When it comes to global expansion, the risks are high and rewards can be higher.

If you have a proven product or service, strong gross revenue retention, and a reliable way of prospecting and closing deals, there’s a lot to be gained from increasing your global footprint. Our investors and advisory team have partnered with hundreds of ScaleUp leaders expanding internationally, which has allowed them to spot patterns among the most successful ones.

This guide is to help SaaS founders like you navigate the complexities of global expansion with confidence. With seven actionable steps, our team will equip you with the insights and strategies needed to seize new opportunities and scale your startup successfully across borders. Let’s dive in.

Decide which market to enter

Expanding into a new market is one of the most critical—and complex—steps in scaling your business.

Selecting which market to expand into first can feel as daunting as it can exciting. But in reality, there are a limited set of geographies to consider.

Evaluate demand and market fit

Start by identifying where your product is already gaining traction. Inbound leads, website traffic, and customer feedback often reveal markets with strong interest.

“If you get a lot of inbound leads from countries where you don’t yet operate, look to see if there are any patterns in where they’re coming from—it may make sense to start there as you have buyers waiting for you to serve their market,” says Rebecca Liu-Doyle, Managing Director at Insight Partners.

Another indicator of potential interest lies within your existing customer base. They already use your product and may have a need for it in other geographies as well.

“If your customers have a particularly strong presence in another country, that could be a smart market to enter,” says Liu-Doyle. “You also have the advantage of being able to talk to your customers and establish demand before you invest in the expansion.”

Competition can also signal opportunity. While counterintuitive, the presence of competitors often validates demand and shows that customers are already educated about your product category.

“Competitors are a form of market validation. If you’re entering a market without any competition, you need to find out if it’s because potential customers aren’t aware of your kind of product, or there simply isn’t enough demand,” says Sgro.

Consider adjacent and regional opportunities

Neighboring or culturally similar markets are often logical first steps in expansion. These regions typically require less adaptation and allow your team to test and refine go-to-market strategies. However, even small differences in language, culture, or regulations can impact adoption, so localization is key.

“It’s the factor that founders under appreciate the most,” says Sgro. “[US Founder[s] think everything can be in English in every market, but that approach starts to fall apart very quickly.”

“Even when two markets look identical, there will be nuances that can make them very different,” adds Travis Kassay, Operating Partner at Insight Partners.

Staffbase, for example, started its international growth by expanding into other German-speaking countries like Austria and Switzerland. They found success in selecting smaller, similar markets before taking on larger, more complex markets.

When evaluating a region, don’t stop at the country level—specific cities or areas often play an outsized role in different industries. Look for hubs that align with your target audience, industry presence, or cost considerations. For example, in the US, Boston is the place to go if your SaaS is in the healthcare tech vertical. Choose your landing spot wisely to set yourself up for optimal networking with those in your industry.

