Key Takeaways

● Inflation is at its highest level in 40 years, creating a different environment for technology businesses.

● Inflation impacts ScaleUp valuations, margins, and cost of capital.

● Better price management is the best way to take action in an inflationary environment.

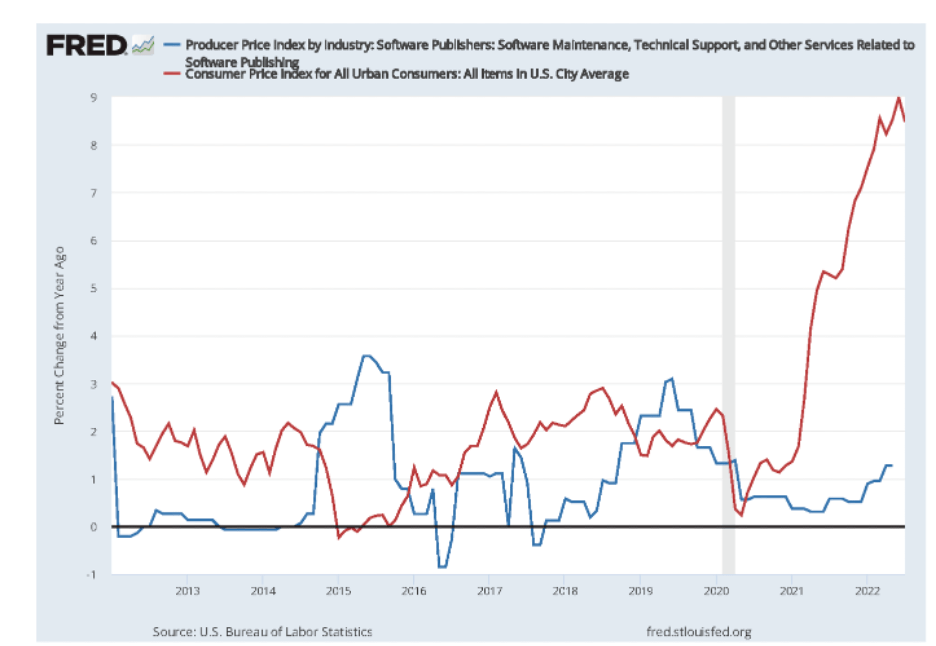

Inflation is at its highest point in 40 years, and software ScaleUps should act to ensure their prices don’t get left behind. A recent reading of the U.S. all items Consumer Price Index (CPI) suggests that, at its recent peak, inflation rose at an annualized rate of 9.1% in the U.S. For comparison, at the start of 2021, that number was 1.4%.

Generally, a CPI of between 2% and 3% per year is considered healthy — it suggests that the economy is expanding and wages are increasing in a controlled, predictable manner. You would have to go back to January 2012 to find an instance when U.S. inflation exceeded 3%, and all the way back to 1981 to find inflation as high as the current levels.

Historically, software and SaaS prices have lagged behind the CPI and continue to do so. With the notable exception of 2015, software inflation has been far below that of consumer goods for at least a decade, usually oscillating around the 0% mark. Even since the pandemic, as hardware prices surged up to 20% over the past two years, software prices rose only around 5% to 7%. This means that your software contract values fall because price increases haven’t kept pace with overall inflation.

Tech stocks have historically fared poorly during bouts of elevated inflation. As stock values fall it becomes harder for tech companies of all sizes to raise capital. In addition, while the price of software typically lags behind CPI inflation, costs don’t. During times of inflation, software companies see a significant increase in the costs of hardware, infrastructure, and labor. This squeezes margins and increases cash burn unless ScaleUps act to keep pricing current with the times.

SaaS Pricing Provides Untapped Potential

Properly setting prices is an untapped opportunity for SaaS providers to squeeze more value out of what they offer. We often see companies who haven’t touched their pricing for three years or more — which might explain the lack of inflationary growth in the sector. Usually this means companies have built up a significant amount of pricing power through market growth and product improvement which they haven’t yet monetized. While this was also the case well before the current inflationary environment, now the opportunities are even greater — while the risks of not adapting your pricing are more severe.

The opportunities for ScaleUps to review their pricing lie in multiple paths. You can change your price metric, your packaging, or simply how much you charge. While, historically, companies have been able to generate significant revenue from either price-metric or packaging changes, in the current environment, a well-thought-out price-level change or contract-based escalators (see below) can also add significantly to your revenue growth.

The work of determining pricing is also never done, is all the more critical in today’s high-inflation environment. Thus, ScaleUps can continue to dynamically assess their pricing as inflation ebbs (hopefully soon) and flows. It allows you to see whether pricing changes reflect the value of what is on offer, and when and if adjustments need to be made.

4 Tactics ScaleUps Can Use To Combat Inflationary Pressures

The challenge of inflation is not insurmountable. There are a number of ways to respond, and it is not a matter of either/or. Any B2B SaaS business facing margin erosion has a number of options open to them:

- Add price escalation terms to contracts. If you have pricing power, we would strongly recommend you consider including price escalation terms into your software contracts so that your prices can keep pace with both your costs and the significant investment in product that is typical of most ScaleUps. In general, we recommend that pricing escalators consist of an inflation component (typically CPI) as the baseline, plus between 3-5% to cover any significant product improvements that customers get “for free” with their current subscription. You should also consider allowing your sales teams to negotiate these numbers down as needed to maintain strong win rates – but for less price-sensitive customers it can provide a helpful boost in future contract years.

- Review your pricing. Compare your prices with the value you generate. If you are underselling, maybe this is the time to review your pricing strategy (by changing metric or packaging) or increase your prices to match what the customer is willing to pay. While this can be a very effective measure, it’s important to think carefully about your price changes and how they will be received by the market. For more information on the “right” way to increase price, see our checklist for success.

- Focus on premium products. If you’re selling a portfolio of products rather than just one, it’s important to keep in mind that premium options in your portfolio are likely to have higher margins and provide higher average contract values. In times where inflation drives up costs, guiding customers who are willing to pay for more expensive products and services can be a good way to improve margins and cash flow.

- Optimize the costs you can control. As my colleague Eli Potter wrote, “a useful framework for strategic cost optimization… helps companies evaluate the trade-offs between benefits, costs, risks and viability of different cost-optimization initiatives.” She recommends a four-step process:

- Asset management

- Align infrastructure to reduce demand

- Rationalize portfolio and infrastructure

- Offer tiered, need-based service levels

Regardless of how high price levels go, or how “transitory” the current inflationary cycle proves to be, CxOs who are able to apply the right strategies will be well-positioned both in today’s inflationary environment and the future.