The negotiation table. The last step before you sign and seal a new employee. For startups and ScaleUps, this often moves beyond base compensation discussions to equity – and here is where negotiations can get murky, or worse, completely sour.

Put simply: Equity compensation negotiations are complicated. At Insight, we have seen many compensation negotiations stall or falter due to a lack of common understanding and assumptions about the real value of equity.

Overcoming Misconceptions

The biggest misconception surrounding equity grant negotiations is that all equity is created equal.

What does this misconception look like in action? Candidates that come from a smaller organization and are joining a larger one might want the same percentage equity grant despite joining a more valuable company. Inversely, the CEO/Board at a smaller company might have to sell the value of equity to someone coming from a much larger organization who is used to higher cash compensation. In both cases, there is a misalignment around the true value of equity relative to the size of the organization.

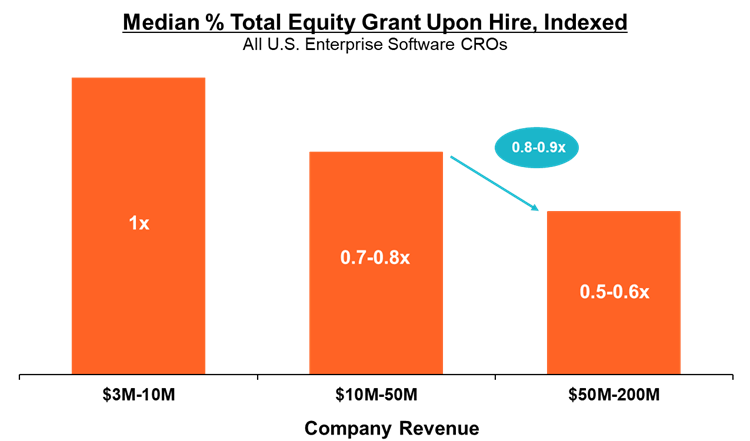

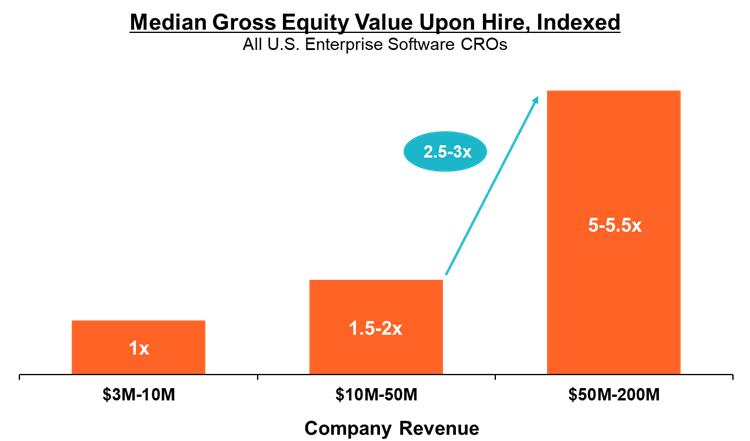

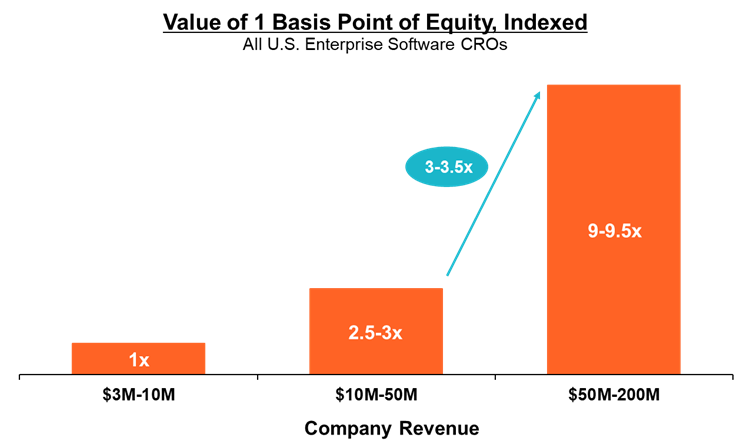

For successful negotiations, it is crucial that both employers and potential employees understand that not all equity is equal. The general principle is that as companies get larger, their equity grants get more valuable – despite the smaller percent ownership. Data from Shareworks by Morgan Stanley’s Option Impact compensation benchmarking tool spotlights several trends on executive equity compensation:

- Executives are granted a lesser equity percentage from larger companies than from smaller ones. As an example, a Chief Revenue Officer (CRO) hire at a company with $50M to $200M in annual recurring revenue (ARR) typically receives about 55% of the equity that a CRO hire at a company with $3M to $10M receives.

- Smaller equity grants from large companies are worth significantly more than large equity grants from smaller companies. A CRO equity grant ranging from 0.8% to 0.9% at a company with $50M to $200M in ARR is worth about 5x more than a 1.5% equity grant from a company with $3M to $10M.

- The dollar value of one basis point of equity increases significantly as company ARR increases. CROs can expect one basis point of equity at a company with $50M to $200M in ARR to be worth about 9x that of one basis point of equity at a company with $3M to $10M in ARR.

But these three trends extend beyond the CRO. If we just examine the value of one basis point of equity for a company with $50M to $200M in ARR versus that of a company with $3M to $10M in ARR, the dollar value of equity varies considerably by role. As companies grow, we find roles like sales and finance have the biggest acceleration of equity compensation while HR and operations have the least.

These trends point to one common truth: Equity value depends on the size of your organization, as well as your role. This is why benchmarking data, when from a reputable source, can prove to be a very powerful negotiation tool.

Enabling More Informed Equity Negotiations

Far too often, hiring teams head to the negotiation table without adequate benchmarking data and executives crowdsource their benchmarks from their networks. But without adequate benchmarking data to guide negotiations, these conversations can take a turn for the worse – either killing an executive’s candidacy completely or starting the relationship off on the wrong foot. To combat this, executives and hiring teams should leverage compensation benchmarking data to encourage a more transparent – and effective – dialogue. Not only will it improve negotiations, but it can lead to more motivated employees and executives, and better long-term relationships overall.

If you would like to learn more about Option Impact or how Insight Partners can support compensation benchmarking needs, please contact compbenchmarks@insightpartners.com.

About Shareworks by Morgan Stanley’s Option Impact:

Option Impact is the largest pre-IPO database in the world and all venture-backed participants can access cash and equity data for all levels and roles at no cost.

Key Benefits:

- 3000+ participants, the largest pre-IPO survey specific to venture-backed companies

- Base salary, bonus, and % total equity on executives, staff, and BOD data

- Automated custom benchmark analysis for all employees and more

To get started, please use the links below:

- Access the correct account:

- Data submittal – $0 for participating venture-backed companies with 21-day QA hold ($500 to expedite the QA process for immediate access) Sign Up Link

- Waived data submittal (immediate access, no input necessary) – $2500 / 6 months Sign Up Link

- Choose access timeline if inputting data.

- Standard QA Review – $0; access within 21 days.

- Access Data Now – $500; immediate access following input and payment.