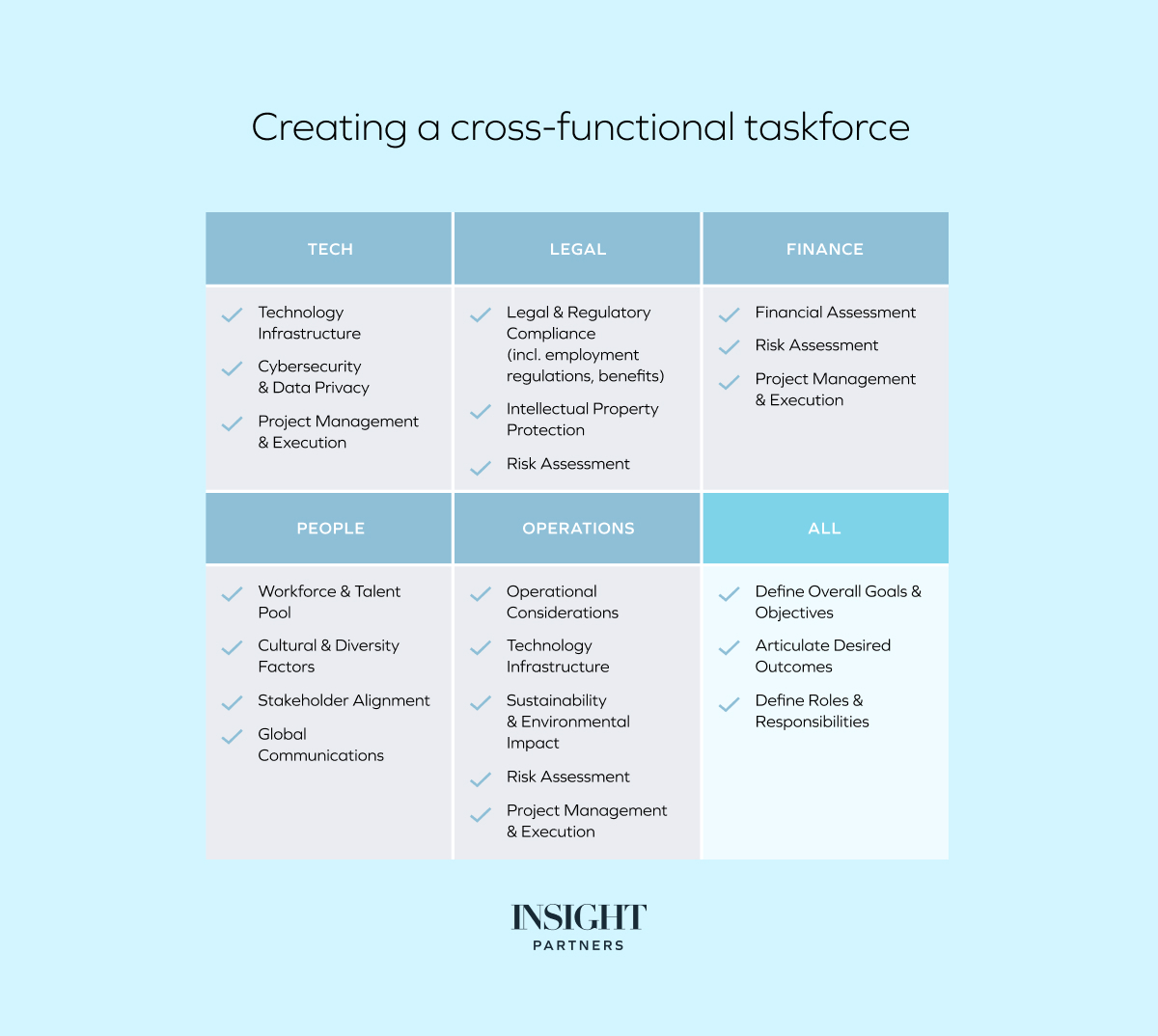

Tapping into the team

To decide which market to expand into, establish a cross-functional project team to work together and make an informed decision. The team should include representatives from key departments such as tech, legal, finance, people, operations and executive leadership, and must consider the perspectives and expertise of each department.

Use data to make your decisions

Many companies stumble by selecting markets based on intuition rather than data. For example, expanding into a city with a high cost of living can lead to resource drain early on.

“This is particularly common for companies expanding into the US. Founders often land in New York or San Francisco, but both are very expensive and competitive, which can make it difficult to hire top talent and may slow you down tremendously,” says Liu-Doyle. “Companies should also consider less saturated cities like Atlanta, Boston, or Raleigh.”

Another data point to consider is the market size and opportunity.

“Work out what your TAM is and what portion is obtainable within the market you’re assessing,” says Meg Fitzgerald, Senior Vice President at Insight Partners.

