Demystifying Blockchain and Cryptocurrency Ideologies

In 2018, equity investments in blockchain and cryptocurrency startups exceeded $1 billion, surpassing the approximately $300 million invested in 2017.[1] In addition, over $6 billion flowed into Initial Coin Offerings (ICOs).[2] In the second half of 2018, however, the valuations of most tokens, including Bitcoin, dropped more than 80% from their peak values in 2017.

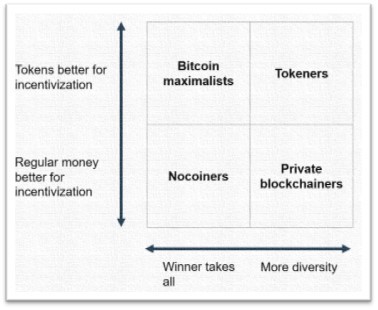

Growing interest in the cryptocurrency and blockchain space has given rise to different ideologies regarding where the space is headed in 2019 and beyond. In this post, we present four ideologies, and categorize them using a simplified framework. They are:

- Nocoiners: Nocoiners believe that cryptocurrencies are overhyped and overfunded, the valuations of cryptocurrencies are unjustified, and most private blockchain projects are solutions looking for a problem.

- Bitcoin Maximalists: Bitcoin Maximalists believe in the value proposition of a decentralized cryptocurrency but believe that Bitcoin is so far ahead of alternatives in terms of traction, credibility, security, and computing power that it will benefit from a “winner takes all” effect.

- Tokeners: Tokeners believe that the creation of separate cryptocurrencies to address specific use cases will drive innovation in decentralized cloud services and marketplaces, much like open protocols and open source software facilitated the widespread adoption of the Internet.

- Private Blockchainers: Private Blockchainers believe that cryptocurrencies are limited in their usefulness to businesses and governments that need to operate within regulatory frameworks, and who have scalability and performance requirements that can’t be handled by public blockchains. However, they believe that the underlying blockchain technology is useful by businesses and governments to create secure distributed ledgers that can address use cases such as provenance, identity, and smart contracts.

(Note: while “Bitcoin Maximalist” and “Nocoiner” are commonly used terms in the cryptocurrency segment, “Tokeners” and “Private Blockchainers” are made up terms for this post).

These four ideologies are distinguished by their stance on whether cryptocurrency assets or traditional money (“fiat currency”) are better at incentivizing the creation of, and innovation around, distributed networks and decentralized marketplaces. They also differ in their view of whether a winner takes all effect will prevail or if diverse solutions will emerge that are tailored to specific use cases.

Like any framework attempting to categorize a wide variety of perspectives into a few groups, this segmentation is an enormous oversimplification. Most well-informed individuals have points-of-view that are significantly more nuanced than any of these category descriptions would imply. Perspectives of people and firms don’t fit neatly into these categories and there are many ideologies that are not captured well by this structure. That said, we believe that this can serve as a helpful organizational framework for thinking about 2019 and beyond.

which of the four #blockchain and #cryptocurrency ideologies discussed in this post do you identify with the most? https://t.co/ZARBDsHiv1 @insightpartners

— Lonne Jaffe (@lonnej) January 30, 2019

Blockchain and Cryptocurrency Ideologies

Nocoiners

Nocoiners believe that cryptocurrencies are overhyped and overfunded, the valuations of cryptocurrencies are unjustified, and most private blockchain projects are solutions looking for problems. They contend that cryptocurrency platforms have yet to be used for a legitimate business use case beyond speculating on the value of cryptocurrencies, and that most private blockchain use cases could be handled by regular databases with data replication and encryption, or by something like the recently announced Amazon QLDB -- a fully managed ledger database with a transparently, cryptographically verifiable transaction log owned by a central authority.

Nocoiners argue:

- Many cryptocurrency projects are incurring “legal debt.” Many projects have underinvested in the hard legal work that is needed to make their offerings compliant with important regulations, and are effectively skirting securities laws designed to protect markets and investors, like those enforced by the Securities and Exchange Commission in the United States.

- The projects have yet to show traction for use cases other than speculation. There are few revenue-generating businesses or applications with the kind of real user scale that would signal product/market fit, other than hardware suppliers and cryptocurrency marketplaces designed to speculate on future prices.

