Our reward for navigating a life-altering pandemic is a combo of events unlike any other. We just came out of a record period of broad market success. Now inflation is rearing its head in ways we haven’t seen in decades, while unemployment remains incredibly low. Growth rates that dipped during COVID have regained strength, but supply chains remain in a snarl that won’t resolve anytime soon. War in Ukraine has unleashed tragedy and havoc that have left global leaders and economists guessing at what’s next.

These truly are unprecedented times. No marketer has experience navigating all of this at the same time.

With economic signals flashing a slowdown ahead, now is the time for companies to get ready—not once a potential downturn hits. In an open webinar on June 23, 2022, Operating Partner Gary Survis was joined by Mutiny founder Jaleh Rezaei and Henry Martz, Head of Finance & BizOps, to provide guidance to CMOs on how to be prepared in these uncertain times.

Marketing Leaders Continue to Hire Despite Softening Demand

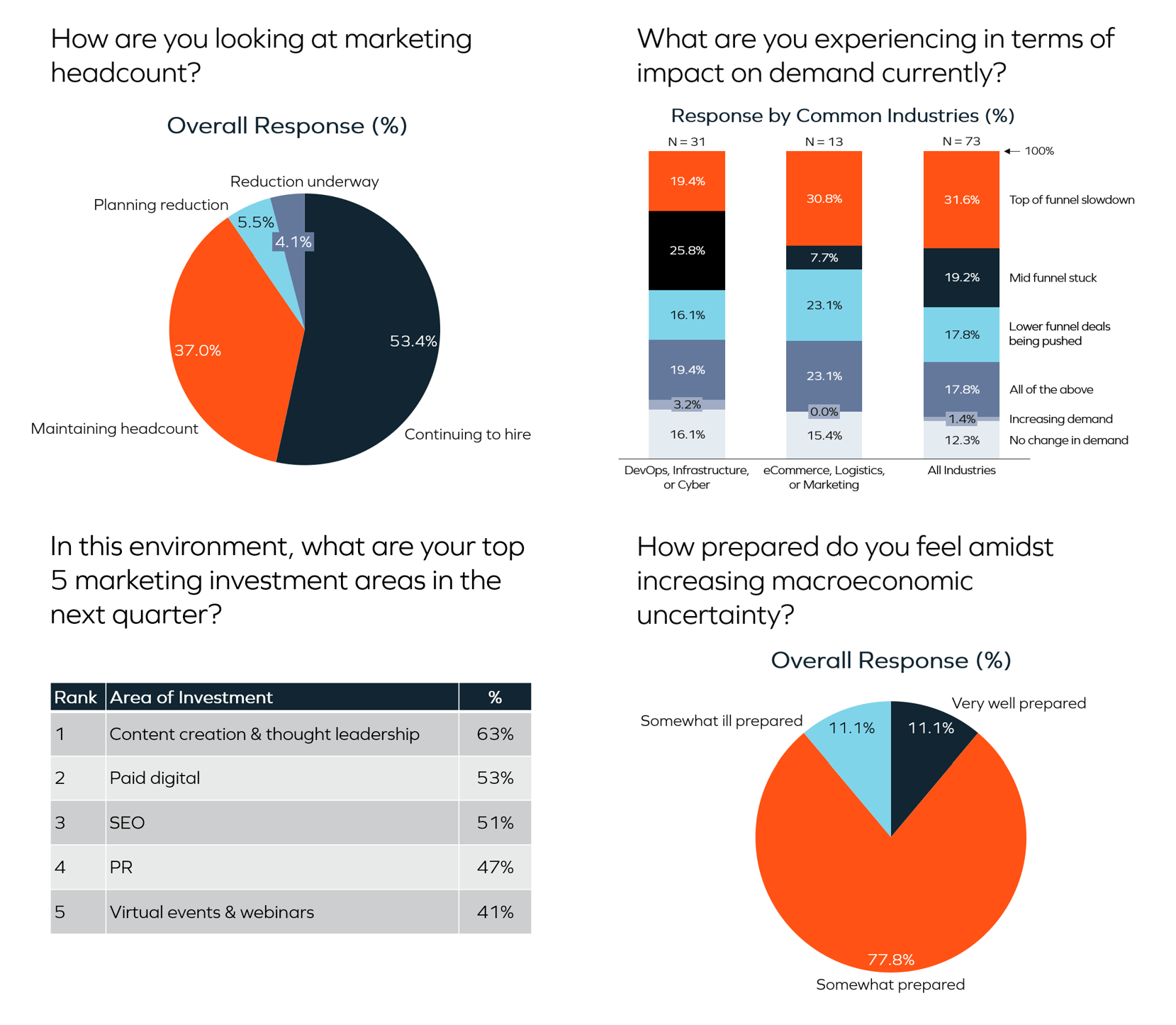

Amidst increasing uncertainty, a survey of 73 marketing leaders from our portfolio indicated mixed levels of current impact. Regarding headcount, the majority (53%) indicated that they’re continuing to hire, but they’re also starting to see decreasing demand throughout the funnel.

Just 12% of marketers report no change in demand; when looking at funnels, 32% indicated that the greatest slowdown is occurring at top of funnel. Industry matters here as well. Those with greater product market fit or that are more difficult to replace (e.g., DevOps) report less slowdown at their top of funnel compared to industries like Marketing that tend to be more impacted in downturns.

Even with softening demand and increasing uncertainty, 78% of marketing leaders feel somewhat prepared to face it, while 11% report feeling very well prepared.