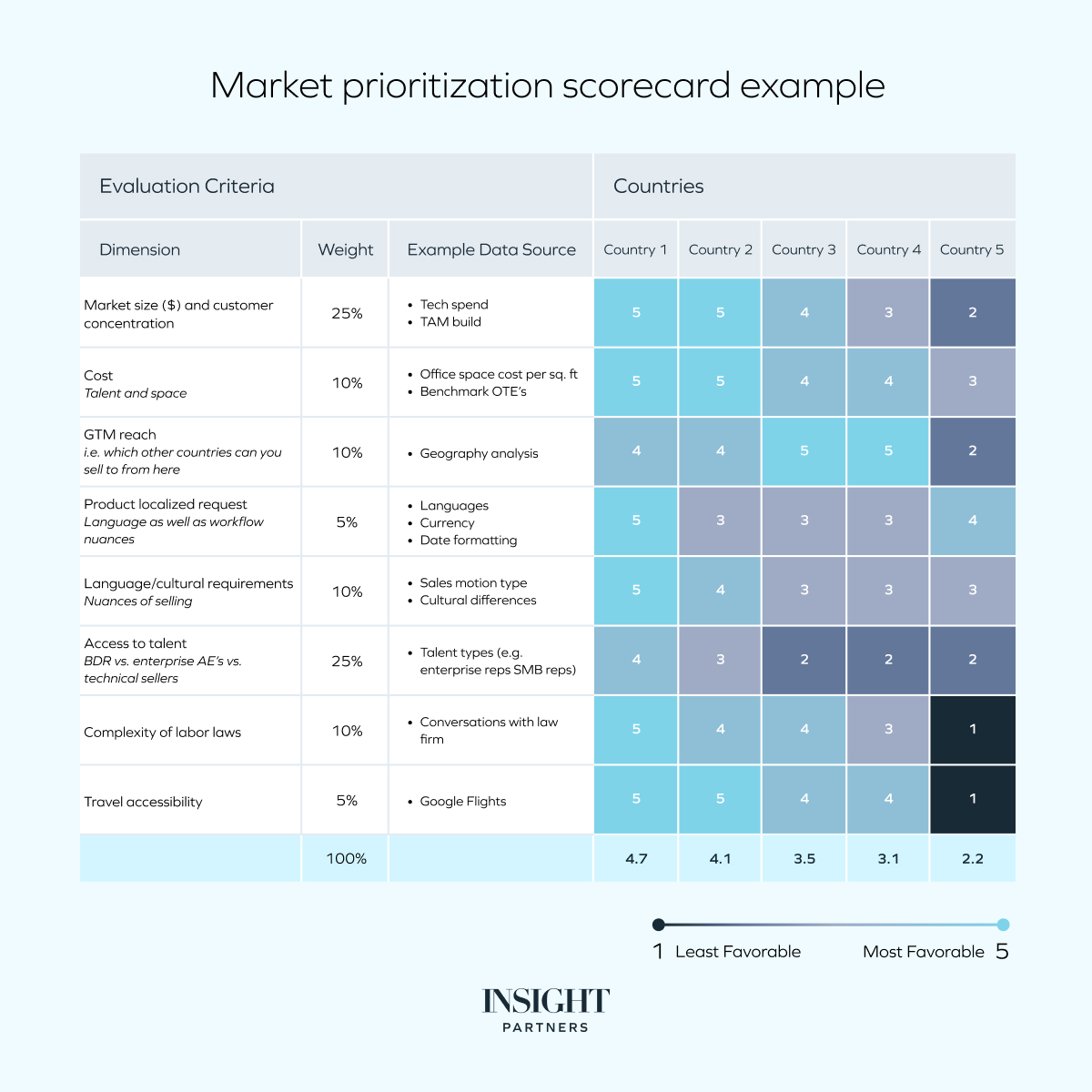

We recommend using a scorecard to help you to evaluate your target markets against different criteria. A scorecard should include factors like market size, customer demand, competitive landscape, and ease of doing business. Prioritize markets where you can win—not just those that appear exciting or high-profile.

Evaluating your next market

To determine which market to expand into next, consider using a scorecard to evaluate a range of geographies.

Understand legal and regulatory frameworks

Once you’ve chosen your target market, it’s time to build a strong legal foundation to operate successfully.

Establish your company structure and employment practices

Deciding how to set up your business legally is one of your first tasks when entering a new market. You typically have

1. Forming a local subsidiary

Creating a local subsidiary provides greater flexibility and control but comes with significant administrative responsibilities.

2. Using an Employer of Record (EOR)

An EOR is a third-party provider that legally employs workers on your behalf, handling payroll, taxes, and compliance. This approach is faster, less resource-intensive, and ideal for companies testing the waters in a new market before fully committing.