- Major technical problems remain to be solved. The major cryptocurrency projects do not have consensus on how to scale the network without processing times and fees spiraling out of control. Bitcoin can process fewer than 10 transactions per second, as compared to the Visa network which can support 24,000 transactions per second.[3] Many of the ideas for improving the scalability of the cryptocurrency platforms involve substantial architectural tradeoffs. These tradeoffs often bring with them a decrease in security of the system and increase in its vulnerability to attack. As projects start to trade security of the system for better performance, their potential advantage over more traditional, centralized networks starts to erode.

- The space is rife with ransomware, fraud, other crime. Assurances found in cryptocurrency platforms such as censorship and seizure resistance can be attractive to good people in locales with oppressive governments, however many of the use cases that benefit from unstoppable financial transactions are problematic.

- Cryptocurrency platforms can be hijacked. Hundreds of attacks are attempted every month, some with the potential to give hackers network control.[4] For example, a security engineer at Coinbase recently estimated that a “51% attack” may have resulted in theft of over $100,000 worth of VTC on the Vertacoin network . Due to the way cryptocurrency open source projects are managed, it can be more challenging than with a centralized network to repair vulnerabilities in the code of the systems and ensure compliance with technical fixes.

- Blockchains are environmentally wasteful. Morgan Stanley forecasted that 0.6% of global electricity consumption in 2018 was attributable to cryptocurrencies, approximately equivalent to Argentina’s power consumption.[5] Significant cost – energy or something similarly expensive or precious – is integral to the transaction authentication process and reward system (often referred to as “mining”) in Proof-of-Work-based systems such as Bitcoin. More energy-efficient protocols that have been designed for other cryptocurrency networks, such as Proof-of-Stake, may have a corresponding increase in security vulnerabilities.

- If you are trading a legal right on a blockchain, it is not censorship or seizure resistant. Today, participants on a cryptocurrency system can trade possession of a token (with value) for possession of a digital asset (e.g. a music file) on the blockchain in an “atomic swap” that doesn’t require a third party. In many token-based systems being built, however, the tokens represent digital ownership of real-world physical or financial assets. Any ownership claim would require the legal system to enforce, and thus the claims are dependent on local governments – hence not truly unstoppable, seizure resistant, or censorship resistant. If digital bearer assets like cryptocurrencies and “tradeable tokens” need the government to enforce ownership rights, they are not truly decentralized, so why incur all the costs of decentralization? Why not just have a nonprofit consortium or company run a tradeable token exchange on a regular (high performance) database in the public cloud, or on a fully managed ledger database such as Amazon QLDB?

Bitcoin Maximalists

Bitcoin Maximalists believe in the value proposition of cryptocurrencies and their associated blockchains, but believe that Bitcoin is so far ahead of alternatives in terms of traction, credibility, and computing power that it will continue to benefit from a winner takes all effect among the cryptocurrency alternatives.

They also often believe:

- Bitcoin is censorship and seizure resistant, and its transactions are unstoppable. Any new blockchains that are not as censorship resistant as the Bitcoin blockchain are pointless, and their designers would be better off using either a regular database or the Bitcoin network. (Nocoiner critics would argue that many nefarious use cases benefit from censorship and seizure resistance).

- Bitcoin is like “digital gold” with advantages over actual gold. Bitcoin is difficult for oppressive regimes to confiscate and easy to transfer across borders and metal detectors. There is a long-term fixed supply, so it is harder to generate inflation in Bitcoin terms. (Nocoiner critics argue that if Bitcoin or something else that doesn’t scale supply with GDP growth were to be used as a global money supply, the deflationary pressures would be disastrous for the macroeconomic system and would cause continuous economic depressions. Furthermore, they argue that the emergence of hundreds of Bitcoin-inspired or forked cryptocurrency platforms means that the supply is not really fixed in any meaningful sense. They may also argue that the Bitcoin price should go down if real interest rates go up, much like actual gold or any other non-income producing asset, since the opportunity cost of holding it versus interest bearing assets like dollars increases).

