Packaging 101: Structuring your Offering to Maximize Revenue and Delight Customers

Buying software is hard. A buyer is typically faced with multiple proposals from vendors offering similar solutions, each with small distinctions in functionality that are not always tied to the problem they are trying to solve. Many software vendors load their options lists with features that can be added on, for a price. The buyer must learn enough to critically assess which of these are useful to deflect the hard-sell for those that aren’t. Many buyers get stuck in this process and end up not buying a solution at all or pushing the decision to a future quarter or year.

This isn’t ideal from the vendor perspective either. Poor product packaging can delay, stall, and even kill deals that were otherwise certain wins. This is because the paradox of choice causes mental discomfort and breaks the trust in the negotiation. In a well-known customer psychology experiment, this concept was tested using a California grocery shop stall offering jam. with a stall offering 24 different varieties, 145 people stopped to take a look at the stall, with 4 buying a jar (through a coupon offered at the stall). When just 6 varieties were offered, only 104 people stopped at the stall, but 31 ended up purchasing. Offering fewer choices led to 8x the sales, and over 10x the conversion rate. A separate meta-analysis of 99 different consumer psychology studies on this topic identified four key purchase criteria where is it important to limit the choices that you offer to boost sales:

- In cases where the customer is trying to make a quick decision

- If the product is highly complex or technical

- When it is hard to exactly compare alternatives

- Where customers don’t have a clear or instinctive knowledge of their preferences

Whether you’re selling software to consumers, SMB customers, or large Enterprises, you will usually see at least two of the above factors. So should we all solve this issue by removing choice completely and offering only one option? That isn’t ideal either. Customers use, buy, and value your product differently, so by only offering one flavor of your product, you are trying to fit a square peg into many different types of round holes.

The solution to both issues is in thoughtful construction of your product packaging around how your customers want to purchase, and the journey they will go through as they use and purchase more of your product. In this article, we will walk through some best practices in packaging you can use to set yourself and your customers up for success.

Setting the foundation with the right structure

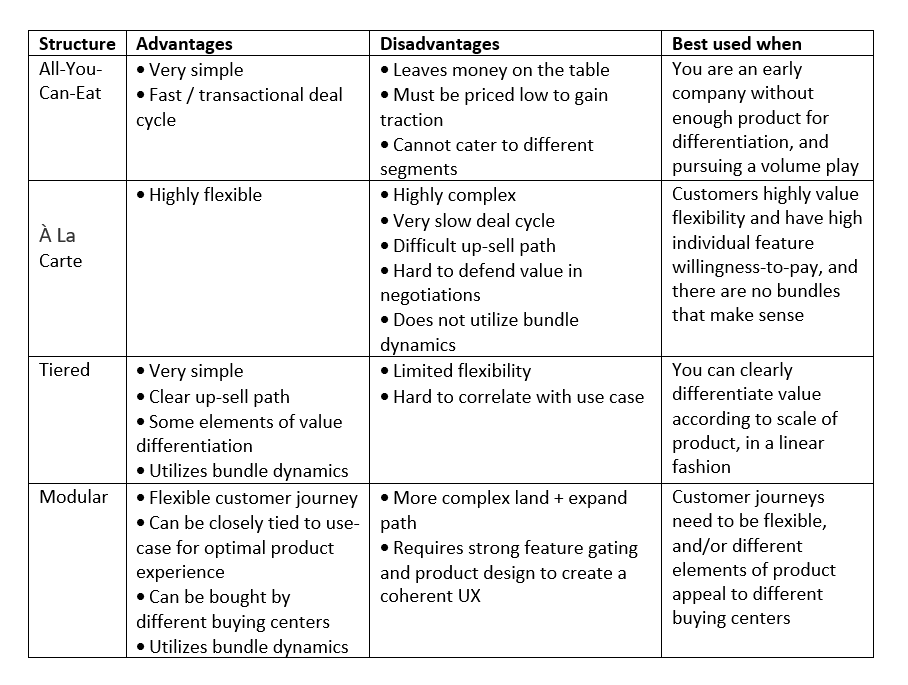

The core of any packaging strategy is how it is structured; which defines the different building blocks used to group features and functionalities. Below are the four most common types of packaging structure that are used by software businesses today:

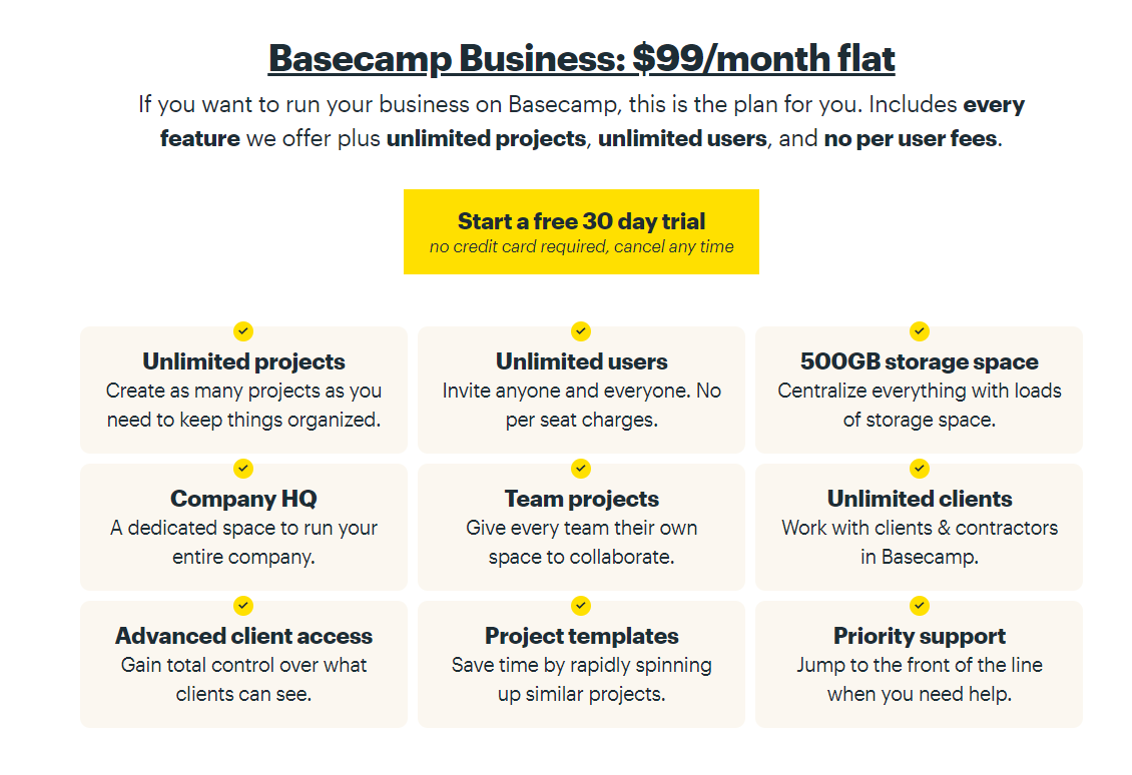

All-you-can-eat

This is the simplest possible offering – every feature you can provide is in one single product offering. Typically offered by smaller startups that are finding product-market fit, it has also been offered as a uniquely simple proposition by more established companies with simple value propositions, such as Basecamp.