“Forming a local subsidiary often comes with a lot of extra obligations,” says Andrew Prodromos, Managing Director and Chief Compliance Officer at Insight Partners. “For example, you may be required to make local tax and employment filings and perform annual audits, even on entities with limited operations. There are also often requirements to have resident directors.”

Beyond company structure, you’ll also need to navigate employment law, which varies widely across jurisdictions.

“Differences in employment law are often where we see the greatest differences between jurisdictions,” says Prodromos. “There will be varying requirements when it comes to payroll, employment taxes, pension contributions, and insurance.”

Your first step is determining whether employment agreements are mandatory or if employees can be hired at-will. If contracts are required, they must address critical clauses candidates expect, such as:

- Equity terms

- Severance agreements

- Accelerated vesting schedules

“Candidates anywhere in the world will likely want to see clauses on equity, severance, and accelerated vesting schedules,” says Dominic Olszowski, Vice President at Insight Partners.

Having a standard contract prepared early enables you to move quickly on hiring decisions.

“Good candidates are in high demand. You don’t want to lose them because you took too long putting the paperwork together,” says Olszowski. “Finding a local lawyer is also useful for getting ahead of matters.”

Comply with data privacy regulations

Data privacy laws are another critical area that can vary greatly by region and create compliance challenges for businesses entering new markets. These laws span operational details such as:

- Privacy policies and regulatory reporting

- Cookie settings for websites

- Call recording and biometric data collection

Engaging local legal counsel early is essential to understanding jurisdiction-specific rules and how they compare to your existing practices.

“Specialized counsel can help you determine which jurisdictions and legal regimes may apply to your business,” says Prodromos. “You should also assess the requirements of your new jurisdiction against your existing data practices and will need to continue to review them periodically as the nature of your business and the laws governing it change.”

The amount and type of data your company processes will dictate how demanding your obligations are. For companies with significant data processing activities, hiring a dedicated resource may be prudent.

“More and more, companies are finding they need a qualified data privacy professional—either on a contract basis or full-time—or even a senior-level resource like a Chief Data Privacy Officer,” says Prodromos.

If you’re in the early stages of expansion with smaller operations, a contractor or an Employer of Record can help manage compliance efficiently.

“Whether to hire someone to oversee this expansion or rely upon a contractor depends on the size and speed of the expected expansion,” says Prodromos.

Address US-specific regulatory and employment challenges

If your expansion includes entering the US market, understanding the complex interplay between federal and state laws is critical.

“Companies will need to navigate both federal and various states’ laws on a variety of topics related to their operations, such as employment law, tax law, and various regulatory or registration requirements,” says Prodromos. “That’s particularly true if you operate in a highly regulated sector such as finance, insurance, or healthcare.”

From an employment perspective, employing people in the US is very different from much of the rest of the world. For example, most US employees are at-will employees rather than under employment contracts. Every state also has separate employment laws, so where the company operates and where its employees are located is important, particularly from an administrative and payroll tax perspective.

“Sales tax is often an issue with tech companies, particularly operating in the US, since they may have exposure in every state,” says Prodromos. “This can create reporting complexity and potential liability for the company if not managed properly.”

Careful planning and local expertise will ensure compliance with both federal and state-specific regulations. For highly regulated industries or tech companies dealing with multistate operations, seeking specialized legal and tax advice early is critical. By proactively addressing these complexities, companies can minimize risks, streamline operations, and set the foundation for sustainable growth in the US market.

Localize product and pricing

Another early decision to make in a new geography is how much you should modify your product and pricing to suit local demand.

Even subtle differences in customer expectations, workflows, or regulations can upend assumptions that held true at home. What feels like a small adjustment on paper may materially influence whether you achieve product-market fit in the new region.

Re-establishing product-market fit

Assuming your product won’t change at all is a risky assumption. Just because you had product-market fit (PMF) in your home market doesn’t automatically mean you will in the new one.

“The ‘M’ in PMF is changing, and that could mean that your ‘P’ has to change too,” says Rachel Weston-Rowell, Senior Vice President at Insight Partners.

