Product Leader, Are R&D Costs on the Agenda of Your Next Strategic Discussion?

Growth is rightfully the number one priority for start-up and scale-up software companies, but upon nearing an exit, establishing a path to profitability becomes the main focus. When that horizon nears, costs need to be addressed, but R&D can seem a massive black box where everything is ‘need to have.’ P&L level analysis is most useful for trends over time, and detailed project views only pop off they page when they convey bad news. The numbers that are most easily accessible are rarely the ones that fire up your board, investors, and team about the direction of your company. But, the earlier a company starts effectively tracking and managing R&D costs, the better prepared they’ll be to establish a path to profitability. Beyond that, companies with an effective way of aligning R&D spend to strategic goals can accelerate growth. How?

The right framework can tell you exactly what you’re spending on your product and highlight the business outcomes those investments are expected to create. My favorite one-line definition of strategy is: “the allocation of finite resources to create maximum business and customer value.”

As a leader, you drive your company’s success by:

- Knowing your most important opportunities and risks

- Deploying resources to capitalize on opportunities and mitigate risks while continuing to serve your existing customer base

There is a wealth of guidance on delivering maximum business and customer value (my favorite is Melissa Perri’s blog, which is one of the things that inspired me to join her team). This blog will lay out how you can monitor and communicate product-related costs to ensure you’re effectively deploying your resources to enable a value-maximizing strategy.

Once you’ve evaluated strategic initiatives with business cases tied to your most important top-line metrics, you can use the following cost framework to evaluate your resource deployment against those business priorities. Conducting this detailed, data-driven exercise is incredibly important. Your qualitative understanding on R&D spend may not reflect the true state of your company. You can’t make the right decisions unless you have a reliable, actionable source of truth.

What are product-related costs?