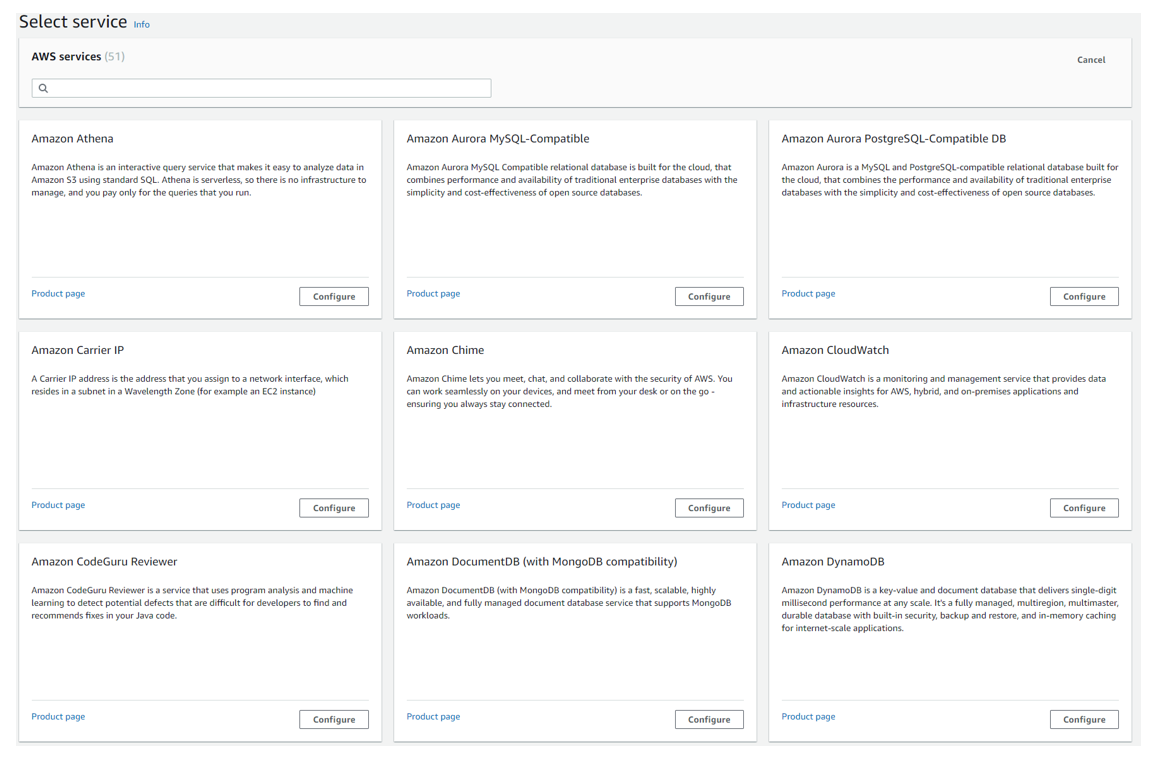

À la Carte

In contrast, the most complex packaging structure is where you allow for a large menu of different features and functionalities to be purchased separately, like a restaurant menu. The flexibility of this allows for it to be highly customizable, and thus it is often seen in software companies targeted towards enterprise (e.g., Oracle, Adobe, Informatica). It is also often seen in cloud infrastructure companies such as Azure and AWS (pictured).