You need to go over the same process you used to establish PMF in your home market and make sure it still holds. First, ask who you are serving. Check if the user and buyer personas are the same. Then, do they have the same problem with the same use cases? If not, you may have to change your product to suit the new use cases. Finally, does the value proposition resonate? For example, if your product helps customers overcome regulatory barriers, those challenges should exist in the new market.

If you skip the PMF part and press ahead with sales, any failure will seem like a sales problem.

“You might assume you have a bad sales rep, the wrong clients, or messaging that doesn’t resonate,” says Weston-Rowell. “Changing those things will never fix the issue if the product isn’t right for your new market. All you’ll do is waste time and set your sales team up for failure by asking them to do an impossible job.”

Tweaking pricing and packaging

Packaging models are rarely different from what’s used in the home market, but you should test other options for your pricing model.

“Good-better-best is the standard approach, but you might need to introduce a cheaper entry-level tier in some markets,” says Ethan DeSilva, Vice President at Insight Partners. “Look at what local companies are advertising on their websites. Channel partners in the region will also be able to give you an idea.”

Pricing levels vary more from market to market. Willingness to pay (WTP), the maximum price a customer is willing to pay for a product, is usually tied to the strength of local currencies.

“The US typically has the highest WTP, followed by the UK and Ireland, then the rest of EMEA,” says DeSilva. “APAC shows significantly lower levels. Understanding this provides proof points that you can use to adjust pricing away from a standard list price.”

Another factor that affects pricing is market positioning. In many regions, customers are more value-driven, so premium pricing for a non-localized solution can be off-putting.

“Just because you’re a premium player in your home market, doesn’t mean you will be elsewhere,” says DeSilva. “Another company might have better product-market fit, high relative value, or stronger brand perception.”

Copado, a DevOps platform that streamlines the software development lifecycle of low-code SaaS applications, prepared to launch its AI capabilities to a new market. But the team faced a critical challenge: developing a clear monetization strategy that aligned its AI capabilities with customer needs, system capabilities, and revenue goals. Without a structured approach to pricing and packaging, Copado risked failing to drive adoption and driving efficient revenue growth.

Partnering with Insight Partners’ Onsite team, Copado leveraged the GenAI Monetization Framework.* The framework is designed to bring structure and focus to the monetization process, while maintaining a revenue focus.

“The most helpful part of the engagement with Onsite was a packaging design workshop, during which we brought in a small cross-functional team to redesign our ‘end state’ packaging structure,” says Ted Elliott, CEO of Copado.

The results were immediate and measurable. “We developed a target end-state that provided a ‘north star’ for our go-to-market and product initiatives. This includes how we attack new business opportunities and drive expansion in our customer base,” adds Elliott.

Copado was also able to better structure their pricing strategy process, implement a crossfunctional roadmap, and set a long-term vision for their packaging strategy.

“Developing a hypothesis for an end-state monetization model allowed Copado to work backwards to determine how they should evolve their packaging and pricing, knowing there will be many more iterations along the way. The Copado team rightly prioritized optimizing adoption, which will give them more optionality for monetization down the line,” says Ethan DeSilva, Vice President at Insight Partners.

By achieving clarity on their monetization strategy, Copado successfully launched its AI product while positioning itself for long-term success.

*The GenAI Monetization Framework is a proprietary tool Insight Partners’ Onsite team uses to support portfolio companies.

Establish sales motion with local partnerships

Channel partners can be invaluable when entering a new market. They sell your product on your behalf, taking a commission for helping you to reach customers you might not otherwise access.

By working with channel partners, you can localize quickly and start distributing your product before you have a sales team set up. They also act as a valuable source of on-the-ground market knowledge, helping you navigate the nuances of a new market. From a customer perspective, trusted local partners provide credibility, building trust in your brand and reducing barriers to adoption.

“Demand-gen focused partnerships are a popular starting place for validating the market is there and generating early pipeline,” says Sgro. “It’s a very common first step for European or Israeli companies coming to the US. For example, before German spare parts distributor Sparetech entered the US market, it set up meetings with local tastemakers to test demand.”

The most reliable way to find a successful channel partner is to leverage your existing customer relationships.

