The CFO's special province has traditionally been tied to fiscal matters in a bid to boost company profitability. Making critical product-led growth (PLG) decisions based on profit, loss and market-segment data is in every ScaleUp CFO’s DNA. This is a role that CFOs have historically performed well.

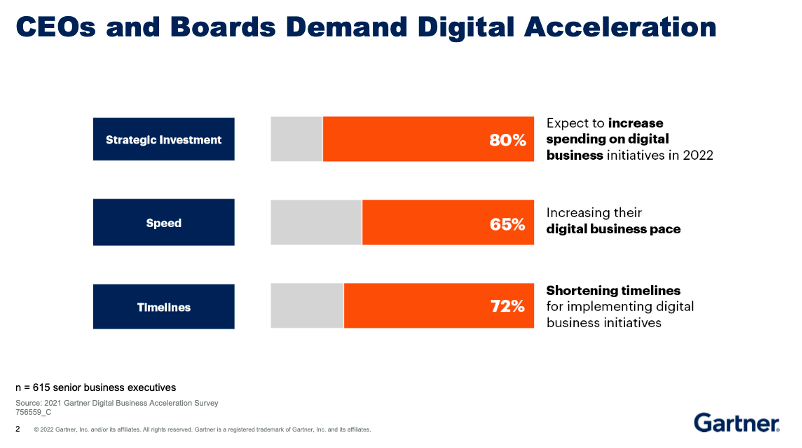

More recently, CEOs and boards of directors are seeking digital acceleration from their CFOs and enterprises. Therefore, the CFO role has transcended the traditional financial functions.

For companies that have not yet taken advantage of the performance and scalability of cloud services, digital acceleration starts with a transition to the cloud.

For ScaleUps already on their digital path, it means faster adoption of emerging technologies like AI, as well as the digitization and automation of business processes for their main customer personas.

A KPMG survey of CEOs shows that an overwhelming majority have already started on the path to a digital transformation as a result of the pandemic.

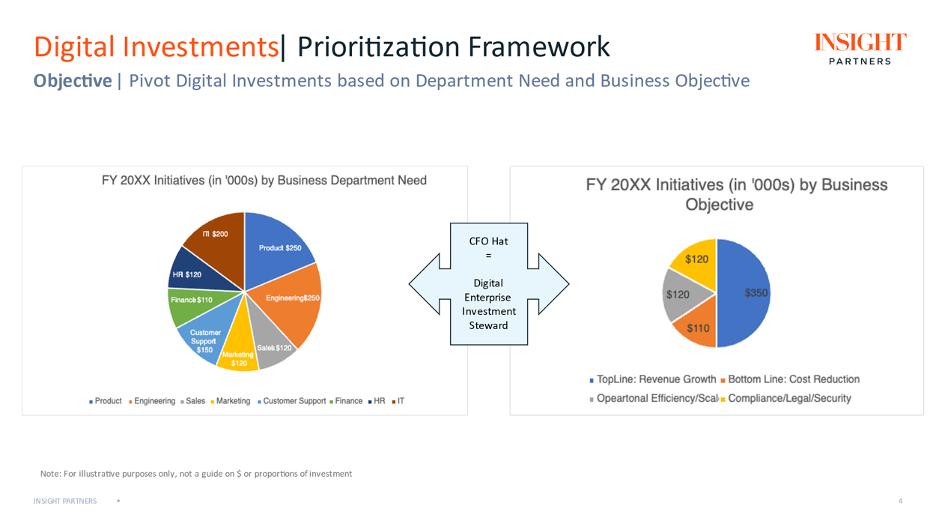

As a result, CFOs have to wear one more hat: the steward of all enterprise digital investments, based on key performance indicators (KPIs). Many CFOs are held accountable not just for financial performance, but for business outcomes and transformation achieved through longer-term technology investments in all business functions.

Digital-first CFOs are expanding their focus to look at digital investment holistically. CFO priorities are now threefold:

- To continuously ensure profitability and a product-market fit

- To align global digital initiatives between R&D, heads of business functions and IT

- To divest operationally from maintenance and re-invest strategically in innovation

The change in the CFO’s role is partly due to a shift in economic climate. As some tech markets stagnate and inflation rises, many executives have had to make difficult decisions to stay on the path to profitability. Careful cost optimization by tech leadership can stem cash flow problems, but CFOs today find themselves moving beyond short-term ledger balancing and focusing instead on guiding the company along a path to long-term profitability. R&D Metrics have also shifted.

The transition can be defined as a fundamental shift in finance-executive thinking, Varvara Alva, CFO for the online parking app SpotHero, an Insight Partners portfolio company, said.

"Digital acceleration raises the stakes for CFOs to ensure technology spending delivers value,” Alva said. “At SpotHero, the role of the CFO is evolving to be a steward of all digital investments with an eye to increase stakeholder value, shorten time to value and ensure an acceptable and transparent ROI."

