AI in financial services is here: How firms are adopting and where they’re stuck

In financial services, AI is no longer a futuristic idea — it’s part of daily business. By 2027, the sector is expected to spend nearly $100B on AI.

But this excitement is tempered by legacy systems, governance requirements, and hard-to-measure ROI. A new wave of startups is emerging to overcome these hurdles while preserving the control, compliance, and precision that financial institutions require.

After spending the past year with hundreds of founders, executives, and operators across financial services, we’ve compiled a front-row view into how banks, asset managers, insurers, and others are approaching AI. This perspective also draws on conversations with enterprise technology leaders, including members of the Insight Partners CIO Council.

Broadly bullish, but ROI remains uncertain and hard to quantify

Financial institutions are excited about AI, but the ROI is hard to measure, and leaders expect clearer results:

“There’s a healthy amount of skepticism around how much efficiency AI can truly deliver. The potential productivity gains are real, but it’s my job to separate substance from noise to determine what will actually deliver impact.”

— Jennifer Charters, EVP and CIO at Lincoln Financial

Most now view AI as a useful tool that can create leverage in targeted areas, but not a universal fix. So, firms are increasingly selective in their approach and prioritizing companies that can show measurable ROI.

AI push is both top-down and bottom-up

Boards and senior executives see peers touting AI initiatives at conferences and earnings calls, and public markets are rewarding firms that can show credible strategies. No one wants to be left behind, so the top-down push toward AI has become as much about optics as efficiency. However, the push isn’t just top-down. Employees want tools that reduce manual work, putting real pressure on procurement and IT teams to move quickly:

“Front-line teams are pushing for automation to make their lives easier while leadership pushes for AI strategy. The two forces have started to reinforce to drive real AI adoption.”

— Dan Zinkin, former CIO Global Investment & Corporate Banking at J.P. Morgan & Head of AI and Data at InvestCloud

The result is a rare alignment across the org chart — many want AI, even if for different reasons.

Main AI use cases today are productivity-oriented

Investment knowledge management

For investment and research teams, AI is chipping away at the hunt for information. Analysts and portfolio managers typically spend hours gathering documents and parsing filings. Still, firms are now deploying internal search and summarization tools that surface relevant content — from research notes and client decks to compliance filings and meeting transcripts. Platforms like Rogo, Metal, and Reflexivity make proprietary knowledge searchable in natural language rather than buried in disparate drives.

Developer efficiency

AI is changing how developers write and maintain code, from boilerplate generation to code conversion and documentation. More AI-suggested code now reaches production, which is particularly useful in financial services, where many systems still rely on Common Business-Oriented Language (COBOL) and mainframes maintained by a shrinking pool of experts. As a result, modernization is slow and risky. Swimm* and CoreStory help teams understand the business logic of code inside legacy systems.

Customer service

AI is speeding up customer support by giving Agents access to internal documents, past interactions, and policy information, replacing time-consuming searches through PDFs and emails. Leaders say these tools don’t replace humans but make service faster and more consistent.

Wonderful*, for example, uses Agents to power voice and text support and is seeing early success in financial services, while Glia* applies AI to automate and analyze customer interactions across banks and credit unions. Jump is vertically focused on financial advisors and uses AI to manage client conversations across onboarding and ongoing relationship needs.

Agentic adoption is early but expanding

Comfort with AI Agents varies, but many firms are exploring them. Some, like BNY, are running dozens of agentic workflows in production:

“We have over 100 agentic digital employees doing everything from enhancing code to validating payment instructions. This AI workforce allows for a different level of collaboration and productivity.”

— Julie Gerdeman, Global Head of Data and Analytics at BNY

Some firms are piloting Agents internally but avoiding client-facing use, while more conservative institutions are holding back altogether due to regulatory concerns and Agent unpredictability. CrewAI*, Relevance AI*, and Tavily* all enable the orchestration and deployment of AI Agents. Despite differing comfort levels, Agents are now seen as the next phase of enterprise AI, and even hesitant firms are laying the groundwork for future use.

Business units drive strategy while the central org enables

Across most institutions, AI strategy is business-led, centrally governed. Business units identify use cases and set priorities, while the central technology teams manage vendors, negotiate contracts, and ensure firmwide standards are met:

“Ideas need sponsorship from the business unit. Every AI use case requires a clear business owner who partners with the central tech team to drive execution and implementation.”

— Ericson Chan, CIO at Zurich Insurance

This structure creates a necessary balance. It gives front-line teams the ability to move quickly while keeping AI aligned with enterprise risk frameworks.