“If you’re a German company expanding into the US and one of your domestic clients has an American office, work that angle to find out who they use as their channel partner,” says Sgro. “We love seeing companies use warm introductions rather than trying to find partnerships on their own because it builds trust much quicker.”

As you expand into multiple new markets, you can start to build a profile of your ideal partner by looking at the ones you’ve previously had success with. You will also need to take into account your GTM strategy in the new market. If it’s the same as before, your channel partner experiences are much more applicable to the next geography.

The best way of managing partnerships with resellers, system integrators, and distributors is to start a partner program – a structured approach to managing relationships with resellers, system integrators, and distributors. The program provides your partners with the resources, training, and incentives they need to successfully promote, sell, and support your product.

There are several pillars of a successful program. To start, you need an incentive structure to make sure there’s mutual benefit. You’ll also need an enablement program to train partners on how to position and sell the product. Eventually, you’ll want to hire a dedicated leader to run the team, as well as a partner marketing strategy to recruit new partners and drive demand through existing ones.

Your relationship with your partners can have a big impact on the trajectory of your business.

“Treat your first partners like gold,” says Fitzgerald. “If you give them love, you’ll create a flywheel. But if you treat them like they are just one in a sea of many, they will notice. Partnership is about mutual respect and joint value creation. If they are productive and driving traction in a new market, give them the recognition they deserve.”

Your relationship with your partners can have a big impact on the trajectory of your business.

“Treat your first partners like gold,” says Fitzgerald. “If you give them love, you’ll create a flywheel. But if you treat them like they are just one in a sea of many, they will notice. Partnership is about mutual respect and joint value creation. If they are productive and driving traction in a new market, give them the recognition they deserve.”

Build local teams and support

There are three things to consider when building local teams: who to hire, where to find them, and how to form the right culture that will carry you to success.

Many companies underestimate how much local talent dynamics can influence early traction, and oversimplify the leap from home-market playbooks to a new region. A thoughtful approach here can prevent costly missteps down the line.

Who to hire first

The most important hires in a new market tend to be your GTM team because your primary objective is regional growth. The best practice is to hire a regional head of sales with a handful of sales people below them.

“If you’re a US company going into the UK or Europe, your local team is often essentially a sales and marketing arm,” says Olszowski.

“There are some variations,” adds Sgro. “Sometimes the sales process can be serviced by HQ for a period of time, but to fully validate a market, you’ll need someone on the ground.”

In terms of background, your new hires should have worked for an international business. “Ideally, they would have experience working at a similar international company,” says Olszowski. “For example, if your home market is Germany, it would be a big advantage if they have previously worked for a Germany-headquartered company and understand the culture.”

How to attract talent

Expanding into a new market isn’t a decision to be taken lightly. That commitment needs to be communicated heavily to potential hires, especially given you likely won’t have the brand recognition that your local competitors do.

“People are risk averse. It’s going to be difficult to get people to join your company unless there’s a clear commitment to the region. Establish your brand by running events, sponsoring other activities, and developing partnerships with local businesses.”

To find the right talent, it’s important to build partnerships with local recruiters who understand the market and can tell you what candidates expect in terms of benefits and pay.

“CEOs can fall off their chairs when they learn what execs are paid in different markets – for example, comp is often a fair bit higher in the US than it is in Europe,” says Olszowski. “Recruiters can give you an idea of compensation benchmarks. Investors can also be helpful. For example, Insight captures comp data on every search across our portfolio so we have real life examples of what new hires are being paid.”

Using recruiters is a helpful starting point for hiring, but you should also be building out your own network concurrently.

“By attending industry events, you’ll be likely to get referrals to people who come highly recommended,” says Olszowski. “Most investors also have strong talent networks which you can leverage and use as an access point to top talent.”

A common mistake is hiring executives that aren’t high-caliber enough.

“At first, many European companies will struggle to recruit the same level of talent in the US as what they’ve been able to attract in their home market,” says Liu-Doyle. “They don’t have the same level of pull, and there’s an overall lack of familiarity.”

But there will always be some element of trial and error.

“Hardly anyone does this perfectly. You learn so much through the process of failing,” says Liu-Doyle. “You have to respond to the signals in front of you and be really self-critical.”