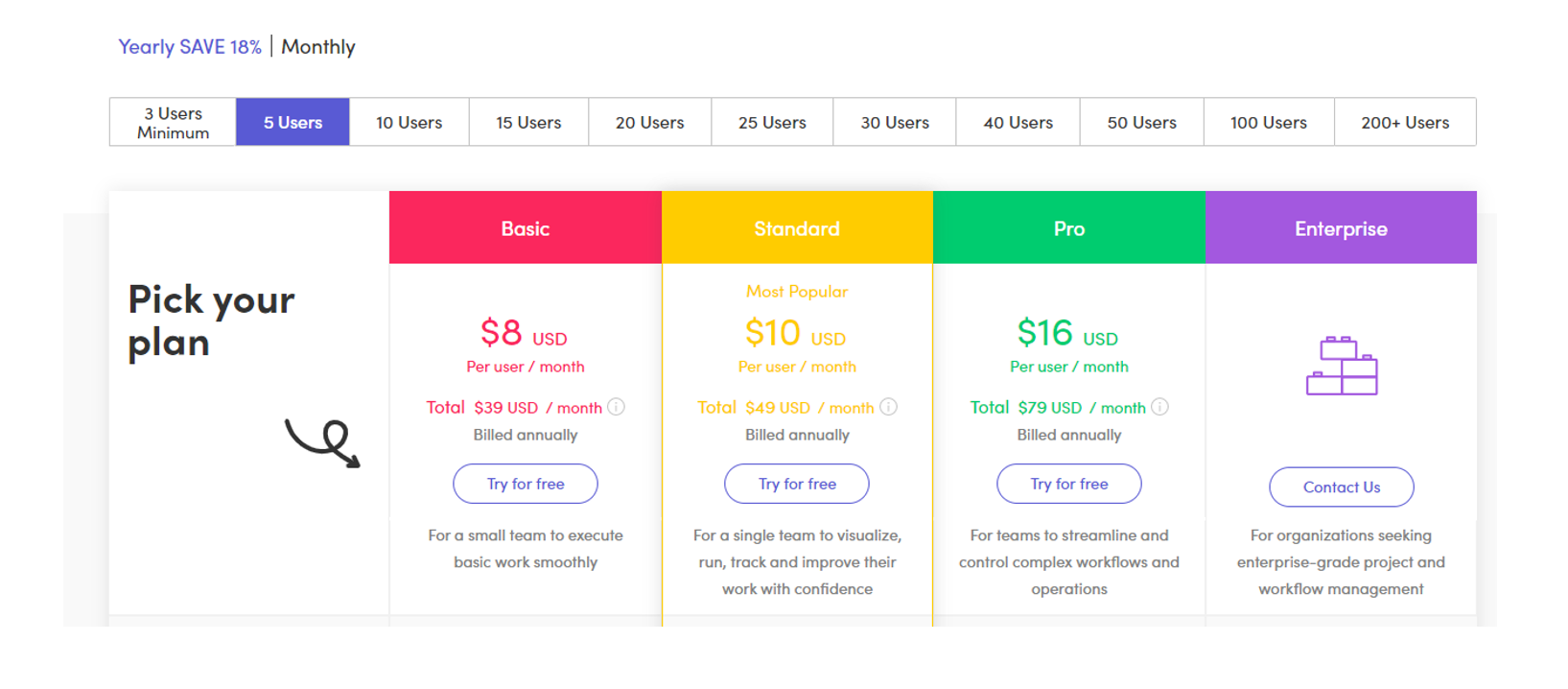

Tiered

Tiered packaging is where you offer a single range of 3-5 packages that increase in functionality as customers upgrade to new tiers. It is a very common packaging structure within SaaS, used by companies such as Salesforce, Shopify, and Monday.com (pictured). It offers simplicity while providing for levels of price-level differentiation. It is usually best paired with a usage-based pricing model that will complement the package simplicity by adding granularity of different price points across the spectrum of customers.

