Voice of the Customer: Lessons Learned from the Insight Portfolio

“Voice of the Customer,” referred to commonly as VoC, has become a widely accepted vehicle to mature organizational customer centricity. But what exactly does VoC refer to?

Despite VoC’s rising popularity, as evidenced by trending LinkedIn hashtags and new-age professional titles such as “Vice President, Global Voice of the Customer,” the SaaS community has not aligned on a common or consistent definition to describe this buzzworthy concept. In marketing or customer success circles, VoC tends to be synonymous with quantitative or qualitative research, a client advisory board (CAB), or customer sentiment surveys (e.g., NPS or CSAT). In technical support or product management circles, VoC often refers to a case deflection effort or feature request channel.

To reconcile these disparate viewpoints, we decided to poke under the hoods of a few companies to listen, learn, and capture some data. Read on to take home some valuable lessons from our recent VoC roundtable and be sure to download our Voice of the Customer Activation Kit by filling out the form at the bottom of this blog.

2021 Insight Voice of the Customer Survey

In 2020 and 2021, the Insight team attended over twenty VoC-related events. To capture a greater diversity of thought, we took our learning exercise a step further by surveying and interviewing companies at varying stages of growth across our portfolio.

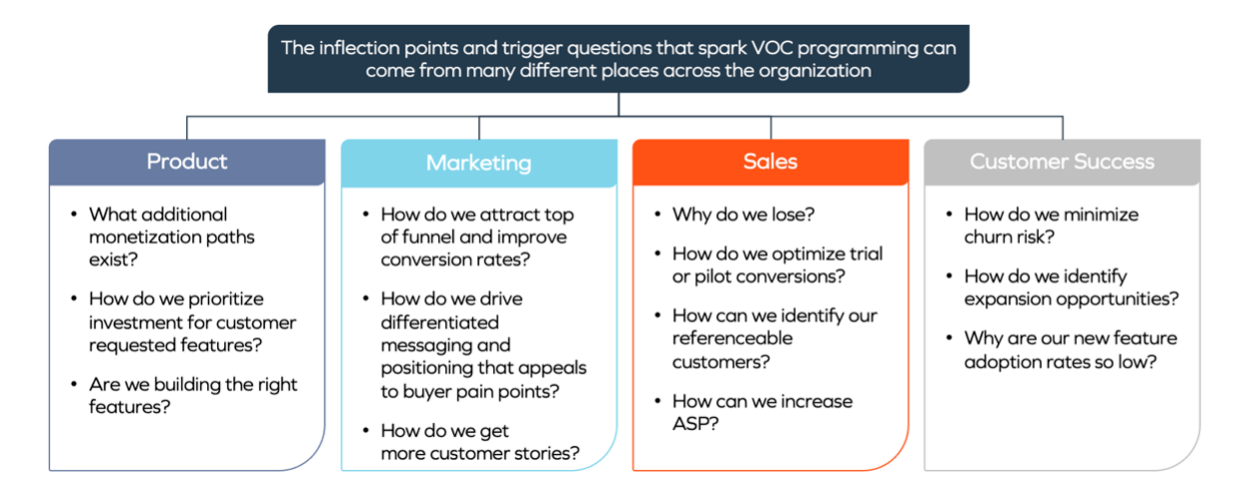

Fifty percent of the companies we surveyed DO NOT currently have a VoC program in place today. Of the remaining 50% that DO, VoC is solving a wide range of organizational challenges. These include:

- Generating customer reviews and references.

- Reducing ticket volume and support costs.

- Bridging the gap between customer, partner, and internal feedback.

- Strategically informing and influencing product development.

- Improving brand visibility.

- Influencing enterprise strategy.

- Generating organizational awareness of product gaps and issues.

- Understanding the impact of new features.

- Identifying customer pain points to improve the customer experience and market positioning.

Unsurprisingly, VoC departmental ownership varies considerably. Forty-four percent of companies reported VoC residence within Customer Success. The remaining 66% of respondents were split almost evenly across marketing, product, sales, and customer support departments.

This variability helps to explain why definitions and perspectives on VoC differ widely within the SaaS community. VoC might have a different address and owner depending on what it is solving for and where it resides within an organization.