- Any good ideas in the broader token ecosystem can be simply adopted by the Bitcoin blockchain if they turn out to be useful. At their core, cryptocurrency-based systems are built on open source software projects with publicly visible code running on servers that are publicly accessible. If good ideas emerge from the broader ecosystem, it would be straightforward for the Bitcoin software and mining community to simply copy and adopt those good ideas. (Tokeners point out that the reverse is also true – any innovations that prove to be useful on the Bitcoin network can be adopted by more specialized cryptocurrency networks and tuned to specific use cases).

- Bitcoin’s scalability issues and additional functionality can be addressed through “Layer 2” solutions. Layer 2 solutions support transactions off the Bitcoin blockchain. These transactions can be rolled up into a single transaction and synced back to the blockchain for final settlement. This could increase transaction speeds and allow for more elaborate functionality and experimentation. Because they benefit from Bitcoin’s scale and security, Layer 2 solutions built on the Bitcoin blockchain are superior to separate, sub-scale cryptocurrencies. (Nocoiner critics argue that most of the performance benefits of Layer 2 solutions are offset by a commensurate decrease in security at the level of the Layer 2 solution. Tokeners believe that Layer 2 solutions are a mediocre jury-rig for a network that is not well-designed for many use cases, and that specialty networks with their own cryptocurrencies and governance models should be used instead).

Tokeners

Tokeners support the creation of separate cryptocurrencies, each with their own blockchain, to address specific use cases. For example, the InterPlanetary File System (IPFS) is a file sharing protocol built on a blockchain that was released in 2014.[6] It uses a cryptocurrency token called Filecoin to incentivize participants to store other people’s data on unused hard drive space. The creators of Filecoin and a number of prominent venture capital investors believe that cryptocurrency-based networks like Filecoin represent a new paradigm for how we might incentivize and organize people.[7]

They argue:

- Token-powered cryptocurrencies and associated public blockchains are the natural successors to open source software. Open source software, which powers much of the world’s computing infrastructure today, allows communities of like-minded developers to contribute to software platforms that everyone can use and that are not controlled by a single vendor. However, in a world of cloud-delivered services, someone actually needs to run the servers, and this costs resources. Token-based systems address this problem by providing suppliers with an incentive – in the form of a cryptocurrency token that has the potential to appreciate – to run a decentralized cloud-delivered service to which everyone can contribute and which everyone can use. This service is not dependent on a single vendor. The suppliers of such a service are like Uber drivers or Airbnb hosts, and earn cryptocurrency in proportion to how early they get involved and how much cloud service capacity they provide.

- Tokens can accelerate the early stages of growth for networks. Tokens incentivize participants to join a network early on, perhaps before it would otherwise be justified based on user adoption or scale, by providing a form of payment that may appreciate over time. This early momentum can help to bootstrap a multi-sided marketplace and achieve network effects – getting the network to a critical mass of engagement. (Nocoiner and Bitcoin Maximalist skeptics argue that many token-based economic systems are designed in such a way that the value of the token may decline over time even if the platform is successful, assuming that prices decrease over time as they often do with cloud services such as AWS. They argue that any incentive for users to hold tokens in between use as a way to drive up prices makes the network itself less efficient).

- The rules on individual cryptocurrency-based platforms can be more dependable than those from corporations. Token-specific blockchains gather communities of like-minded developers that share stable rules and principles. Similar to how the governance structure of open source databases or operating systems can sometimes engender comfort with developers that a corporation won’t change the rules of the platform, token-based cloud services that are decentralized can provide a similar level of comfort to cloud application developers building on the system. As a developer, if you use a storage system like Filecoin as a basis for a cloud service, you don’t need to worry about a large corporation changing the rules once you have bet your business on the Filecoin platform.

- Token values can be stabilized. Prices can be stabilized by tying token values to stable assets, such as the dollar, creating “stablecoins” that track traditional currencies through some combination of algorithmic trading and holding reserve assets.

- Tokens can facilitate the creation of autonomous organizations. Decentralized Autonomous Organizations (DAOs) are a model for organization whereby decisions are made by consensus. To vote in favor of an initiative or project, participants (who can be humans or machines) stake their tokens.