Part of this new role is a need to work across department boundaries to ensure companies are allocating their resources appropriately. “Between digital acceleration and shifting of the lens from growth at any cost to disciplined and measured growth, CFOs are well positioned to be the tiebreaker for cross-department prioritization of digital investments, traditionally a COO/CIO hat,” Alva said.

Steward of digital path to sustainable profitability

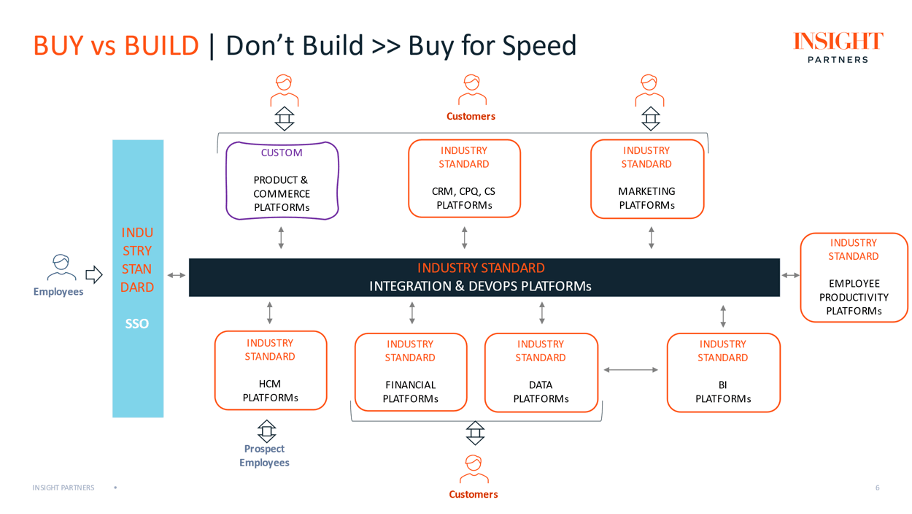

For ScaleUps new to prioritizing sustainable profitability, the build-versus-buy decision can be a hard one to navigate. In organizations with highly siloed teams, department leaders often have trouble deciding whether to solve operational roadblocks by buying existing products or by devoting engineering effort to building custom in-house tooling. Many times, teams choose to build in-house rather than buy off-the-shelf software and platforms. While building tools in-house does not inherently sap productivity, it can take away engineering focus and resources from the revenue-generating product.

A 2022 Retool survey showed that engineers spend about a third of their time building and maintaining internal tools such as dashboards, admin panels and custom applications that are never adopted by end-users. Large companies fare no better than small ones — the survey found that engineering time spent on internal tools only decreased after a company reached 10,000 or more employees.

The reasons for this deviation vary. In nascent ScaleUps reaching their first growth phase, building internal tools in-house can be due to a large number of early-career engineers who lack the experience to know when they are reinventing the wheel. Junior engineers are sometimes eager to grow their skills, regardless of how it impacts the company’s core mission.

In other cases, the focus on tooling happens even with attentive engineering leaders. Companies sometimes believe it is quicker to go to market by solving the productivity problem in-house rather than go through the acquisition and integration process for an off-the-shelf solution. In some situations, companies believe existing solutions fail to meet their security and privacy needs, without considering whether these requirements provide a competitive advantage to their revenue stream. Finally, companies that run large operations teams (often found in fin- or insurtech companies) can require unique software solutions to manage the administrative process behind their service.

Ensuring the digital roadmap points in the right direction is traditionally a CTO or CIO's responsibility. But the companies facing this kind of roadmap misdirection are often too small to have a dedicated CIO. Some may not even have a dedicated IT department, instead outsourcing IT decisions to a third-party vendor. Many do have a CIO/CTO, but their role may be focused on operational concerns within their own department.

Unlike most other executives, CFOs have a big-picture view of how the organization allocates its resources. As companies navigate the demand for digital acceleration in tough economic times, more and more digital CFOs find themselves ideally placed to connect R&D and IT strategy and to drive software tool-selection using sustainable profitability as the company’s North Star. CFOs can also act as the independent tie-breaker in cross-department prioritization ensuring customer focus, agility and flexibility of the company business models.

Steward of enterprise digital investments, based on KPIs

The second part of the digital CFO’s role is steering company investments based on KPIs. How efficiently ScaleUps can reprioritize their capital investment is a key bellwether of their ability to remain profitable.

The role can be described as a balancing act, Helen Lin, founder of finance analytics company Discern, said.

“Today, CFOs are tasked with nimbly straddling digital acceleration and improving valuation-driving KPIs,” Lin said. “While historically CFOs have primarily focused on monitoring finance KPIs, it is important for CFOs to also include growth and efficiency KPIs in order to better align with board objectives.”

Navigating this role means making conscious decisions about which departments and teams to prioritize for investment based on how those investments can spur sustainable growth. Finance executives responding to digital transformation and acceleration continue to prioritize high-value projects and revenue-generating initiatives.

