The Culture Challenge in Post-Merger Integrations

Several years after the failed AOL-Time Warner merger, former AOL CEO Steve Case summarized his perspective about the deal by saying: “Vision without execution is a hallucination.”

Like most mergers, AOL and Time Warner made sense on paper. Leaders had planned out the strategic and financial ways the two entities could thrive together. Did the quickly-changing Internet space make the partnership challenging? Sure. But, one of the most frequently cited reasons for the AOL Time Warner failure rested on an often overlooked dimension of mergers: culture integration.

Culture clash is a leading cause of M&A failure—and not just in mega deals like AOL Time Warner. In a Bain study, executives who managed through a merger listed culture as the leading reason why a deal failed to meet its true potential. The scenario is common. Two entities arrive with years of norms, values and behaviors that are tried and true. Uncertain about the future, employees are reluctant to abandon what has made them successful. Suspicion – of change, the “other side”, of the deal itself -- starts to fester. Tribal behavior takes shape. Disrespect follows. Workers get frustrated, leave, or lose productivity. As the business sputters, synergies that leaders hoped for slowly dissipate.

What is Corporate Culture?

Academic researchers say that a positive culture can account for a 20%-30% performance increase over average companies. But, corporate culture is hard to define, let alone create, even when leaders have a good sense of the type of culture they want. When asked to define their company culture, many employees will cite a mission statement or a slogan. However, culture runs far deeper than catchphrases.

A 2013 Harvard Business Review article by John Coleman cites 6 components of corporate culture:

- Vision: a corporate statement of purpose that describes what value the company offers and what it stands for, often in the form of a mission statement (e.g., Hilton’s vision is “to fill the earth with the light and warmth of hospitality).

- Values: a set of words or phrases that are guidelines of how the company wants its employees to behave (e.g., Google is famous for their value “Don’t be evil”. Whole Foods has eight value statements including: “We satisfy, delight, and nourish our customers" and "We support team member excellence and happiness").

- Practices: concrete company practices that reinforce cultural value. These practices must run through every facet of the company – from recruiting to marketing and experience design.

- People: ambassadors of the culture starting at the top and reaching throughout all levels of employees (e.g., Tony Hsieh, CEO of Zappos, tells the story of a customer service agent who ordered pizza for a hungry customer. Though Zappos hinges on delivering shoes (not pizza), the agent embodied the value of “delivering happiness”).

- Narrative: the story of a company, which informs where it came from and where it is going. Like families, companies have a history which reinforces company identity.

- Place: the physical environment in which a company operates must support corporate values and desired action (e.g., office location, building architecture, floor layout, interior design, hardware and desk choices – all facets of “place” must support corporate values and desired action).

Using this framework of corporate culture is a great way to think and analyze culture when evaluating mergers and acquisitions. As you delve into the below actions, use the above framework to help guide your efforts.

Top Tips for Avoiding the Post-Merger Culture Clash

Our experience suggests 5 actions that will help to avoid any potential issues:

- Make culture a part of due diligence. Assessing potential cultural obstacles in a structured, focused way should be as much a part of M&A due diligence as product forecasts, data rooms, and strategic brainstorming. Spearhead the cultural assessment with a team of HR executives, team leaders, and line employees from both companies. The goals: a) understand differences in the two cultures – including motivations, values, work methods, and social behaviors, b) identify key cultural “leaders” to retain and enlist in post-merger activities, and c) create a blueprint for cultural values that will define the new entity.

- Spend time together ASAP. Day 1, get on the plane. C-level executives and senior team leaders should interact in person – setting an example for both organizations. For the next year, leaders should plan frequent off-sites with the dual goal of business planning and fostering cultural cohesion – helping to build relationships and identify common values. Companies with large remote workforces beware: virtual meetings will not cut it. Virtual participation will solidify differences borne from distance and the absence of social cues.

- Be explicit about setting culture. An explicit outcome of these initial offsite workshops should be for the combined company to agree on cultural values. This plan should be as detailed and heralded as the strategic, financial and product plans. A laundry list that simply combines both sets of company values won’t suffice. The plan should include a streamlined set of values the company can realistically uphold and is willing to invest in by way of incentives, training, and systems.

- Monitor frequently. Shaping culture is not a one-time activity. Companies should engage in ongoing activities to assess cultural health. We suggest surveying employees every 2 weeks for the first 3 months after a merger is completed – across all departments -- tracking opinions of the new company, job satisfaction, and soliciting ideas for improvement. Leaders should publish survey results openly and devise concrete actions to improve problem areas, enlisting employee ideas every step of the way. Engagement platforms like CultureAmp can be useful tools to solicit feedback.

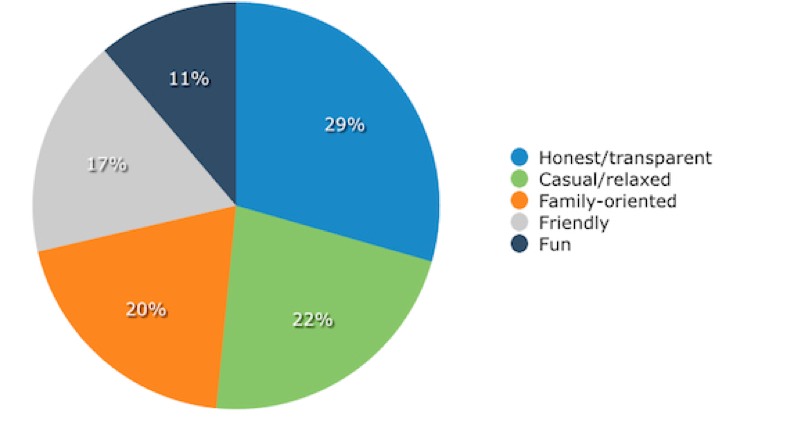

- Be transparent and decisive. Throughout merger integration, executives should be transparent and decisive as they address cultural assimilation. Whether mixing the best cultural elements of each company or creating a new culture, honesty is the most preferred cultural attribute for employees. But that needs to be combined with sure footedness so that employees feel confident that their leaders have a path forward. In light of the suspicion and nervousness that often accompany a change in ownership, honesty and confidence are even more paramount during the post-merger integration stage.

Most Preferred Company Culture Attributes

For the majority of portfolio companies at Insight, the cost and investment associated with people is by far the largest part of their P&L. Therefore, getting culture right to make sure people can thrive and be productive is critical to success.