Building a thriving global culture

Cultural misalignment can be a significant challenge during global expansions that is often undervalued. Failing to understand and adapt to the local culture and business practices may lead to misunderstandings, strained relationships with customers and partners, and hinder the establishment of trust and credibility in the new market.

Building the right culture is especially important when a geography will become your core market, such as expanding from Europe to the US. We recommend having someone who can bridge the gap between your home HQ and your new market.

“You need to bring over what I call ‘founder DNA’ to reach your full potential, quickly – someone who can begin building a foundation of cohesive culture on day one,” says Liu-Doyle.

“This should be a strategic, customer-centric role. You will need someone who rolls up their sleeves and knows how to get things done in HQ,” says Fitzgerald. “Ideally this person speaks the local language and has some level of connection to the country. The goal is to act as a mini in-country General Manager, be the boots on the ground, and sound the alarm if things are moving in the wrong direction.”

As well as building a strong local culture in your new market, you also need to form a well-crafted global culture that spans your entire entity. It should promote a consistent organizational identity, enhance employee engagement, and streamline decision-making processes. There are three high-impact areas to focus on.

✔️ Communication

Your new market should have a clear identity of its own. Establish dedicated country updates, sharing milestone achievements, market insights, and localized updates. The new market should also communicate smoothly with your home market. Consider implementing digital tools for seamless collaboration across different offices, and prioritize communication across regions to enhance transparency and connectedness on a global scale.

✔️ Collaboration

To avoid creating silos, employees in the new market should also work on projects with other offices. You can achieve this through temporary assignments or job rotations, which promote understanding. Also consider creating informal country teams to encourage knowledge exchange among local and headquarters employees.

✔️ Cross-cultural education

Succeeding in a new market means understanding its culture. Training programs and resources can promote understanding and drive awareness. It’s important for employees to understand local nuances, such as communication styles, greeting customs, and holidays. Events to celebrate diverse traditions and customs also foster inclusivity and appreciation.

Tailor marketing strategies

Expanding into a new market means rethinking your marketing approach to resonate with local buyers.

What works in your home market may not translate directly, and success requires a thoughtful strategy and experimentation to see what really sticks.

Build brand awareness early

While your brand may be well-known at home, that’s rarely the case in a new geography.

“We’ve seen many companies assume that the awareness is the same and invest in sales rather than marketing only to find out that the amount of inbound leads is much lower than in their home market,” says Kassay. “It’s essential to build a basic level of awareness and ensure your customer base understands the need your product is addressing before investing in local market sales or customer success teams.”

Focus on creating localized content that educates customers about your product and the problem it solves. Some elements of your brand—such as mission, values, and purpose—should remain consistent globally. However, regional communication, messaging, and social media activity should be adapted to reflect local audiences.

Develop a layered marketing approach

Marketing success in a new region requires experimentation to develop a repeatable system that drives pipeline and closes deals.

The first step is to invest in localized content and SEO. This involves taking global assets and tweaking them based on your understanding of the local customer base until you find out what’s accelerating pipeline in the new market.

“Localized messaging along with a strong content strategy is your foundation. Ensuring you understand how buyers discover in your new market and investing in digital strategies like SEO and Generative Engine Optimization (GEO) early is critical,” says Fitzgerald.

Once that’s established, start testing localized paid digital. The approach here may differ depending on restrictions that are specific to the market, so if you don’t have someone in-house who can handle this, an agency can help you.

“In the US, companies have limited restrictions on their marketing efforts allowing them to reach out to prospects fairly easily,” says Kassay. “Although some specific state laws may impose restrictions, such as California.”

By contrast, in the UK and Europe, companies must comply with GDPR (General Data Protection Regulation), which requires explicit consent before engaging in outreach, particularly with individual contacts. “This can significantly dampen the effectiveness of US developed marketing campaigns,” adds Kassay.

Fitzgerald warns against jumping into paid digital before understanding your market fully.

“Over-investing in paid digital without proper testing is a common mistake. Buyer research is so important. You can invest more seriously in paid after you’ve properly tested, done the local research, and built your organic strategies. We are experiencing a revolution in all things search so ensuring you research local buyer preferences is key.”

