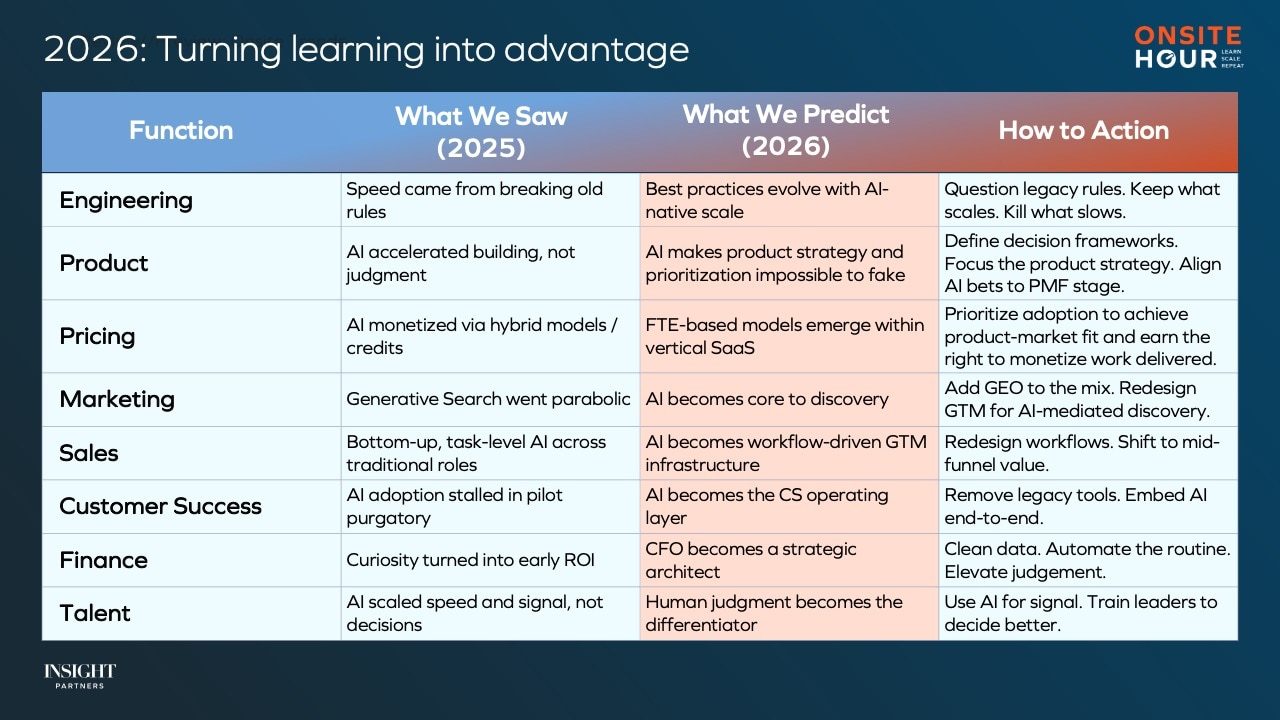

The patterns shaping AI adoption in 2026

By 2026, the experimental phase of enterprise AI is over. The past year was defined by teams layering AI on top of fragile workflows in pursuit of quick wins. That novelty has faded. What remains is a more durable shift: AI is moving from a feature to foundational infrastructure.

As software creation becomes faster and cheaper, execution alone is no longer a differentiator. The constraint has moved upstream. Strategy, data integrity, and decision-making can now determine whether AI accelerates growth or simply magnifies existing dysfunction. In many organizations, the real bottleneck is not technology. It’s human indecision.

Across functions, the same theme emerged: Companies that treat AI as connective tissue, rather than a point solution, are reshaping how software businesses are built and scaled.

This piece comes from Onsite Hour, a weekly virtual event series for portfolio companies, created by Insight’s 130+ in-house experts. This blog draws on insights from Insight Partners advisors and operators, including Jordi Buller, Rachel Weston Rowell, Ethan DeSilva, Neal Behrend, Jeremey Donovan, Blake Lindgren, Winnie Aoieong, and Dominic Olszowski.

You can also read this year’s Investor predictions and GTM, enterprise, and government predictions at the links.

Rethinking the “right” architecture

For years, cloud-native, multi-tenant architectures were treated as universal best practices. In an AI-native world, those assumptions are being challenged. Technology Advisor Jordi Buller observes, “We’re starting to see the rise of anti-patterns actually being really useful as teams are figuring out how to continue to scale and grow.”