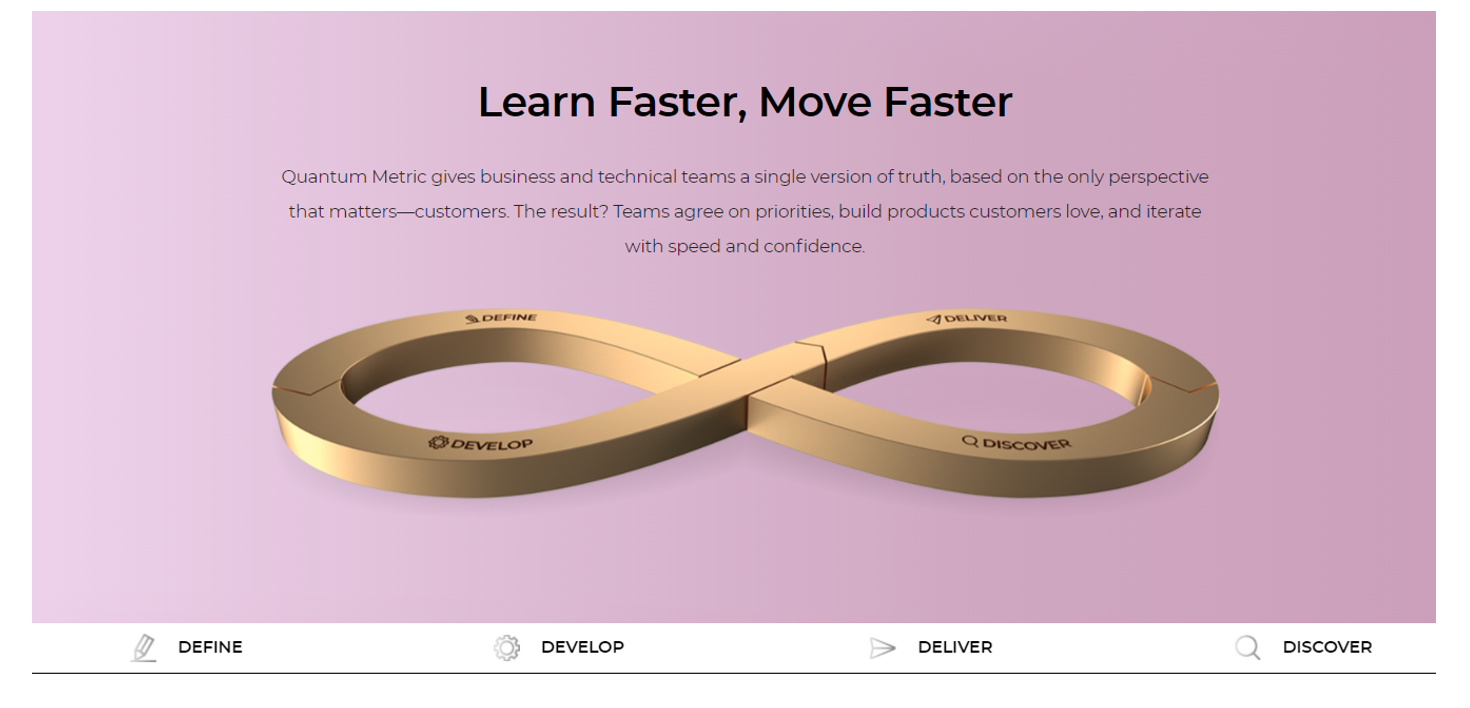

Modular

Modular packaging is where you offer bundles of features targeted at a function or use case, which are purchasable independently of each other. In some consumer cases such as LinkedIn, these are targeted at different customers, but they can also be used to target different ways of using the product or different buying departments within a B2B customer’s organization, such as Quantum Metric (pictured below). It can be bolstered by adding a platform component if you have a common tier of features that every customer needs, to set a minimum spend level and consistent experience.

Choosing the right path

The structure that is suitable for your business will depend on your customer’s preferences and the technicality of your product. Occasionally an all-you-can-eat or à la carte offering is suitable, but most software companies can optimize their customer’s willingness-to-pay and up-sell potential by using either a tiered or modular packaging structure. In these offerings, you can utilize the power of bundling dynamics to get customers to buy more than they typically would otherwise. Below is a summary of the different approaches and their strengths and weaknesses.

The right way to bundle – placing features into the structure

If the optimal structure for your business is tiered or modular, you need to take care to construct the right bundles to appeal to your different customer segments. Bundling is a science and an art – it requires a good knowledge of what your customers value at a granular level, with the right messaging and value communication to drive desired purchase behaviors.

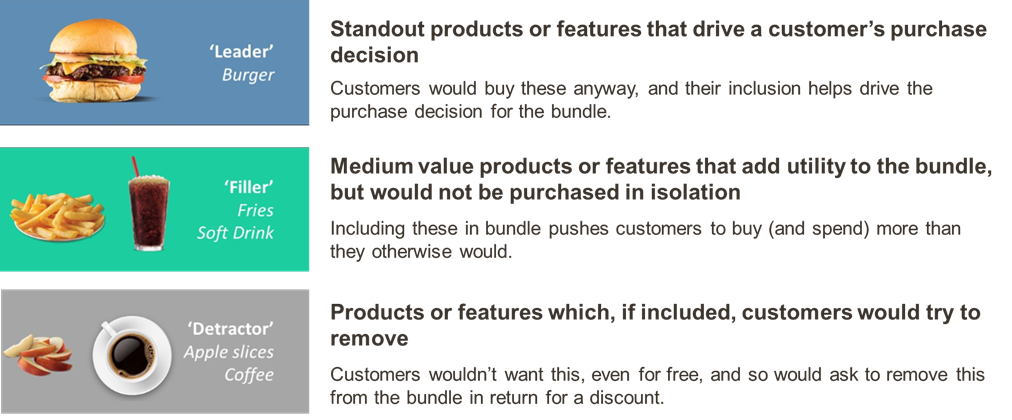

Learning from the McMeal

Within each bundle (either a module or a new tier, depending on your structure), you need a mixture of features that balance what customers want to buy, and those that complement them. Simon-Kucher and Partners have established the McDonald’s Value Meal as the clearest case study for how to bundle products or features together. Within this bundle, you have a leader feature – the burger – that is the one the customer would have a high willingness to buy on its own. You also have filler features – the fries and soft drink – that add value to the overall meal and make it seem like good value. I would have comfortably paid $4.49 for my Bacon Clubhouse burger alone, so at only $2 more for two extra items, it’s a no-brainer. From McDonald’s perspective, they have managed to make a $6.49 sale when I only really wanted a burger.

The thing to avoid in any bundle, though, is a detractor. This is including a feature within the bundle that many customers would actively not want. If you were forced to take some apple slices or a coffee with your McDonald’s meal, you might avoid buying the bundle altogether. In software, detractor features are the ones that many customers ask if they can pull out of your offering in exchange for a discount. While illogical, this psychological dynamic is so strong that if you offered a customer an identical bundle with and without the detractor feature, the amount they would pay will be lower for the bundle with the additional feature. These features should either be available separately as add-on features/products, sorted into a bundle targeted at customers who value that feature, or simply ignored in your value messaging.

What makes a feature a Leader / Filler / Detractor?