Knowing Where Your Customers Are Is the First Step

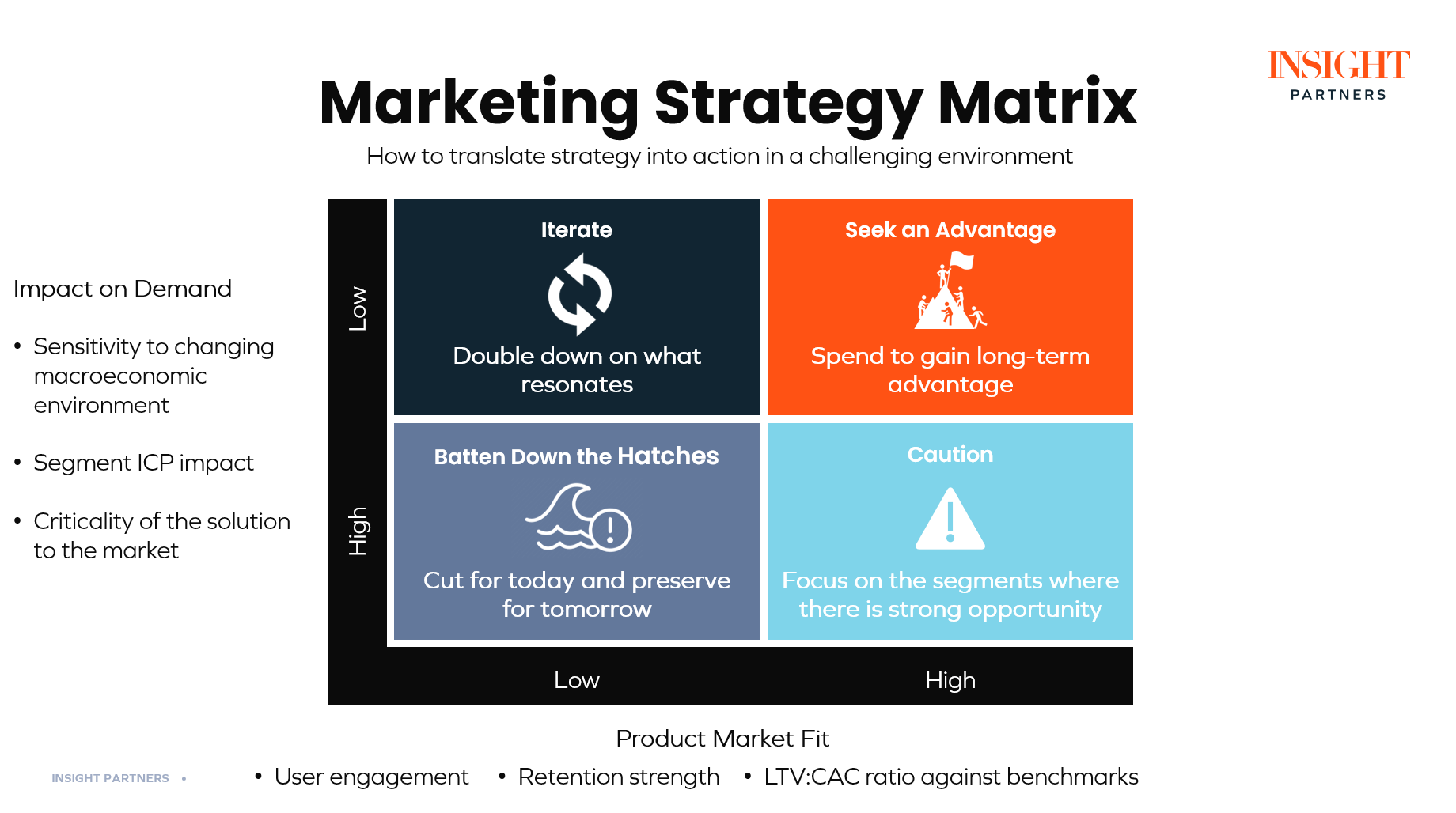

Mapping your next steps requires taking stock of not only your customers, but also your company’s readiness to solve its immediate problems today. Since we all love a two-by-two matrix, let’s map how to evaluate your first move. The first axis is Product Market Fit. CMOs should be self-critical about their product market fit as measured by user engagement, retention strength, and how efficiently the company meets benchmarks. Brutal honesty is crucial in identifying the right strategy for today’s market.

The second axis is Impact on Demand. CMOs must cut through the noise to quantify what impact external forces are having on their KPIs. Different industries will be more impacted by others in a changing economic environment (e.g., a cybersecurity company will experience lower impact on demand than a financial services scaleup). It’s crucial to understand if your customers are tightening their belts or leaning into market opportunities.

To increase preparedness, marketing leaders should recognize that while their company may not fit neatly into a single quadrant, it’s important to understand how specific parts of the business will be impacted to build a comprehensive strategy.

What to do if your company has:

High PMF, Low Impact on Demand = Seek an Advantage

Previous downturns have shown that those companies that move aggressively from a position of strength can gain long-term competitive advantage. While we are not recommending reckless spending, it could be a good time to take advantage of weak competitors through actions that can drive growth and flip competitors, such as aggressive pricing or flexibility in payment terms.

High PMF, High Impact on Demand = Caution

Companies in this quadrant need to be a bit more selective in choosing where to focus their resources. It is important for you to remain aggressive and focus on those segments where you have high PMF and not waste efforts on segments where the product just is not quite right yet.

Low PMF, Low Impact on Demand = Iterate

If your organization is in this quadrant, then you should double down on what resonates as you iterate to drive product-market fit. A company that is facing these challenges needs to move quickly to drive PMF in those segments where there is opportunity. Now is not the time to try and sell into those hard-to-sell segments like the government.

Low PMF, High Impact on Demand = Batten Down the Hatches

It is difficult to be in the position of driving toward PMF while at the whims of turbulent demand, so companies in this quadrant should focus first and foremost on survival. Continue to make progress on establishing PMF to take advantage of the market when economies strengthen. In the meantime, be conservative on spending and evaluate programs in terms of scale, differentiation, and profitability to keep those that are most efficient and strategic.