Arriving at a compatible definition

It took us several weeks to land on a suitable definition that could accommodate the different schools of VoC thought. This definition passes our litmus test for now:

Voice of the Customer is the programmatic approach to collect, analyze, and action customer insights to improve the customer experience (CX) and accelerate growth.

VoC is an evolutionary journey

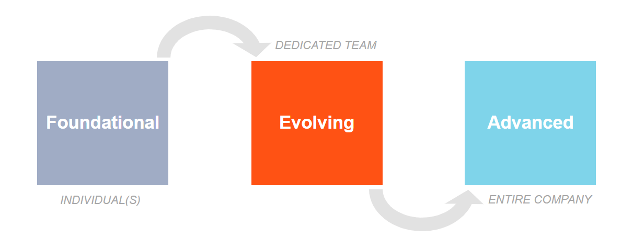

Implementing a successful VoC program is an iterative “test and learn” process. Each new milestone leads to additional opportunities to elevate your program’s impact and influence needle-moving growth levers. Here’s how we classify each stage:

Foundational: At this stage, companies have identified a critical gap and are collecting targeted insights to address it. Typically, a specific trigger event sets the gears in motion (e.g., unexpected churn). VoC is largely a reactive effort and typically represents a portion of a single FTE’s time.

Evolving: VoC is evolving into a scalable and proactive program. Companies typically have a dedicated VoC resource or team that is focused on early tech automation and driving more-aggressive customer and business outcomes.

Advanced: It typically takes several years before a company advances to this stage. To serve a substantial customer base (think thousands of customers or millions of users), VoC is deeply integrated into organizational-wide OKRs and planning processes. Companies often have a standalone VoC team or department with a dedicated budget and headcount. They may even have a named VoC or customer experience (CX) executive.

Regardless of whether you are a 10M or 100M ARR company, if you are just getting started, avoid over-engineering your program. Start by addressing your customers’ most pressing needs to generate some initial traction.

When to start a VoC program

Now! VoC should be an integral component of a company’s early DNA. The longer you wait, the larger and costlier your gaps will grow as your company scales rapidly.

VoC Business Impact

VoC programs have the potential to drive considerable company ROI by driving product innovation, demand gen, and higher rates of retention. As a company’s customer base grows, VoC offers a scalable customer engagement platform that doubles up to generate rich customer insights while also fostering customer centricity, brand affinity, and product stickiness.

Demystifying VoC - a recent roundtable

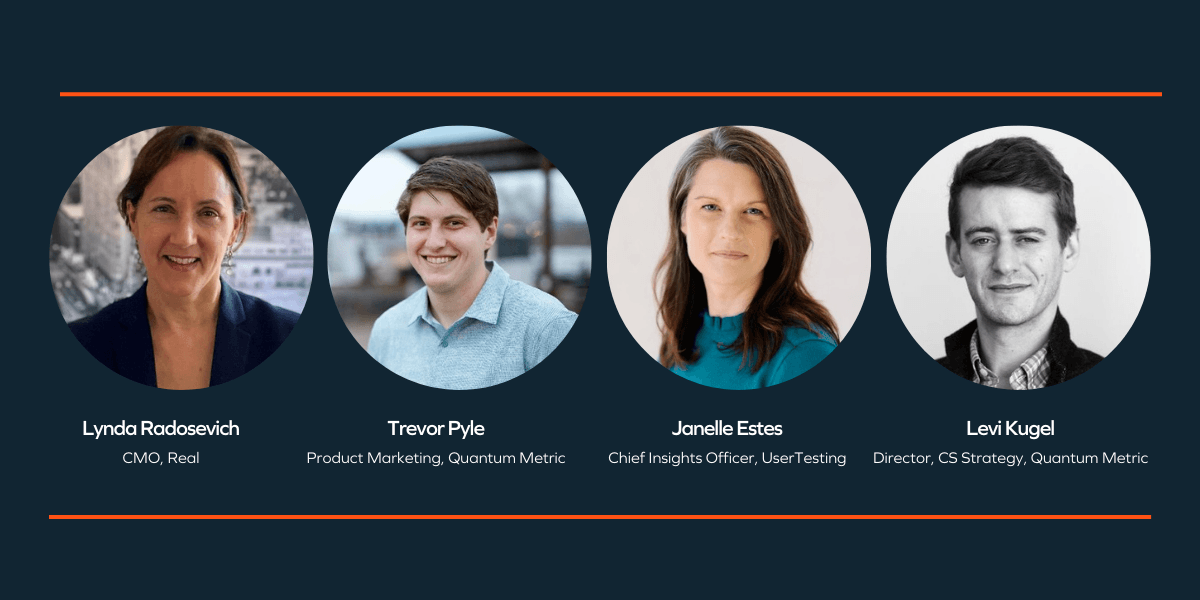

In May, we sat down with three Insight portfolio companies to understand the evolution of their VoC programming. Our esteemed panel included the following VoC practitioners:

Here are the highlights from our discussion:

Andrew Korbel [Insight Partners]: How do you define VoC?

- Janelle Estes [UserTesting]: VoC has been tied to things like NPS and surveys, but it goes beyond that. It is about collecting input from customers as they are having an experience with your product. It is a more holistic view of the customer and less reactive than just capturing standard measures.

- Lynda Radosevich [Real]: We never spun up a formal VoC program, but from the start, we made sure to embed join and other surveys from our founding in 2015. It has given us a rich pool of customer data to lead our business with.

- Trevor Pyle [Quantum Metric]: We bucket VoC into inferred feedback, indirect feedback, and direct feedback. Direct is verbatim from customers in the form of CSAT or other surveying. Indirect comes from sentiment analysis, call center analytics, look at emails, and other things like that. Quantum Metric captures the inferred feedback – behavioral metrics like if someone is repeatedly clicking somewhere or force reloading or showing other traits of frustration.

- Levi Kugel [Quantum Metric]: We have all these customer signals that tell us so much about the customer journey as they are engaging with a product. VoC for us is really an amazing way to get direct feedback from the customer in addition to inferring what they struggle with. We married the two to get this beautiful story of customer sentiment and satisfaction.

Andrew Korbel [Insight]: What was the inflection point to start a VoC program within your company?

- Levi Kugel [Quantum Metric]: It was quite serendipitous for us and has evolved. It has become about creating and fostering a partnership with the customer to be able to continuously test the wind and understand our key stakeholders. The executive visibility into how our customers are feeling about us on a regular basis was really the impetus that drove us to jump into this.

- Trevor Pyle [Quantum Metric]: From my angle, it was much more tactical. How do we better identify advocates who we are engaged with? How do we find those people who absolutely love the product that we've never even spoken with? That is where it kind of came into structuring it out. We have scaled up that program to identify some of those advocates. I also have to mention the godfather of VoC, our Chief Customer Officer, who founded OpinionLab. He’s been embedding VoC from the start.

- Levi Kugel [Quantum Metric]: Thinking about Trevor’s point on the CCO, having somebody at the executive level that can champion the importance of this is critical to a successful program. Back to the inflection point, though; as we got more feedback, it started to get challenging how to organize it. That made us realize that we needed to really invest in a way to keep track of this, and then also become more proactive with the feedback that we were getting.

- Lynda Radosevich [Real]: It was in the founding DNA of the company with simple customer onboarding and exit surveys. Then we started doing qualitative surveys to get more insight into what people were happy or unhappy with. Finally, I would say our community is a big part of our VoC. It is unstructured, but I cannot emphasize it enough. It influences our product direction and strategy. What I most appreciate is that we have data going back to the beginning. Don’t be afraid to start gathering, even if you don’t have a strategy yet. You will find uses for it. We’ve used data for investors, we’ve used it for product roadmaps, we’ve used it to completely change our quarterly goals.

Andrew Korbel [Insight]: How are you operationalizing VoC?

- Lynda Radosevich [Real]: We make VoC visible at the leadership level and back to customers through webinars. Even if you don’t have dedicated staff like us, find an owner for VoC. Also, you really have to market the results within the organization, especially at the senior level. Creating a presentation and marketing the heck out of your data helps make customer-driven decisions.

- Levi Kugel [Quantum Metric]: VoC and Quantum Metric are like steak and eggs – they go well together. A very large portion of our customers use VoC as a means of accelerating customer satisfaction. At a baseline, a lot of our customers can click and understand how a customer’s journey led to a sad, dissatisfied response or any sort of feedback. We can then take that, and using Quantum together with VoC, quantify this on the rest of your customer base. We can put a dollar amount of whatever transactional behavior you have on your site and quantify it.