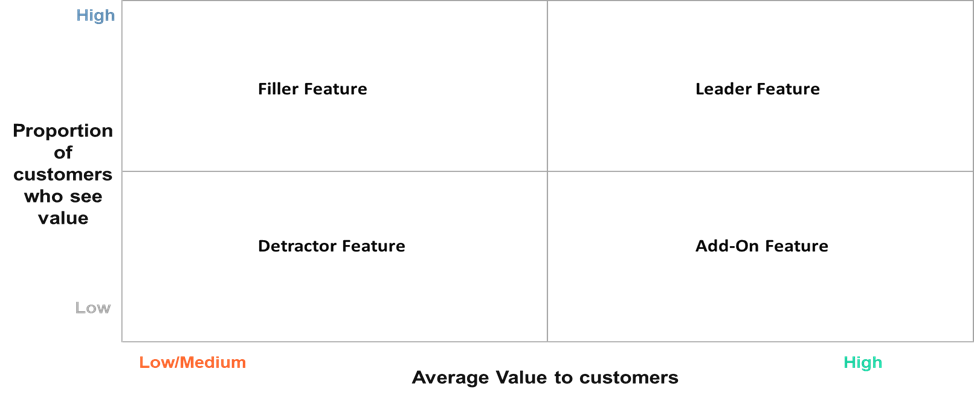

To determine whether a feature or functionality is a leader/filler/detractor (or should be offered as a stand-alone) – you need to understand two things: how valuable that feature is to the average customer, and what proportion of customers in a certain segment find that feature valuable

- If the feature is highly valuable to a large proportion of the market, that feature is a leader.

- If the feature is of low-medium value and a large proportion of the market find it valuable, that feature is a filler.

- If the feature is of low-medium value and a small proportion of the market find it valuable, that feature is a detractor.

- If the feature is highly valuable to a small proportion of the market, that feature should be sold separately as an add-on.

It is important to scale the “size of the market” you look at here to the segment that you are targeting the bundle to. If you are aiming to put together an “Enterprise” bundle, then look only at your enterprise customers. To map features onto the matrix above, there are two main data sources you can use:

- Product usage data: How frequently a given customer uses the product can provide a proxy for how much value they derive, and how many customers in the segment use this feature can demonstrate the proportion of customers who value it.

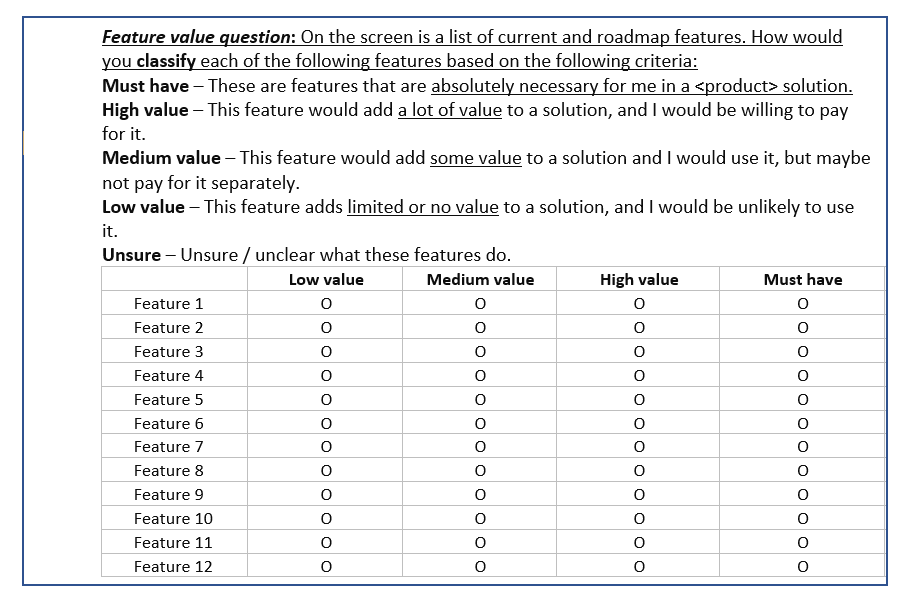

- Market research: Asking customers what features they value (relative to others) can be a good way to determine what is most important to them. In these questions, it is important to use a specifically labeled scale (such as the one below) rather than a rating scale, because otherwise, customers will likely default to ranking everything as highly valuable.

Summary

Alongside your price model, product packaging is the most critical aspect of your pricing strategy to get right. The right packaging structure should be a central tenet of your value messaging and a core pillar of your customer journey.

Typically, companies can optimize this by grouping features into well-designed bundles that maximize willingness-to-pay and encourage customers to spend more. By being thoughtful about how features (both new and existing) fit into this structure, you can maximize the value of your product for each customer, while creating a logical and efficient up-sell path.