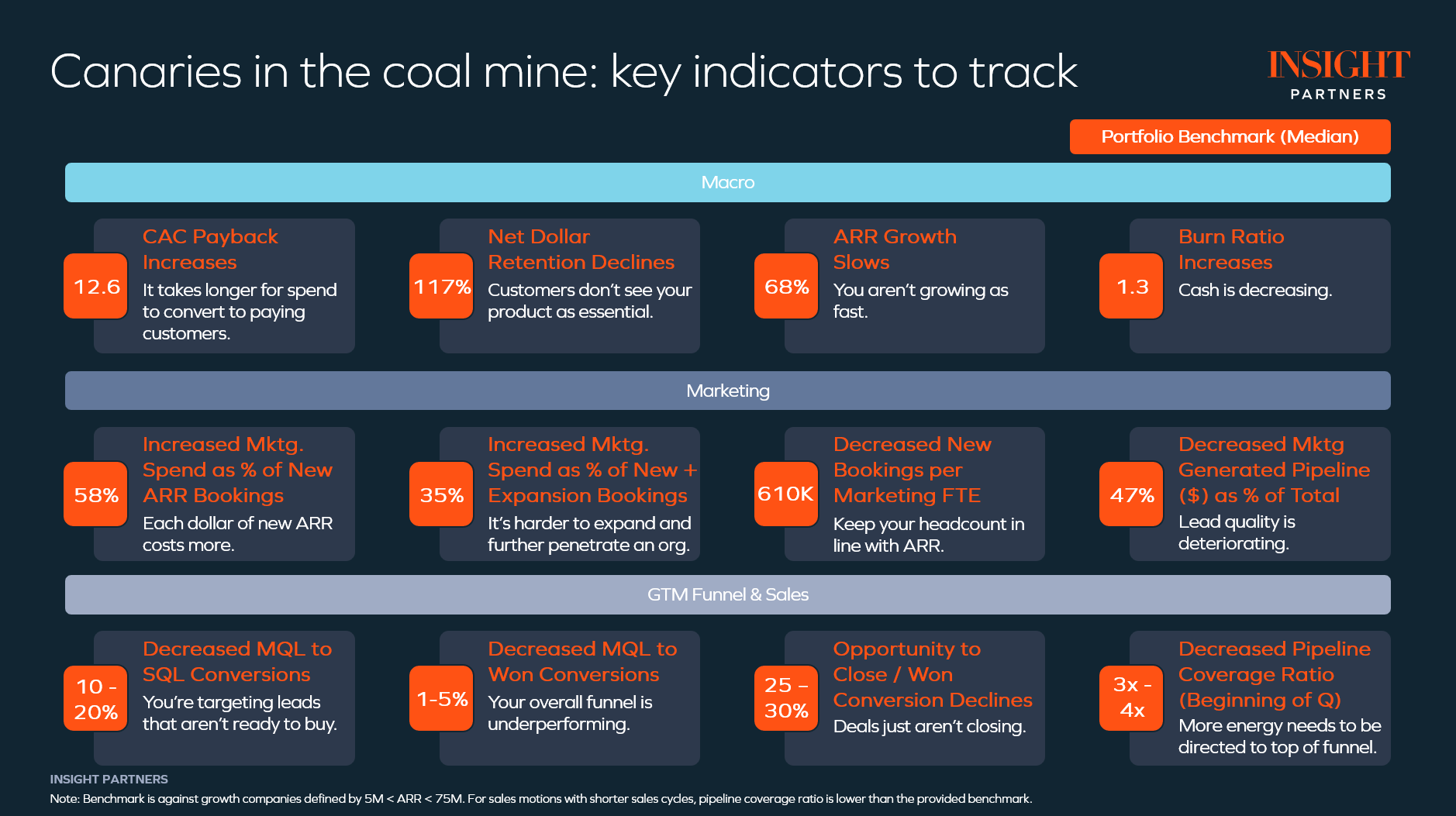

Keep Track of The KPIs That Matter

As uncertainty increases, CMOs need to pay attention to the early warning signs of deterioration both within marketing and across the business as a whole. KPIs shared with Product and Sales provide crucial bellwethers into the health of the organization and inform how marketing can boost performance. Whether you are facing a top-of-funnel volume issue or finding your opportunities are stuck in the middle of the funnel, it is critical that marketing leaders be proactive ahead of changes rather than reactive.

Take Action Across These Five Key Areas Ahead of a Potential Downturn

Marketing Budget

More than a third (34%) of marketing leaders do not plan to change overall marketing spending today. In fact, they report doubling down in key areas to drive differentiation like content creation, thought leadership, and webinars. These formats allow companies to take ownership of their narrative and tell it at scale across digital channels. Other key areas of investment include paid digital, SEO, PR, and virtual events. While this may not seem all that different from current strategies, it is important also to watch the proportions between awareness, digital, and field marketing spending and be able to measure impact.

While marketing leaders may not be asked to make cuts right now, they should proactively identify which elements of their marketing mix are mission-critical and which are nice-to-have. Remember, marketing budgets should be pegged to new bookings, and if new bookings show any signs of slowing, then prepare to cut marketing budgets. Now is the time to plan your potential budget reductions and which levers you might pull, so you can be agile as conditions evolve.