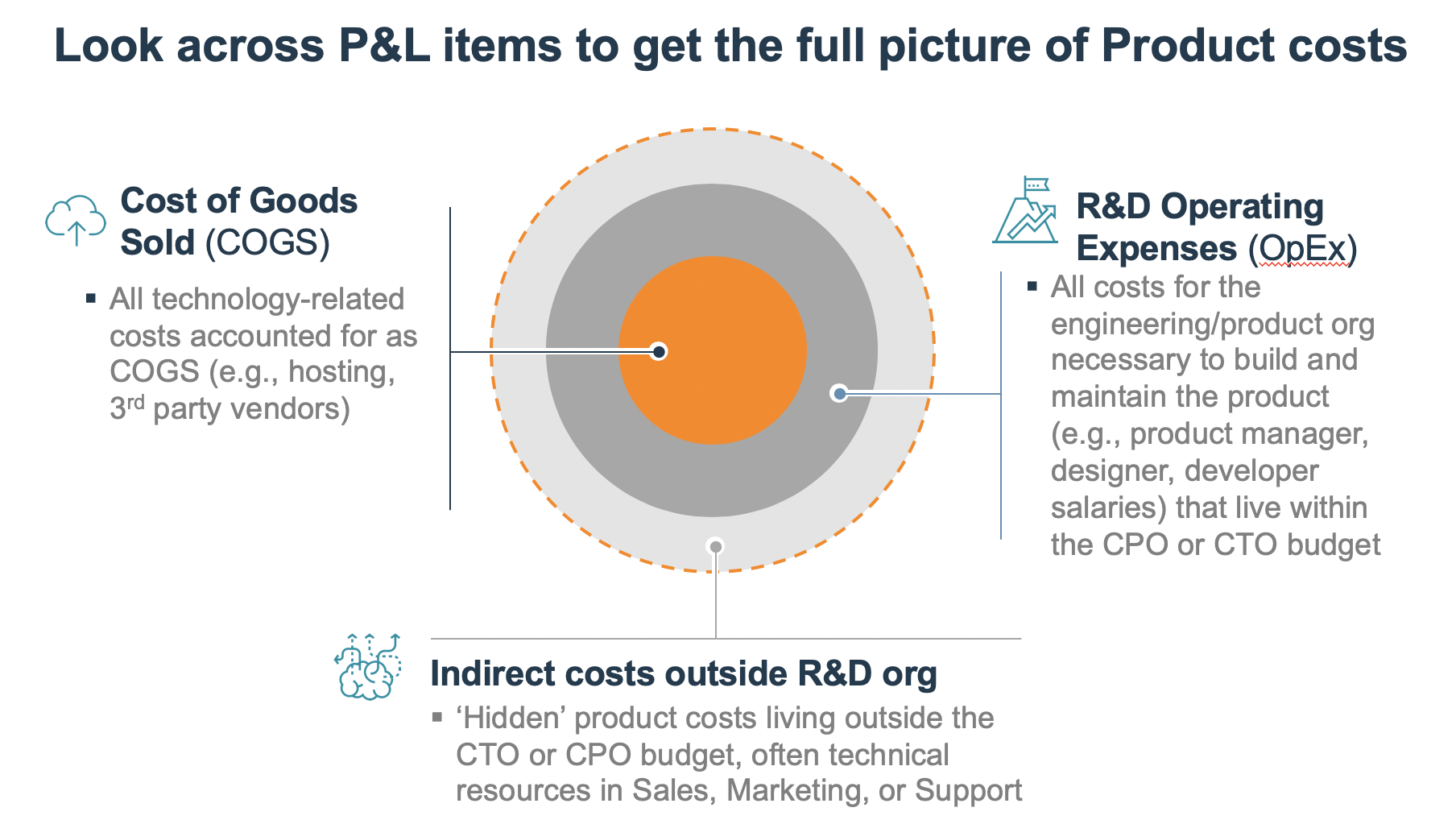

Before diving into how to meaningfully categorize spend, it’s important to know what dollars should count as product costs. There are three types of cost most B2B SaaS companies should capture in this analysis:

- COGs: Delineated by finance, these include the marginal cost incurred to deliver your ongoing service (e.g., hosting costs, licensing/royalty fees).

- R&D OpEx: The remainder of your R&D budget is represented here, typically all other labor and 3rd party spend on engineering and product.

- In-direct product costs: Technical resources such as implementation engineers, solution architects, and technical customer service teams that may live in sales or support budgets. As these technical resources are needed to sell and deliver the value of your product, you want to capture them as product costs.

As you communicate your total cost, you’ll want to be clear what P&L line items you drew from, so that your audience can contextualize the costs you’re talking about. Then, you’re ready to allocate your costs into strategically meaningful buckets, a process called manual baselining. When you adopt this practice and build it into your company strategic review, you’ll want to consider automating the analysis, but starting from a manual baseline gets you the snapshot you need to understand the current state of your business, and it allows you to capture any assumptions and logic rules you may need to automate the allocation in the future.

