In 2020, the Insight family were excited to watch as our portfolio company JFrog went public. Congratulations to the whole team! On the first day of trading, shares jumped 47% to $64.79 from an IPO price of $44 and have remained at this level since. This exceeded the initial estimates of $33 to $37 per share. JFrog’s excellent performance is based on its sound fundamental metrics – it boasts 46% year-on-year revenue growth and a net dollar retention (NDR) of 139%.

The same day, the market also welcomed Snowflake’s IPO, the largest in SaaS history. Snowflake boasts world-class SaaS metrics, growing at 121% year-over-year and with 158% NDR, which has helped it to reach its current $92 billion valuation, at the time of this writing. One of the main common links between these two success stories is they both use usage-based pricing.

In this article, we will discuss the benefits that can be found and some best practices when using and evaluating a usage-based pricing model.

The case for usage-based pricing

Usage-based pricing allows a natural rate of “land-and-expand” growth; the revenue you receive rises commensurate with your customer’s increasing usage of the product. Public companies with this model have historically performed incredibly well. A snapshot of usage-based pricing companies that have IPOd in the last five years shows that they all boast strong fundamental metrics:

|

Name |

IPO Year |

Revenue Growth |

Net Dollar Retention |

|

Agora |

2020 |

128% |

183% |

|

Snowflake |

2020 |

121% |

158% |

|

JFrog |

2020 |

46% |

139% |

|

Fastly |

2019 |

62% |

138% |

|

Twilio |

2016 |

46% |

132% |

|

Datadog |

2019 |

68% |

130% |

|

Elastic Cloud |

2018 |

44% |

130% |

|

Dynatrace |

2019 |

27% |

120% |

|

Cloudflare |

2019 |

48% |

115% |

|

Usage-Based Pricing Median |

46% |

132% |

|

|

SaaS Median |

|

25% |

117% |

|

Usage-Based Pricing Mean |

60% |

138% |

|

|

SaaS Mean |

|

29% |

120% |

Source – Company filings reported via Public Comps

Comparing this to a broader list of 99 public B2B SaaS companies represented by “SaaS median / mean” in the table, it is clear usage-based companies outperform. Not only does the above list outperform the average company in terms of NDR by 18%, but the top eight companies all utilize usage-based pricing. The next best company that doesn’t utilize usage-based pricing is Zoom, which can boast a 130% NDR – that’s still less than the average of the companies that do.

The advantage of such high NDR is that it creates an effective, organic growth flywheel that can be used to support your overall revenue growth story in an efficient way. If the companies on this list were to keep their current levels, they would be able to grow faster than the average SaaS company without selling to a single new customer.

What makes usage-based pricing different?

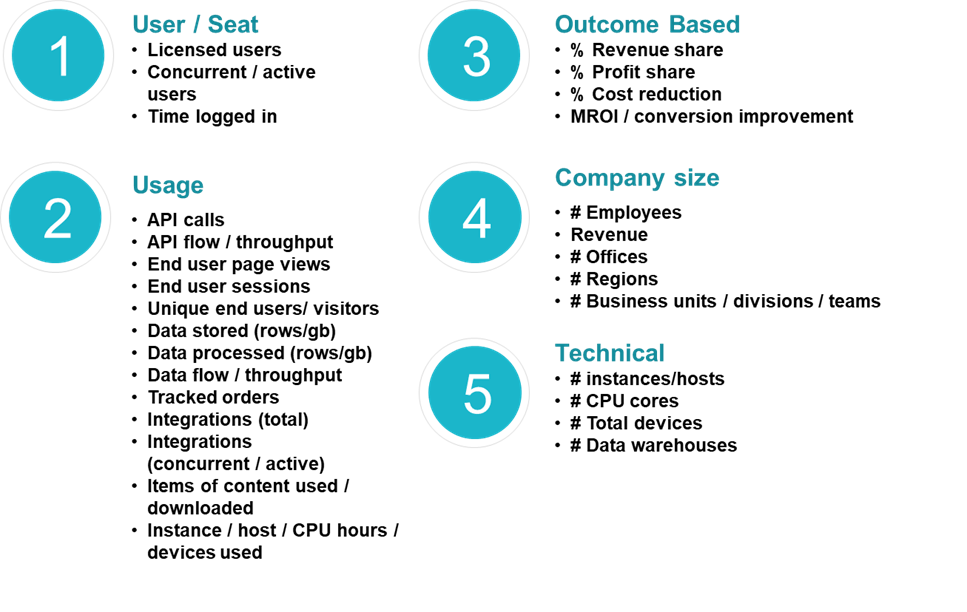

Usage-based pricing metrics are those that are linked to actual usage of the product in question rather than the number of users using the product, size of company, or based on the outcomes. In the last decade, it has become more feasible to track detailed usage metrics as license models have moved to SaaS and data handling has improved. Now it is the second most frequently used type of metric after users. Some examples of typical pricing metrics are below:

It is important to note that none of these types of metrics are universally better than others. The right metric for you will depend on your market, customer type, and product capabilities. There are examples of good applications of all these metrics:

- Per-user – Per-user is the right way to charge in cases where most of your value is directly tied to how many people are using the product. For instance, every salesperson who uses Salesforce should bring in more revenue and add productivity, while every new employee who is licensed to use Zoom is another person who can work remotely. Where that isn’t the case, per-user is typically a poor metric and should be avoided. For instance, a company whose product is meant to improve efficiencies for performing a given task should avoid per-user, as the more value and efficiencies you drive, the fewer users need to be using the product.

- Usage-based – Usage-based is typically the best option for most companies in cases where most value isn’t tied closely to users of the actual product. It can support a wide variety of different metrics pertaining to how customers derive value from the product, such as compute usage for Snowflake, Storage/Data transfer for JFrog, and messages sent for Twilio.