Innovation teams are moving closer to the CEO, not the CTO, to reduce decision latency. Some organizations are returning to on‑premise deployments to address data privacy, regulatory requirements, and CIO concerns. At the same time, human-in-the-loop workflows are re-emerging as a practical response to the volume of AI-generated code produced by tools like Copilot and Claude.

Rather than signaling regression, these shifts reflect a pragmatic recalibration. “We are probably now at some similar epochal evolution of what it’s going to look like,” Buller noted, comparing today’s shift to the industry’s move away from the waterfall model.

In practice, this is changing how engineering leaders allocate time and responsibility. Senior engineers are shifting away from writing syntax and toward orchestrating and reviewing AI Agents, treating code generation as a starting point rather than an end state.

Agility remains relevant, but only where it actively removes friction — teams are stripping ceremonies to sustain speed. And instead of broad integration, many companies are forming small, isolated innovation teams that can break cleanly from legacy constraints.

“There’s very little that cannot and should not be questioned right now, and it’s all about what we identify and move past.”

When product strategy becomes the bottleneck

As engineering velocity increases, weaknesses in product strategy become harder to ignore. The cost of building the wrong thing has never been higher, precisely because it is so easy to build.

“[The advantage] will be who has the clearest strategy and decision-making system.”

Executive Vice President Rachel Weston Rowell notes that product teams are moving away from measuring output and toward measuring judgment. Writing more Product Requirements Documents (PRDs) is no longer the goal. Making fewer, higher-conviction decisions is. “I expect in the next year, the advantage won’t be who has the most AI. It will be who has the clearest strategy and decision-making system,” says Weston Rowell.

Discovery and delivery have collapsed into a continuous loop. Product leaders now rely less on anecdotal feedback and more on pattern recognition across call transcripts, usage data, and behavioral signals. Effective teams are explicit about decision rights where AI informs, and where humans decide.

“In 2026, AI won’t be making decisions for product managers, but it will make it painfully visible where we have indecision and lack of strategy,” says Weston Rowell.

This has forced a reset in how product teams operate day to day. Static quarterly roadmaps are giving way to dynamic portfolios that adjust continuously as market signals evolve. The value of a PM is no longer measured by the volume of documentation produced, but by the clarity of strategic intent behind each decision. Product bets are increasingly treated as live experiments, iterating in near real time as both code and customer feedback accelerate.

Product-market fit unlocks predictable price models

In 2026, monetization is inseparable from product design. Vice President Ethan DeSilva argues that many usage-based credit models have reached their limits. Buyers want predictability. Sellers want simplicity.

As agentic solutions evolve to own end-to-end workflows, some companies are experimenting with fractional full-time equivalent (FTE) pricing. “I think Agentic AI solutions in vertical SaaS with strong product-market fit will move beyond credit-based models and unlock fractional FTE-based pricing models,” says DeSilva. This model aligns pricing with how buyers already think about ROI, while avoiding the attribution challenges and the need for buyers to develop new mental models that come with outcome-based pricing.

“Predictability is becoming a competitive advantage.”

As inference costs decline, the margin risk of predictable pricing continues to fall. “You need to build the product around the price model,” DeSilva advises. “Predictability is becoming a competitive advantage.”

As these models mature, pricing teams are deprioritizing token-level precision in favor of simpler economics that buyers can plan around. Bundled and adoption-friendly models are being used to earn trust with buyers and accelerate learning loops, especially in early agentic deployments. In an environment where compute costs continue to fall, predictable pricing is emerging as a stronger competitive signal than hyper-granular usage measurement.

Not just SEO, add generative engine optimization

The B2B buying journey has shifted faster than many teams anticipated. Senior Vice President Neal Behrend highlights that generative AI and conversational search moved from a secondary research channel to the primary one in under a year.

“GenAI and conversational search are now the most used sources of information.”

“GenAI and conversational search are now the most used sources of information. That doesn’t mean they’re the most trustworthy, it just means the most people are saying that they’re using it as part of their research process,” says Behrend.

As a result, brand visibility inside AI-generated answers has become a board-level concern. Marketing teams are increasingly responsible for supplying structured, credible data that large language models rely on when forming recommendations.

This evolution has given rise to generative engine optimization (GEO). “Your AI visibility is going to be a core component of your go-to-market motion,” says Behrend. “What the AI is saying about you, and the opinions it’s sharing, are going to be really important.”