How you can meaningfully categorize product costs

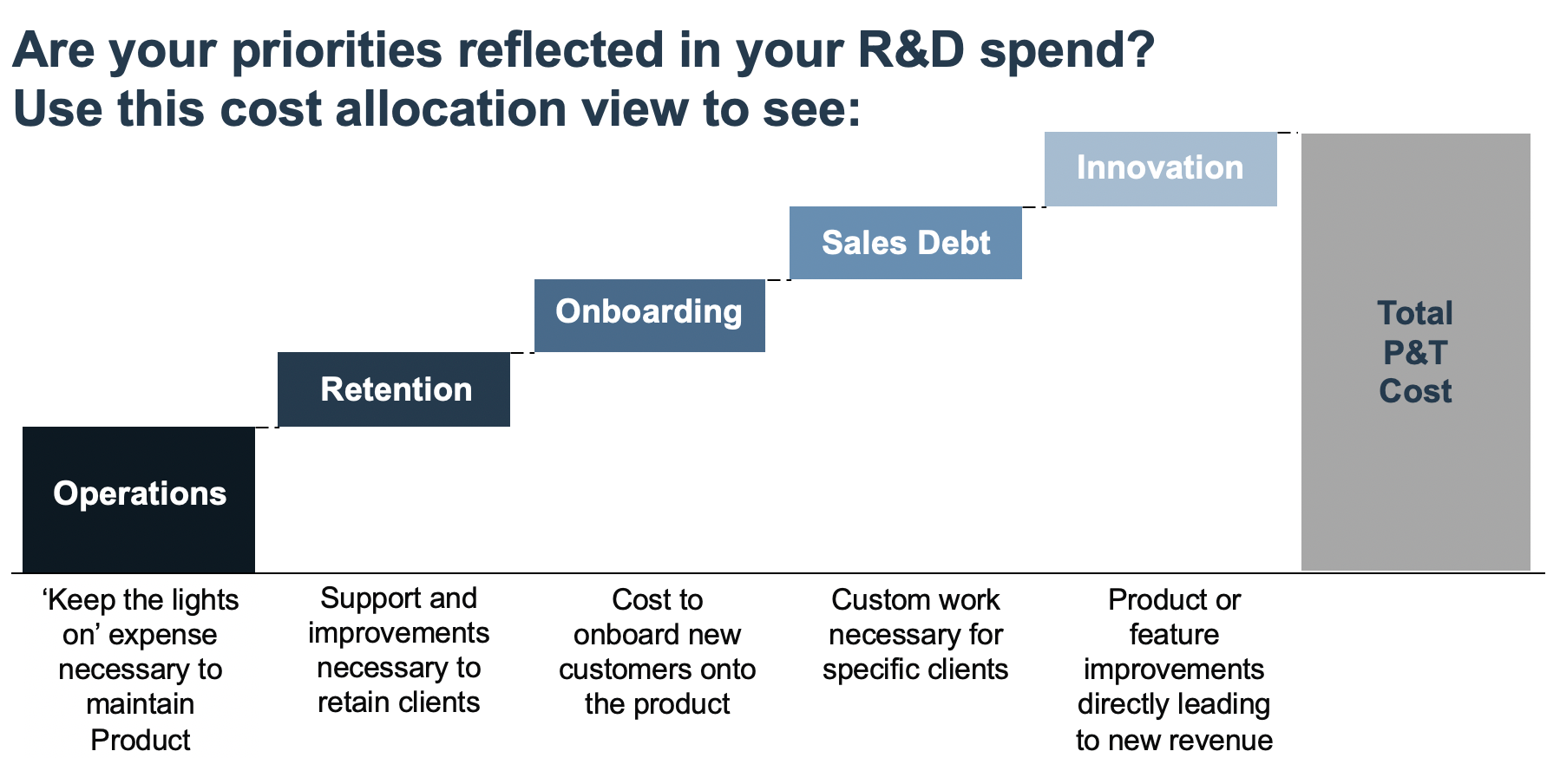

To effectively baseline your resource allocation and then monitor your ongoing deployment against your strategy, we recommend segmenting your R&D costs into the following categories:

We like this segmentation for a few reasons:

- It captures all product costs in a mutually exclusive way.

- The buckets are easy to communicate throughout your organization, from scrum teams all the way to the board.

- It’s easy to connect your top-line goals (e.g., “Reducing Churn”) to the full set of steps you are taking to reach that goal (e.g., “Cost of Retention”).

Cost to Operate:

Capital required to serve your existing contract revenue. Your CFO might think about this as cost to keep the lights on (often abbreviated KLO). This bucket should only include costs needed to continue delivering your service without factoring in any effort going towards improvements or enhancements that will drive retention, e.g. hosting spend, licensing/royalty fees, and critical bug fixes (those needed to keep the service running).

Outside of extreme circumstances, you probably don’t think about your business through this lens. Here is a quick test to clarify if a cost belongs in Cost to Operate vs a different bucket (e.g., Cost of Retention): take a typical customer on a one year contract (or whatever time frame is relevant for your business), and ask, “What is the bare minimum I would need to spend to continue delivering my service to this customer if I didn’t care about them renewing their subscription?” Anything that doesn’t clear that mental check shouldn’t be in Cost to Operate.

Knowing your cost to operate is important as an indicator of your value. The difference between your locked-in revenue and your cost to operate is one way investors may value your business.

In practice:

- Your goal should be to keep cost to operate as low as possible while effectively delivering your product.

- A growth stage company shouldn’t have a high % of spend on cost to operate (>50% should raise eyebrows, depending on your business model). You may need to pay down tech debt to reduce your cost to operate.

Cost of Retention:

Money spent on preventing customer churn beyond your Cost to Operate. These costs include non-critical bug fixes and special enhancements to prevent churn, but which are not expected to drive new logo growth or upsell. Frequently, these tasks are surfaced by account managers, support teams, product managers, or customer advisory boards.

In practice:

- If your business is churning like crazy, but your spend on retention is low, you’ll want to consider diverting resources to retention so that you don’t become a leaky bucket.

- On the other hand, if your churn is very low, but your spend on retention is large relative to other buckets, you may actually be hamstringing your growth by underfunding innovation.

Cost of Onboarding:

Investment required to implement solutions and train users. However, if you charge an implementation or professional services fee to cover the cost of onboarding new customers, as many companies do, we recommend removing those costs from your allocation and evaluating the profitability of that service separately.

In practice:

- If your cost of onboarding is high and you aren’t charging an implementation fee, you may want to explore improving self-service functionality and customer service tools.

- Alternatively, setting up industry specific templates or pre-configurations to get new customers started on the right foot can lower Cost of Onboarding without much R&D investment.

Cost of Sales Debt:

The cost of developing specific features and functionality that your sales team promises to prospects in order to win deals, aka customer commits. Making these commitments can be a great tactic, especially for early stage B2B companies locking in their first clients. However, given the specificity of many customer needs, this functionality is often less applicable in the broader market, and thus less strategic. Therefore, it’s important to isolate the money you are putting towards customer commits when you look at your R&D spend.