- Outcome based – This is a good option where you have a clear flow of revenue or clearly defined return on investment (ROI) that is trackable through the product. For instance, Shopify’s payments platform enables it to levy a percentage-based fee on every transaction it processes. In companies where the ROI link isn’t impartial and immediate (e.g., payment processing or directly saved cost), we would usually advise against outcome-based as it is easily gamed – customers will tend to try and argue down their own perception of product value / return on investment as a tactic to reduce price.

- Company size – This can be a useful metric for software solutions that add value to the entire organization of a company in a way that doesn’t require total employee engagement, for instance, Workday. Since company size is often less directly tied to value, we would often recommend per-user or usage-based as the main metric as long as it’s still suitable. Company size is particularly effective as a secondary metric alongside per-user or usage-based (such as differentiated price lists for SMB and Enterprise customers).

- Technical – Technical pricing is based on the total number of devices / servers / machines that a customer has, rather than the total number of devices / servers / machines that are in use at any given time. Historically prevalent in on-premises software deployments (where actual usage couldn’t be calculated), this has mostly been superseded by usage-based pricing.

Usage-based doesn’t always mean pay as you go

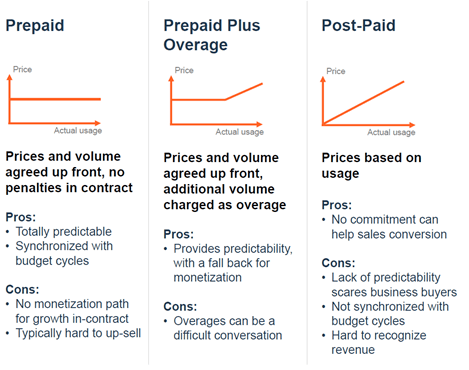

The most common misconception of usage-based pricing is that it must be charged after the usage has occurred, like a pay-as-you-go cellphone plan. Critics of this are rightfully concerned about the predictability of revenue, with the potential for customers to significantly reduce their bill with lower usage. However, this billing model is only one form of usage-based pricing and is relatively infrequently used within software. There are three main types of billing:

- Prepaid – Similar to purchasing a bundle of cellphone minutes or data in advance, this is where the amount paid is fixed and will not vary based on actual usage within the plan. If the plan isn’t time-based, usually the customer will lose access to the product or service once they have used the allotted usage. If it is time-based, the amount paid will be renegotiated upon renewal, and no charges will be levied for overuse or refunds given for underuse. It is infrequently used within software due to inflexibility, and we would typically recommend prepaid plus overage for recurring subscription models.

- Prepaid plus overage – Like most monthly cellphone plans, where you have a bundle of minutes and data that expire at the end of the month. If you exceed this bundle, you must pay for the additional use, typically at a premium rate. The advantage of this is that the overage penalties will form a compelling argument for the customer to upgrade to a higher plan limit for future months. Most SaaS companies that use usage-based pricing through a sales-led model operate in this way, such as JFrog or AWS (for reserved instances).

- Postpaid – Your classic pay-as-you-go model. This is typically effective when selling to SMB customers who don’t need the predictability of a set budget for a year and will pay a premium for flexibility. It is typically seen in self-service sales environments such as Snowflake’s credit system or AWS’ self-service offerings.

Optimizing usage-based pricing – all about the metric

The most critical element to get right when designing a usage-based pricing model is to select the right price metric. Selecting a metric that customers can understand, have a willingness to pay for, and are likely to grow their usage over time is a tough ask, but it is by far the best way to generate consistent up-sell and achieve high NDR. We would typically recommend that companies fully assess the right metric to use as soon as they hit $5M average recurring revenue (ARR), if not sooner – the benefits will compound the earlier you settle on the best metric. We would recommend that your metric score well or very well in most of the below areas:

- Value aligned: The metric scales alongside customer perception of the value of your product. This is vital to ensure that customers are willing to pay for the increase in their usage.

- Predictable: The metric level is easy for both sales and customers to understand (through data or 3rd-party tools such as SimilarWeb) and predict in advance (through steady growth or simple calculations). Without this, customers will be uncomfortable with committing to contracts.

- Usage friendly: The metric doesn’t affect how customers might increase their usage of the product. If it did, then it would limit your overall product penetration into the customer organization, and therefore customer health and product stickiness.

- Linked to growth: Customers’ metric levels will scale alongside deeper usage of product and/or growth of the business. The usage metric should always be likely to grow in the medium term. Avoid choosing something that could be consolidated (e.g., as technology advances).

- Scales with variable cost: The metric scales consistently with your product’s variable cost. Most relevant for compute heavy SaaS or IaaS, if the metric and your cost base aren’t aligned, you could end up with unprofitable deals at high volume.

Want more guidance on what metric is right for you? Insight Portfolio companies can download our full price model playbook here.

Bottom line

Usage-based pricing can allow companies to achieve and maintain high sustainable levels of net dollar retention and revenue growth. It is the foundation for the strong revenue returns of many high-performing public and private SaaS companies.

If suitable for your business, we would recommend following these best practices to make it a success:

- Make the call early: Critically assess whether usage-based pricing is suitable and what the “right” metric is as early as possible. It will be hard to migrate and up-sell customers who have signed before you have finalized your usage-based pricing structure.

- Avoid unnecessary complexity: Base pricing around a single metric (or at most a small number of related metrics) that:

- Are aligned with value from the product.

- Are likely to grow.

- Do not restrict normal/best practice usage of the product.

- Are predictable.

- Scale with value the customer receives.

- Find ways to drive recurrence: Look to build prepaid revenue streams with your larger clients, and ensure that if you have a post-paid contingent that volatility is unlikely. Look for usage metrics that will grow steadily rather than fluctuate.