- Tokens can serve as a financial protocol for the Internet that was missing in the original design of TCP/IP/HTTPS, and that may enable new, improved services, machine payments, and machine custodianship of digital money. Internet-enabled devices and humans could own tokens and pass small payments back and forth to other devices or humans in order to gain access to resources or services. This could be helpful for cloud services for which it doesn’t make sense to have an advertising-supported or subscription revenue model. For instance, a weather sensor could require payment of tokens in exchange for answering an API call or a self-driving car could accept payments for rides and use these same funds to pay for its fuel and maintenance.[8]

- Tokens could help democratize technology investing. Startups can raise funds by issuing tokens, which can be later redeemed for a product or service, much like a Kickstarter project. This model could increase funding options for startup founders, while providing an alternative path for international or non-accredited investors to benefit from potential appreciation of the token value. It could also shorten the time-to-liquidity for investors if the tokens are tradeable on an exchange early on. (Critics point out that attempting to bypass accreditation rules has many associated pitfalls and is essentially a form of legal debt. They may also note that any token pre-sold to an investor instead of earned by a supplier on the network will “dilute” the incentivization power of the token, decreasing the attractiveness of the network to early suppliers -- since the investor, instead of the early service providers, would capture some of the appreciation).

- Token-based systems will solve the “oracle problem” and figure out how to learn from the real world effectively. Many smart contracts are designed as code that automates the movement of tokens in response to actions or events that take place in the real world. For this to work, smart contract systems need to have some kind of mechanism through which the platform can find out what actually happened in the real world, and a related mechanism to adjudicate disputes. Various approaches have been proposed, including voting systems that reward participants for accurate votes about what took place off the blockchain, although none of these approaches have yet achieved widespread adoption.

- Token-based systems can enable the flow of charity payments, the purchase of services, and the issuance of micro-loans to individuals in developing countries. With the right authentication capabilities at the endpoint (e.g. face recognition), donors or lenders could use a token-based system to ensure that individuals located in regions with widespread corruption actually receive donations or payments for services, despite challenges with the local financial system.

Private Blockchainers

A cafe customer wants to know whether the beans used to roast her coffee really originated in Kenya. She opens a portal to the IBM Blockchain, where she can see that her beans were transported from the African highlands, to the Port of Mombasa, and finally to her local roaster. This is the picture painted by a 2018 IBM commercial.

IBM and other Private Blockchainers (a term which, like “Tokener,” is made up for this piece) believe that blockchain technologies are useful for functions like provenance, security, and auditability, and for use cases as varied as supply chain management, health care record sharing, land registries, and escrow services. Private Blockchainers believe that public blockchains with associated cryptocurrencies, like Bitcoin and Ethereum, are limited in their usefulness for businesses and governments who have security, performance, and regulatory requirements -- and that the needs of these businesses and governments are not addressed sufficiently today by the public blockchains with their associated cryptocurrencies.

They believe that private blockchains can address this concern with system architectures that do not have an associated cryptocurrency to incentivize participants. Instead of using a cryptocurrency, nodes on the network are run by stakeholders (e.g. corporations participating in a supply chain), perhaps with support from an important participant in the ecosystem, such as a large company, non-profit consortium, or a government.

Private Blockchainers argue:

- Private blockchains are useful for provenance because they are immutable, and the transactions are verifiable by all participants. Blockchains can be used to track the origin of food, land titles, diamonds, pharmaceuticals, and more. For example, Walmart has required that all spinach and lettuce suppliers use a blockchain by 2019.[9] Building shared databases is fundamentally challenging from a computer science perspective, and all approaches have security concerns. Private blockchains are more a more secure way to build a shared database because participants control their private keys and transactions can be simultaneously immutable, private and verifiable. (Critics argue that since these systems are not truly decentralized, since they are being set up by central authorities such as a consortium or a participant in the system like Walmart. They argue that many of these proposed private blockchain systems could be deployed more easily on a centralized service like Amazon QLDB or another fully managed ledger database that has similar performance benefits. The critics point out that without the need for censorship and seizure resistant transactions or a cryptocurrency to incentivize participants, the benefits of a blockchain architecture don’t outweigh the costs in terms of complexity, the difficulty of private key management, and slower performance).