In practice:

- If you’re a B2B company, chances are this is a pretty large percentage of your spend in the early years. As you grow, it’s important to rein in this cost before you strangle innovation with individual customer requests.

- If your business is established and you serve a fragmented customer base, but your cost of customer commits outweighs your spend on innovation, you may want to revisit your sales approach to free up R&D to develop features with broader market appeal.

Cost of Innovation:

The development effort you dedicate to new features, functionality, and products which will help you expand your customer base with new logos and grow the value of your existing customers with upsell and cross-sell. Your new logos may be in new geographies, verticals, or customer segments, and the investments you make to reach those customers are innovation that expand your business. Spend in the innovation bucket should always be tied to expansion in some way, whether within your existing customer base or beyond. In the absence of churn issues, this bucket is the most important discretionary bucket for growth stage companies.

In practice:

- 'Innovation’ is a term that is often cavalierly thrown around to describe anything that improves a product. Be disciplined about what you apply this label to. If your financial plan projects significant growth, make sure a high % of your spend is on features and products which will expand your serviceable addressable market to new customer segments, grow your average contract value through upsell or cross-sell opportunities, justify price increases, or improve win rates due to increased competitive differentiation.

- R&D innovation can also be a write off depending on your country or state, and therefore it should be tightly tracked.

Tying these five categories of R&D together can give you a clean picture on where you are driving your business today and allow you to make actionable product investment decisions based on your company context:

Example single product cost allocation. Note: if you have a portfolio of products, you’ll want to understand your money spent overall and by product.

Where does Tech Debt fit in?

Paying down tech debt is a healthy part of the SDLC, and it’s often necessary for scalability and the efficient development of new features. Spend on tech debt can be development time spent on refactoring, rearchitecting, or transitioning platforms, but it’s best not to give yourself the easy out of adding a bucket for spend on tech debt. Tech debt spend should always serve a strategic purpose, and thus be reflected in one of the buckets laid out above. For example,

- Re-architecting in order to reduce your ongoing cost to operate should temporarily show up in cost to operate, after which you’d want to measure that your hosting costs actually went down.

- Refactoring to reduce the time to deliver new features would fall under innovation.

- Expanding or re-implementing your test coverage to reduce released defects would fall under the cost of retention.

Your first R&D allocation: take the first step and iterate

You should aim for your first allocation to be as accurate as possible, but you likely will not have all of the systems, processes, and data tagging 100% ready for this exercise. You should conduct the first manual baselining exercise anyway. You’ll be surprised by the level of insight you glean from the first pass, even if imperfect, and you’ll learn by doing, allowing you to iterate and increase accuracy over time.

Some costs are relatively easy to allocate (e.g., hosting costs), while R&D labor can be more complicated, especially if a single team is working on multiple projects which may fall into different buckets. Best practice is to use the accounts payable and labor costs from your system of record. Then, create the manual baseline by tagging spend by vendor or invoice for 3rd party costs and using data from your HR and project management systems to segment your labor costs. To expedite the process in the future, add tags to your JIRA or workflow system to designate what bucket an epic or story falls into, and then use work tracking or story points to estimate the cost of delivering each epic/story.

Now that you have a baseline, what should you do with it?

There is no such thing as a bad manual baseline. You should look at your manual baseline and simply ask: are we deploying our resources in a way that will deliver our business strategy? If no, what do we need to change? Often, executives try to make these decisions based on anecdotal evidence, but you need a data-based, quantitative source of truth if you want to make the right decisions for your company.

Additionally, your cost allocation will depend on where you are in the product lifecycle. Early in the product lifecycle you should be emphasizing growth, reflected in a high % of spend on innovation. Managers of mature products should be prioritizing retention and minimizing cost to operate to maintain and improve profitability.

Your first baseline will tell you where you are, and how your resource deployment changes over time will help you track the execution of your strategy and communicate it to your executives, board, and investors. Keep in mind that you should be iterating on the metrics you track the same way you do with products, this is V1 not your final version. Eventually, this kind of cost tracking should not only be an indispensable part of your strategy review cycle, but something you track continuously to help you make day to day decisions as a product leader.

Again, cost is only one side of the strategic equation, revenue is still the most important thing to keep your eye on. But, knowing with certainty where you’re deploying your resources will increase your ability to deliver the customer and business value you’ve mapped as your path to success. Additionally, when it comes time to establish a path to profitability, you’ll have visibility into your R&D spend to understand what’s critical, what’s discretionary, and how you plan to evolve your cost structure over time. What executive and board wouldn’t want someone focused on profitability on their team?