Teams are responding by narrowing their focus on the specific queries and categories where AI-generated answers most influence buying decisions. Measurement is shifting toward how often — and how favorably — a brand appears inside generative outputs, not just search rankings. From there, content and data strategies are being deployed to mirror how customers actually engage with conversational tools, in addition to legacy SEO strategies.

Moving beyond pilot purgatory

In 2025, many revenue teams applied AI tactically — improving email drafts or call summaries without changing underlying workflows. Executive Vice President Jeremey Donovan and Vice President Blake Lindgren argue that this approach has run its course. “We had this issue in 2025 of…kind of trying to dam a river by throwing sticks into the river as an individual, and that really isn’t the way we think that AI in sales is going to generate value,” says Donovan.

“We realized that simply layering AI on top of old manual workflows only gave us micro-efficiencies.”

Impact comes from redesigning systems end-to-end. AI is becoming an operating layer that can surface risk, expansion signals, and churn indicators earlier than humans can.

This shift elevates the role of the customer-facing professional.

“We realized that simply layering AI on top of old manual workflows only gave us micro-efficiencies,” argues Lindgren. Effective CSMs are no longer task managers; they are strategic advisors, supported by automation that handles onboarding, data hygiene, and reporting.

The result is a reorientation of sales and customer success around integrated workflows. AI is moving from top-of-funnel productivity tools into mid- and late-funnel systems that surface account risk and opportunity.

Automated onboarding and data mapping are shortening time to value, allowing CSMs to engage as strategic advisors earlier. Rather than optimizing isolated use cases, teams are adopting operating-system-level approaches that manage the full customer lifecycle.

From scorekeeper to value architect

In many organizations, finance teams have emerged as some of the fastest adopters of AI, driven by clear data structures and measurable outcomes. Senior Vice President Winnie Aoieong notes that the CFO mandate is expanding from cost control to value creation.

“The modern CFO is not just the guardian of value, but the architect of future value.”

AI-enabled finance organizations are improving forecast accuracy and compressing cycle times dramatically. Yet automation is not eliminating finance roles. It is changing them.

The work now centers on validating AI outputs, governing automated decisions, and partnering cross-functionally to unlock growth. “The modern CFO is not just the guardian of value, but the architect of future value,” Aoieong says.

To support this shift, finance leaders are investing heavily in foundational capabilities. Data quality has become non-negotiable, with teams doing the unglamorous work of cleansing and standardizing inputs. At the same time, finance organizations are upskilling talent to validate AI-generated models and insights. Governance has expanded beyond finance alone, requiring tighter alignment with IT and legal to ensure accountability as automation scales.

Prioritizing judgment over pedigree

As AI improves pattern recognition, human judgment becomes more valuable, not less. Senior Vice President Dominic Olszowski observes that hiring decisions are shifting away from surface-level resume signals and toward deeper indicators of how leaders think and operate.

“We expect the combination of AI and human judgment that leads to some of the best hiring outcomes.”

AI tools now synthesize interview data and behavioral signals to surface strengths and inconsistencies. This allows human interviewers to focus on context, culture, and nuance, areas where experience still matters most. We expect the combination of AI and human judgment that leads to some of the best hiring outcomes,” Olszowski notes.

As a result, hiring teams can rely on richer signal profiles built from synthesized interview and behavioral data, rather than surface-level credentials. AI augments judgment by identifying patterns at scale, while humans provide the context around company stage, role requirements, and team dynamics. With administrative work increasingly automated, recruiters and leaders are able to reinvest time into deeper, higher-trust relationships with candidates.

Clarity is the advantage

The defining advantage of 2026 is not access to AI, but the ability to deploy it with intent. As software creation becomes commoditized, strategy and data discipline determine outcomes.

The companies that win should be willing to challenge best practices built for a slower era. The question for leadership teams is no longer whether to adopt AI, but which legacy assumptions they are prepared to abandon to unlock the next phase of growth.

Editor’s note: This post contains forward-looking statements and predictions regarding the future of AI. These statements are based on our current expectations and assumptions, and actual results may differ materially from those expressed or implied in these statements. The information provided in this post is for informational purposes only and does not constitute financial, investment, or professional advice. This post should not be considered as a recommendation to buy, sell, or hold any particular investment or security. Investments in AI and related technologies involve inherent risks, and past performance is not indicative of future results.