- Tradeable tokens can represent full or fractional ownership of assets. Private blockchains create permanent, immutable records. They are therefore well suited to business and governments who want to increase auditability and transparency of tradeable assets, like fractional shares of real estate assets or public land registries. (Critics argue that fractional ownership of financial and physical assets is possible in many domains without the use of a blockchain, and those fractional ownership shares can be freely tradeable in marketplaces run on a centralized database, without requiring decentralization. They also argue that since legal ownership rights requires government enforcement, decentralization does not yield real censorship or seizure resistance and thus has few advantages over a centralized asset exchange, which can easily handle fractional ownership).

- Smart contracts can govern the transfer of assets. Since the ownership of assets can be represented on blockchains, smart contracts could be used to hold assets in escrow, make music royalty payments, facilitate credit default swaps, and more. This could allow for the disintermediation of entities, such as banks, brokers, or law firms, who charge a fee today to handle these processes. (Critics argue that smart contracts are just pieces of software that are harder to upgrade when bugs are identified, and until you solve the oracle problem the smart contracts won’t be able to handle the really hard parts of automating these human-intensive systems: figuring out what happened in the real world and adjudicating disputes).

- Identity can be tracked through private keys and blockchains. Assuming individuals are able to manage their private keys and there is a mechanism to restore lost credentials, blockchains could serve as an identity system that people or companies could use to manage access to their own sensitive private data, such as healthcare or financial records. For example, some universities are experimenting with the use case of publishing the cancellation of diplomas or certificates to a blockchain. If you have a diploma digitally signed by a university, you could submit it to apply for a job – and if that diploma has been revoked, the university could just update an immutable registry on a blockchain. An employer could then check that registry as part of a background check before accepting the diploma as valid.

- Private blockchains/distributed ledgers can be used for faster and more secure payments and settlements. These technologies can more efficiently move money cross-border or between banks or companies, while keeping transaction costs low and facilitating faster transactions.

What’s Insight’s View?

As context, Insight Venture Partners is a growth stage technology investor with more than 150 current software investments, and deep experience investing in both high-growth infrastructure software businesses as well as multi-sided marketplace businesses such as Alibaba and Twitter. Insight has over $20 billion in assets under management and typically invests in companies who have already achieved product/market fit and real-world traction, have battle-tested business models, and are growing rapidly. Most of the resources available from Insight to assist portfolio companies are focused on the core functions involved in rapidly scaling best-in-class businesses.

Our view is that despite the large amount of capital and talent flowing into cryptocurrencies and blockchain-based startup equity, both the technology and business models still involve a lot of experimentation and many of the initiatives are very early-stage in terms of user traction. Even the more mature and stable platforms, such as Bitcoin itself, are evolving rapidly. As is the case with many open source business models and Internet protocols, there can be successful technologies that benefit the industry that are not monetized successfully.

That said, the technology is extremely interesting, as are the new business models with which entrepreneurs are experimenting, and so we are watching new developments very closely. In the meantime, we have actively invested in companies in the cybersecurity (e.g., Darktrace, Recorded Future & Tenable) and fraud detection markets (e.g. Sift Science), many of which have an important role to play in allowing “grown-up” enterprises (e.g. large banks, corporations, or governments) to participate in any new, maturing technology area. We are also supporting the ecosystem with investments in companies like TradingView, the leading web provider of financial charting software and a social platform for investing research, who provide support on their platform for cryptocurrencies.

And finally, we are on the lookout for businesses, led by high-caliber entrepreneurs, that are leveraging cryptocurrency platforms, distributed ledgers, or blockchain technologies and that are enjoying substantial real-world traction, adoption and scale. We can help them scale to the enterprise and geographically. Any new technology and business model that leads to change and disruption will create opportunities for entrepreneurs, customers and investors. Cryptocurrency and blockchain are no exception.

[1] https://news.crunchbase.com/news/2018-vc-investment-crypto-startups-set-surpass-2017-tally/

[2]https://www.coindesk.com/6-3-billion-2018-ico-funding-already-outpaced-2017/

[3] https://bitcoinist.com/breaking-down-the-scalability-trilemma/

[5] https://www.morganstanley.com/ideas/cryptocurrencies-global-utilities

[7] https://www.nytimes.com/2018/01/16/magazine/beyond-the-bitcoin-bubble.html

[8] https://mixpanel.com/blog/2016/10/04/machine-payable-web/

[9] https://www.nytimes.com/2018/09/24/business/walmart-blockchain-lettuce.html