usage. Offer free months at first to provide a discount for this year, although discretionary discounting beyond this may also be necessary to get the deal across the line.

- Strong cash Position / Limited impact – Avoid discounting where possible, focusing concessions on contract terms. While we typically recommend applying a standardized price increase on like-for-like renewals in “normal years”, this should be avoided in the current climate. Instead focus renewal efforts for healthy customers on up-sell to higher plans or usage levels.

- Strong cash position / Material decrease – Offer concessions to customers who are struggling to see the same value from your product as they did before, and those who are experiencing budget difficulties. Right-size usage levels for customers who will use the product less in the next year, and track usage to ensure you can charge for overage, or can use this data in future renewal discussions

General tips for optimizing renewal value communication still apply

Even in the current economic environment, there are evergreen pricing best practices for renewal optimization that still apply. In the light of increasing price pressure these are more important than ever. Below are two examples of approaches that can help support a successful renewal negotiation.

- Differentiate your pricing and negotiation strategy by customer in order to best match willingness-to-pay. In addition to the variables underpinning your typical price model, we’d recommend differentiating your renewal approach on a customer-by-customer basis looking at the following factors:

- Customer adoption (e.g. customer health score and data on actual product usage). Usage data is core to understanding the value customers receive from your product and to help CSMs and salespeople make a compelling argument for renewal

- ROI impact / mission criticality of your product to the customer

- Likely impact of current crisis on economics of customer (or economics of industry that the customer operates in)

- Customer’s plans for expanding (or decreasing) product usage

- Customer adoption of new features released in the last year (i.e. how much value have you added since last negotiation)

- Customer specific communications help remind healthy customers about the value that they are receiving from the product and strengthen their value perception going into a negotiation. We’d recommend the following data points be shared with the customer to help strengthen your negotiation:

- Key areas of value relevant to their industry and product set which have been introduced in the releases since their last renewal

- Actual product usage of their features to prove that they are receiving this value

- Frequent updates / communications around this topic mid-contract where feasible (e.g., ‘Here’s what we’ve added in this quarter’ newsletters)

Have more questions around managing pricing during COVID-19? Onsite is here to guide you via our experience and pattern recognition. We can be reached at PricingOnCall@insightpartners.com.

Explore the SaaS Growth Acceleration Framework

Explore this topic and 40+ other critical business considerations in our interactive SaaS Growth Acceleration Framework for founders and GTM leaders.Here’s how SaaS leaders ($10m + ARR) can use this framework to win:

- Understand the downstream implications of 40+ critical business decisions

- View how product-related decisions can shake the foundation of your go-to-market strategy

- Dig deeper into any GTM component to view key questions you should be asking when making changes