A 2021 survey of CFOs found that 67% refused to “waste precious dollars on IT investments that don’t move the needle.”

Many companies have a twofold approach to investment prioritization for capabilities that drive:

- Business impact: Revenue growth, cost reduction, operational efficiency, legal and compliance.

- Stakeholder value: Predictable delivery, reduction of manual efforts and data quality.

Paring down on waste is less about stopping useless software projects and more about balancing priorities — few initiatives are completely useless. More often, it requires drawing a line to define which initiatives are critical to the revenue stream. For example, organizations sometimes adopt top-tier enterprise software solutions for their feature set regardless of whether the price is justified by the return on investment. Not every company needs an expensive AI-powered recruiting solution.

Identifying cases where “best of breed” can be replaced by “good enough” is critical to ensuring the company makes the most worthwhile use of its limited resources. This step is especially important for fledgling ScaleUps with tight runways. Stopping unnecessary cash burn by focusing the organization’s investments on revenue generation can forestall serious finance problems down the line.

Steward of investing in value generation and innovation

Customer-first CFOs focus on value creation through KPIs. Digital CFOs look at a variety of KPIs to gauge whether their decisions will provide a good foundation for sustainable growth.

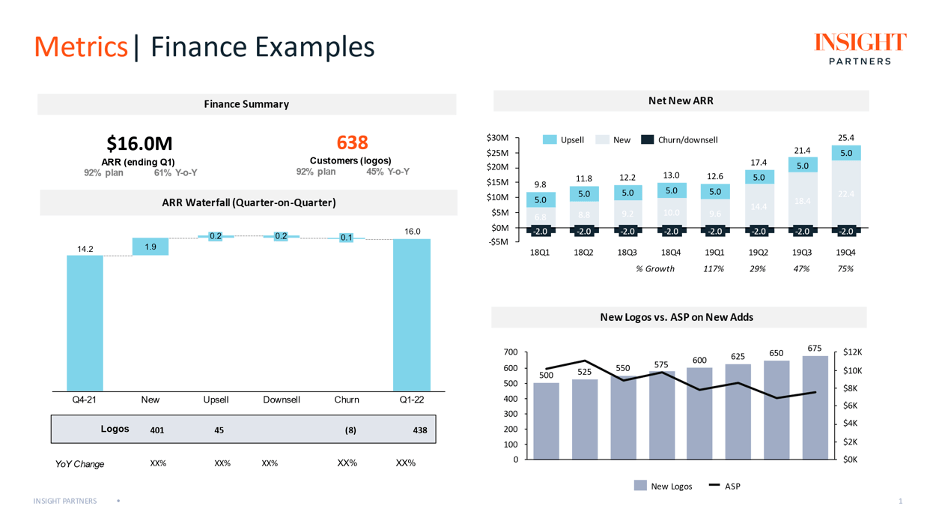

One key performance indicator is how much an enterprise spends on research and development. R&D spending is different for every organization, but in general, it should correlate to annual recurring revenue (ARR). ARR is a critical metric for SaaS companies, as it charts revenue from a company’s service-level agreements (SLAs). Low ARR companies invest heavily in R&D, sometimes at levels greater than 100% of their subscription license revenue. Similarly, companies with high rates of ARR growth also spend more on R&D than companies with low rates of ARR growth. This is unsurprising, as these are often young StartUps actively working to mature their product offering.

R&D investment slows as companies grow in revenue (mostly because ARR growth outpaces company spending). Although there is no “right” amount to invest in R&D, CFOs can use this metric as a guide to determine whether they are on track to promote growth for their enterprise through steady research and development.

Finance data is not the only set of information executives use to gauge whether they are making progress. Sales and marketing data can also provide valuable information on the effectiveness of a company’s go-to-market strategy, and whether product improvements are actually translating into increased revenue.

Finance executives use metrics like year-over-year (YOY) growth, year-to-date (YTD) sales and customer acquisition cost (CAC) to measure whether their sales pipeline is performing to requirements. These metrics also drive value creation questions such as:

- Can we demonstrate monthly customer ARR?

- Can we track a single customer from lead to close?

- Can we track upcoming customer renewals?

- Do we have reliable daily product usage data for each customer?

These questions function as a feedback loop for executives. CFOs are increasingly turning to these metrics to identify areas of improvement in a constantly changing economic climate. Gaps in metrics that should align (for example, a disparity between forecasted demand and actual results) can indicate flaws in the sales or marketing process and ultimately a loss of value for the customer.

A make-or-break factor for ScaleUps

Taking charge of a finance organization is no easy task. As business leaders have begun to demand digital acceleration on tightening budgets, CFOs have found themselves wearing multiple hats. As one of the few executives with a high-level vision over a ScaleUp’s entire financial landscape, the CFO is uniquely suited to making sure the organization makes the best use of its resources. Whether this comes in the form of pruning unnecessary items from the roadmap or identifying the best return on investment in company spending, the CFO’s ability to wear multiple hats can be a make-or-break factor for aspiring ScaleUps.