Setting Quotas in B2B SaaS Sales When Facing High Exchange Rate Volatility

Key Insights:

- While typically normal changes in foreign exchange rates (FX) have limited impacts on SaaS companies, 2022 has not been a normal year.

- Reps closing deals in denominated currencies other than the one applied to their quota should neither gain nor lose due to FX changes.

- We recommend setting exchange rates at the start of each quota measurement period.

In 2022, the United States (US) Federal Reserve hiked interest rates in order to fight rising inflation. This has made dollar-denominated bonds more attractive versus those based on other currencies. In addition, US assets are increasingly viewed as a safe haven since the American economy has been less affected by fuel price shocks and by the war in Ukraine. Consequently, the dollar has strengthened against other currencies.

Exchange rate impact on company performance

The general impact of a stronger local currency on multinational companies is negative.

Consider a US-based company’s response to a stronger dollar. If the US company raises prices in Europe, then unit sales will likely drop by more than the price increase as buyers switch to cheaper European alternatives. If the US company leaves its European prices fixed, then the value of each unit sold declines when converted to dollars.

There are some offsets to this lose-lose scenario. First, the stronger dollar lowers the cost of goods and services purchased abroad. Second, producers of differentiated solutions face lower price elasticity; in lay terms, companies can increase prices to some extent without experiencing as much of a drop-off in unit sales as would companies selling commodities.

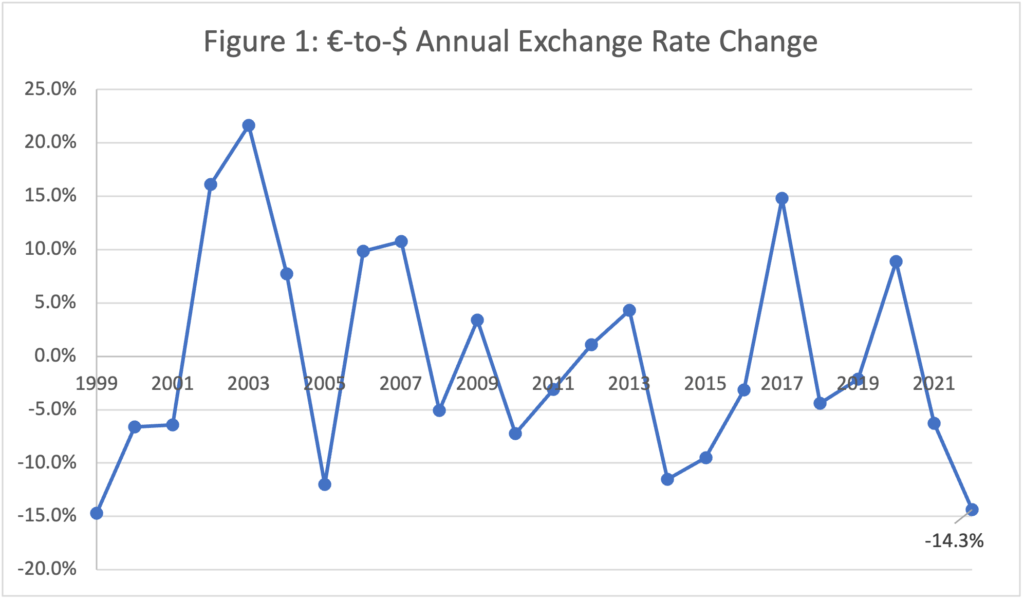

While the puts and takes described above mean normal changes in foreign exchange rates (FX) will have limited impacts on SaaS ScaleUps, 2022 has not been a normal year. In the 23 years spanning 1999 to 2021, the euro has only fallen more than 10% relative to the dollar three times (see Figure 1). Thus far, the euro is down nearly 15% relative to the dollar.

Source: macrotrends.net

Exchange rate impact on quota attainment

Let’s explore the impact of FX on quota attainment for sales professionals. For simplicity, and because it mirrors the current state of the world, we will compare a US-based rep to a Germany-based rep.

For our range of examples, we will assume:

- Reps start 2022 with quotas based on the Jan 1st exchange rate of 1.1371 €/$. Quotas are thus $1M when denominated in dollars and €880K when denominated in euros.

- Prices per deal are set at the beginning of the year at $100K or €88K.

- The Euro/Dollar exchange rate is down 15% YTD.

In the first scenario, imagine each rep only sells domestically. In this situation, there is no FX impact for the reps other than the fact that it will be easier for the German rep to sell against US-based competitors who may have to raise prices (or limit discounts) to make up for the exchange rate impact.

Next, consider a German rep whose quota is in euros but who sells to US prospects using dollar-denominated contracts at $100K per deal. If this rep’s plan applied floating FX rates, then she would receive a credit of €101K instead of €85K for each sale at current rates. Hence, the rep benefits from the floating exchange rate. Had the FX rate been fixed, there would be no impact on quota attainment.

Assuming the company is based in Europe, they benefit as well since the increase in euro-denominated bookings more than offsets the extra commission paid to the rep in the floating FX scenario. If the FX rate were fixed, the company benefits even more.

The reverse is of course true for a US rep whose quota is in dollars but who sells into Germany using euro-denominated contracts. An €88K deal converts to $87K instead of $100K if quota credit is subject to a floating exchange rate. With a fixed FX rate, the US rep is ‘protected’ and would experience no impact.

The stronger dollar is detrimental to the US-based company whose euro-denominated sales convert to fewer dollars than expected given the pricing set at the start of the year. Allowing the FX rate applied to quota credit to float transfers some of the company’s pain to the rep.

Our recommendation

One of the key best practices in sales compensation design is that reps should be compensated for their direct effort over what they can control. Since FX is out of their control, reps closing deals in denominated currencies other than the one applied to their quota should neither gain nor lose due to FX changes. Hence, we recommend setting exchange rates at the start of each quota measurement period. Fortunately, this approach is also easier for quota administration.

Our recommendation of a fixed FX rate for quota credit concentrates all FX benefits and risks in the hands of management. Even without elaborate hedging, organizations can protect themselves from FX risk by sourcing talent locally and by borrowing in local currency.

The silver lining is that strongly negative FX impacts are rare. They apply to companies with a strengthening local currency who conduct a large amount of business denominated in a weaker foreign currency and who lack the natural hedges described previously. Finally and fortunately, currency swings exceeding +/-15% are relatively rare in developed nations.

—

Disclaimer: Please note that this guidance is not legal or tax advice.