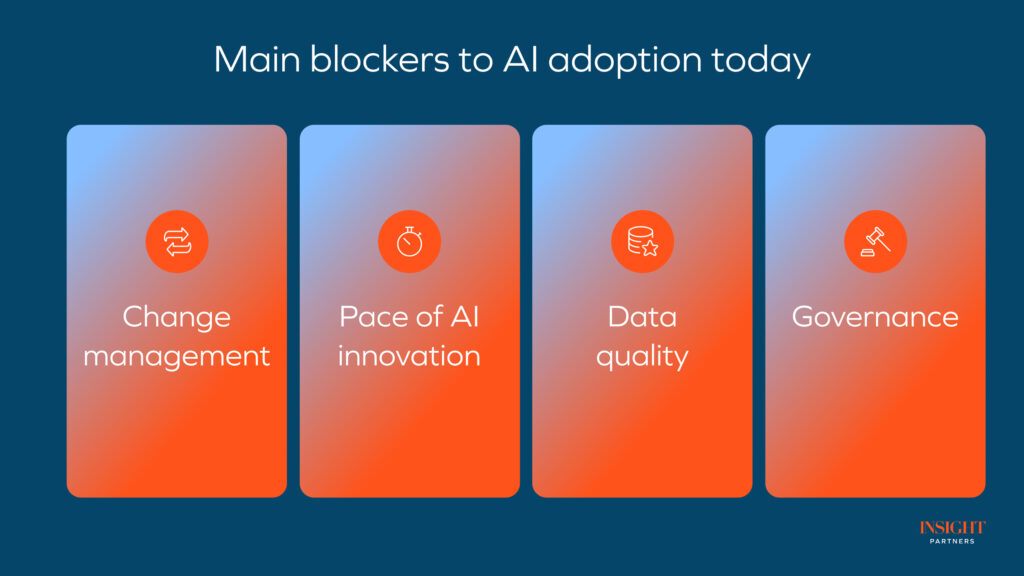

Main blockers to AI adoption

Change management and AI literacy

The human side of AI adoption can sometimes prove harder than the technical one. Despite AI’s potential to streamline work, many employees don’t trust the tools, creating cultural resistance:

“Creating a culture for AI adoption is key. If you forget about the human element and don’t take people on the data and AI journey, you will never have adoption.”

— Akhil Lalwani, CDO at Allianz UK

Leaders are responding with internal training, documentation, and AI literacy initiatives designed to show the goal of enhancing, not eliminating, human work.

Pace of AI innovation

Counterintuitively, the pace of AI innovation has made some technology leaders cautious. Firms worry about adopting a solution, embedding it across the organization, only to realize it’s obsolete just months later. As a result, teams are wary of tools that create vendor lock-in and are piloting more options to avoid becoming dependent on any single provider.

Data quality and fragmentation

Financial institutions still lack the pipes to unify data across different systems:

“Regardless of the end AI use cases, it’s data that’s fueling the transformation. If companies don’t have a clear view about how to transform and manage their foundational data, they won’t be able to scale and operate AI with the speed or quality needed to compete.”

– Kjersten Moody, former CDO at Prudential

Many banks still keep large volumes of untagged or on-premise data, meaning only a small share is truly AI-ready. Data cleanup is time-consuming, and rising data volumes make the problem worse, paving the way for improvements throughout the data organization. When it comes to data storage, Eon turns cloud backups into searchable, usable data, and Riverpool is an Agent-driven platform that constructs and maintains data warehouses.

Acceldata*, Atlan*, and Pantomath all exist to improve data reliability, with Acceldata focused on observability, Atlan on lineage, and Pantomath on data operations. Many leaders now view stronger data hygiene as the essential prerequisite for unlocking AI’s potential.

Governance, security, and risk management

Financial institutions operate under heavy regulatory scrutiny, and uncertainty around LLM behavior makes compliance teams uneasy. Because these systems are inherently nondeterministic, they don’t align easily with workflows that require consistent, auditable results. Most firms still lack standardized frameworks to assess accuracy, trace model reasoning, or measure performance against regulatory expectations.

Fiddler* and Arize improve transparency and auditability across AI/ML models. Cymphony helps companies monitor how employees use data and tools, enabling them to prevent internal security risks as they adopt AI. And tools like Harmony provide proactive, intelligent IT management with built-in compliance controls, helping firms maintain auditable workflows as they use AI. Until clearer rules and stronger control mechanisms emerge, governance will continue to define the speed and scope of AI adoption.

As AI becomes embedded in financial services, the real opportunity belongs to companies that can deliver practical, governed, and measurable value to institutions.

If you’re building in the space, we’d love to meet. Email us at earnowitz@insightpartners.com.

*Note: Insight Partners has invested in Swimm, Wonderful, Glia, CrewAI, Relevance AI, Tavily, Acceldata, Atlan, Fiddler, HoneyHive, and Anjuna.

Quotes in this article have been sourced from industry conversations and given with permission.