Demand Generation

At minimum, review and, if needed, adjust forecasts on a weekly basis based on changes you are seeing. Our perspective is that Q2 will be good for our portfolio, so while we’re not saying things are coming to an end, CMOs need to be proactive and realistic about lead and pipeline forecasts (i.e., what the Marketing org can deliver).

While it may seem obvious, focus resources on scaling efficient demand gen channels, as measured by those that meet your LTV:CAC goals. For example, email nurture programs are often relegated to “set it and forget it” status, which produces mediocre results. Yet email is a low-cost channel, effective for engaging top- and mid-funnel prospects. Look at your email nurture click/open rate and set up some subject line tests. Speaking of tests, we all like to think we instill a testing culture as it’s essential for unlocking growth. Especially in periods of economic uncertainty, you should reinforce the criticality of testing, especially in the area of funnel optimization, which has the potential to greatly improve demand gen efficiency.

People

Just 10% of marketing leaders in our portfolio report plans or processes to reduce headcount, but now is the time to right-size teams, manage performance, and evaluate talent costs. While the majority (53%) of our portfolio companies report they’re continuing to hire, they should recognize the opportunity to evaluate lower performers and make room for better performers at better price points. In general, it would be prudent to adjust headcount expectations down and remain as lean as possible, but like all marketing expenses, reduction in costs shouldn’t come at the loss of opportunity.

Simultaneously, this is a time for opportunistic hiring as the amount of talent on the market will likely increase as organizations reduce headcount. With market volatility and layoffs, the talent pool available to you will be strong. Think strategically about what roles are crucial value-adds versus nice-to-haves, and be ready to pounce on high-quality candidates who would be transformative to your org.

Messaging

As the CMO, your job is to ensure you are meeting the market where they are. It is likely that your messaging about who you are and why you’re unique won’t change unless you or your market has drastically changed. Take Snowflake and Meta as examples: Snowflake still wants people to go to its summit, and Meta still wants people in the metaverse. Messaging may still change, but realize that for many companies, it hasn’t changed significantly today.

However, the tone and copy of your ads and prompts might change if your market has. For example, in industries where rate hikes will impact the market, it’s important to be mindful and acknowledge that reality. Or if you sell to startups that are focusing on preserving cash flow, you may have to reframe the value proposition for that ICP. Where marketing does make changes in messaging, CMOs need to also drive alignment and increase enablement activities to ensure marketing and sales are working with the same messages.

Events

Companies often feel the urge to pull back on events, but the reality is those dollars are already committed in the short term. Where committed to events, companies should focus on better-driving ROI to get the most out of events. Don’t focus solely on demand gen, but rather look at driving ROI by building brand, leveraging events for Analyst Relations and Public Relations, accelerating pipeline, and gathering market insights to drive product innovation.

We’re not fully out of COVID, and we’re likely to see higher costs as inflation hits everything from cost of travel to cost of complementary cappuccinos at events. It’s important to look at virtual events to drive greater impact and cost efficiency. Companies may even consider partnering with an event to be in-person while also driving a virtual component.

--

As we head into increasing uncertainty, we encourage marketing leaders to leverage the above guidance to prepare for the changing environment. History has taught us that the most impactful marketing leaders never let a good crisis go to waste. While risk mitigation amidst economic volatility is key, savvy marketers are seeing this as an opportunity to consolidate leadership, deploy innovative new programs, and do more with less, thereby reinforcing marketing as the growth engine of their business.

CMOs should focus on alignment across sales, product, and marketing, and watch the right indicators to know the thresholds for action and proactively prepare. Core assumptions on how we consider CAC and ARR will be challenged. It is incumbent on marketing leaders to lead the organization’s measurement of the new normal following market corrections.

Above all, remain agile. Don’t be lulled into a sense of complacency because you’re not seeing changes today. Control your burn, clearly articulate what activities are mission-critical, and build scenario plans that can be implemented quickly and seamlessly (base case, best case, worst case). It’s better to be prepared and act with confidence than be put in a position where you’re forced to react.

For more guidance, download our deck as well as Mutiny’s presentation on demand and conversion program tactics.

These are general principles and may not apply to all businesses in all circumstances. This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice.

Learn More About the CMO Playbook for Economic Headwinds

For more guidance, download Insight Partners’ and Mutiny’s presentations about on demand and conversion program tactics.