- Trevor Pyle [Quantum Metric]: We take the same process internally. If an executive stakeholder is at NPS = 1 because some feature is broken, we can go and look at that, see how many other people are experiencing the same issue, and determine how to prioritize. Last, if customers leave negative feedback in the platform, we have an integration that sends that to a Slack channel and notifies the account team and support team.

- Janelle Estes [UserTesting]: We start every company all-hands meeting with a customer story. That is a way to frame everybody around the fact that there is a world beyond our teams internally. The other thing that we do is we meet at the management level bi-weekly and use the HEART framework by Google. It's a great framework for looking at different parts of your customer experience to measure it. So the word HEART, each letter in that word stands for a metric related to customer engagement or sentiment.

Andrew Korbel [Insight]: What’s in your tech stack for VoC? What are some tools that you could not execute VoC without?

- Levi Kugel [Quantum Metric]: Aside from using Quantum Metric, it’s worth mentioning that we started very small, very simple, and it was so powerful. We currently run two types of surveys: transactional NPS, which we engage with our customers as they’re in the product, and relational NPS, which we engage with our key stakeholders on a regular cadence. Our tech stack really revolves around Qualtrics and Quantum. We were able to accomplish everything we wanted to do for under $1,000 with Qualtrics to start.

- Trevor Pyle [Quantum Metric]: The cheaper tool that we used initially is called Beamer, which also has an NPS component. We connected that with Zapier to connect it to Slack and Salesforce.

- Lynda Radosevich [Real]: We’ve been scrappy in our approach. If you look at the different types of surveys we do, we create our own NPS onboarding and exit surveys using Typeform. Intercom is our customer service ticketing system that provides a transactional CSAT score. We have our customers do the NPS survey without entering their names, so there’s integration between Typeform and Intercom. For analysis, I output into a CSV and then work quantitatively, but also use a word cloud generator. I would also mention we’re using Facebook workplace as our community. We get a ton of feedback and specific product recommendations. All of that goes into our wiki.

- Janelle Estes [UserTesting]: We use Qualtrics for NPS. We also use Survey Monkey for other things. After onboarding, in regular check-ins with our customers, we have Zendesk in our support team to track calls and see CSAT. We use Pendo in our product for messaging, but also to get feedback at certain moments in time. We found that incredibly useful when we launch a new feature and can get feedback about it in the product. We also use a product called Chorus in sales calls. I think Gong is the other one available. We don’t have a central place where this all lives, though. I still feel like that problem has not been solved yet.

- Lynda Radosevich [Real]: We use Chart.io as our analytics interface. We feed NPS into Chart.io, but that doesn’t mean it’s used. Our biannual NPS presentation loops are our one place, but I agree there is not one great place to house this information.

Andrew Korbel [Insight]: What is one learning you’ve had that you wish you’d known before you started down this path?

- Levi Kugel [Quantum Metric]: One of the most surprising things for me was the power of utilizing chat, and in particular, Slack, to really showcase incoming feedback to the company. People are taking the feedback, rallying around it, and trying to solve problems for people.

- Trevor Pyle [Quantum Metric]: We have our NPS feedback survey deployed on anybody who’s been into the platform for 14 days. We realized at one point we had feedback turned on for trial accounts or folks that were in active sales processes with us. At first, we freaked out. Then, it was really interesting because we invited the solutions engineers who are running the proof of concept, and they said it was great feedback to give to the champions to get more stakeholder buy-in. You have to decide if that works with your sales cycle. If you have a longer sales cycle, it could be kind of cool to get VoC as soon as they are in your prospect funnel.

- Janelle Estes [UserTesting]: The most important thing is trying everything that you’re leaning back to something that the business cares about. The way that I’ve done that is when we see lots of requests come in for the same thing, we tie dollars and revenue to those asks. Then our qualitative data are stories we can tell about the customers that are asking about this.

- Lynda Radosevich [Real]: Start now, if you haven’t already and be scrappy if you have to. Make a big deal about the results – market your results. The last thing is tell stories. If you do an NPS, and you get ecstatic customers, interview a handful of them and get some stories. Interview the unhappy ones and get some stories.

Voice of the Customer Activation Kit

We encourage you to complete this form to download our VoC guide, checklist, and roadmap.