Finally, start thinking about events. It’s usually a good idea to run your first events with a partner to leverage their existing brand awareness and trust.

“Attach your brand to existing communities as much as possible,” says Fitzgerald. “You should also make the most out of local trade shows and events that have your ICP in attendance.”

The way you position your product in a new market will also depend heavily on who the local vendors are. Marketing messaging should position your company uniquely versus the competition.

“Know who the local players are and arm your GTM team with language around why you’re different and why you should win,” says Fitzgerald.

Building a brand that scales locally and globally

Your brand is complex and should be treated thus. Some elements of your brand should remain consistent across geographies while other parts can be adapted more locally.

Templafy, an AI-powered enterprise document generation platform, faced the challenge of enhancing its brand presence in the competitive US market. With its roots in Copenhagen, Denmark, Templafy’s initial brand image did not resonate with American businesses, limiting its ability to communicate its value and attract new clients.

Templafy partnered with Insight Partners’ Onsite Advisory team to view marketing efforts with a new lens. Through collaborative workshops and strategic planning sessions, Onsite empowered Templafy’s leadership to make decisions that more effectively resonated with their audience.

“The Insight Onsite team provided crucial support throughout Templafy’s rebranding initiative,” says Jesper Theill Eriksen, CEO of Templafy. “The Onsite team worked with us to analyze market trends, refine messaging, and align the brand with US enterprise expectations.”

The rebrand delivered tangible results. Templafy modernized its image, emphasizing innovation and its mission to help enterprises efficiently create revenue generating documents. The effort significantly boosted visibility, client engagement, and new business opportunities. “The overall impact has been a major increase in brand recognition and growth,” adds Eriksen.

Reflecting on their collaboration with Templafy, Meg Fitzgerald, SVP at Insight Partners, says, “This partnership shows how important the nuances of entering a new market can be. While the same product can bring value to customers in multiple markets, the branding may need to be tweaked to resonate within each new global territory.”

By partnering with Onsite and sharpening its brand identity, Templafy unlocked new opportunities and positioned itself for sustained growth in a key market.

Optimize infrastructure and measure success

Once your operation is up and running in the new market, you need to monitor infrastructure, like data centers and customer support, to make sure it can handle international growth.

You should also set metrics to measure success. Ultimately, new market entry is not successful if you cannot demonstrate sustained growth at attractive unit economics.

“In the earliest days, the most important metrics are pipeline generated, active opportunities created, and business closed,” says Sgro. “You need to be able to show you can get meetings, turn them into pipeline, and close those deals repeatedly without a founder being involved.”

From a marketing perspective, look at early indicators such as website traffic and branded search, as well as social media engagement and follower growth.

“You want to see buyers finding you on their own and positively talking about you on review sites, discussion forums, and relevant social channels,” says Fitzgerald. “Top-of-funnel metrics and conversion rates are helpful early indicators, but what really matters is closed won bookings. Measuring efficiency by channel from the start will help ensure you have a clear view of where to invest that next dollar.”

The process of unlocking a new market takes time, and depends on factors like market complexity and company maturity.

“Metrics become more important as time goes on,” says Gatto. “In the first year, you would look at leading indicators, such as pipeline creation. The following year, you’d focus on measurable revenue contribution to get a sense of whether new market entry is showing potential. If revenue contribution and momentum aren’t showing signs of potential by the end of the second year, it’s time to re-evaluate whether the market is right for your business or whether the product and GTM strategies are well-suited.”

Access Navigating international expansion for European founders to learn…

- Strategies to overcome the biggest hurdles for Europe-based founders, including paths of expansion, international hiring logistics, cultural considerations, and more

- Insights on Europe’s current market and future opportunities for startups and ScaleUps

- Lessons from SaaS leaders, who have successfully cracked the U.S. market after starting in the EU

Access How India will become the world’s next tech powerhouse to learn…

- Pragmatic approaches to establish a global presence while rooted in India’s thriving entrepreneurial landscape.

- How to overcome challenges in customer outreach, product marketing, and distributed team management

- Lessons from SaaS leaders who have harnessed India’s economic growth and tech ecosystem for domestic innovation and international scaling