The ScaleUp Guide to Analyst Relations: A Fast Track to Enterprise Credibility

If you currently sell to Enterprise IT Buyers, or plan to on your path to IPO, then Analyst Relations needs to be a critical part of your go-to-market strategy. Being positively mentioned by Industry Analysts like Gartner and Forrester helps ScaleUp companies fast track legitimacy with Enterprise IT Buyers, build brand equity, and increase overall market awareness. This means more leads, pipeline, and closed deals – not to mention more options when it comes time to pursue funding or an exit. Ultimately, nothing says “market leader” like being named a market leader.

What is Analyst Relations?

Analyst Relations is effectively engaging industry Analysts like Gartner and Forrester to drive advocacy and market impact. Gartner and Forrester are the two largest firms, but there are numerous others including IDC and 451, and targeted firms like ARC Advisory.

When you think of Gartner or Forrester, what usually come to mind are the Gartner Magic Quadrant (MQ) and the Forrester Wave and New Wave. These reports evaluate top market players within key technology categories and play a critical role in the Enterprise IT buying process. Being named a Leader is a stamp of approval and will drive awareness and credibility with Enterprise IT Buyers.

While these reports are the most visible of Analyst outputs, Analysts are having hundreds of thousands of conversations with their clients each year, many of whom are in the Global 500 or Fortune 1000. Most of these conversations will mention specific tech vendors and can range from education and awareness to creating short lists to vendor evaluation.

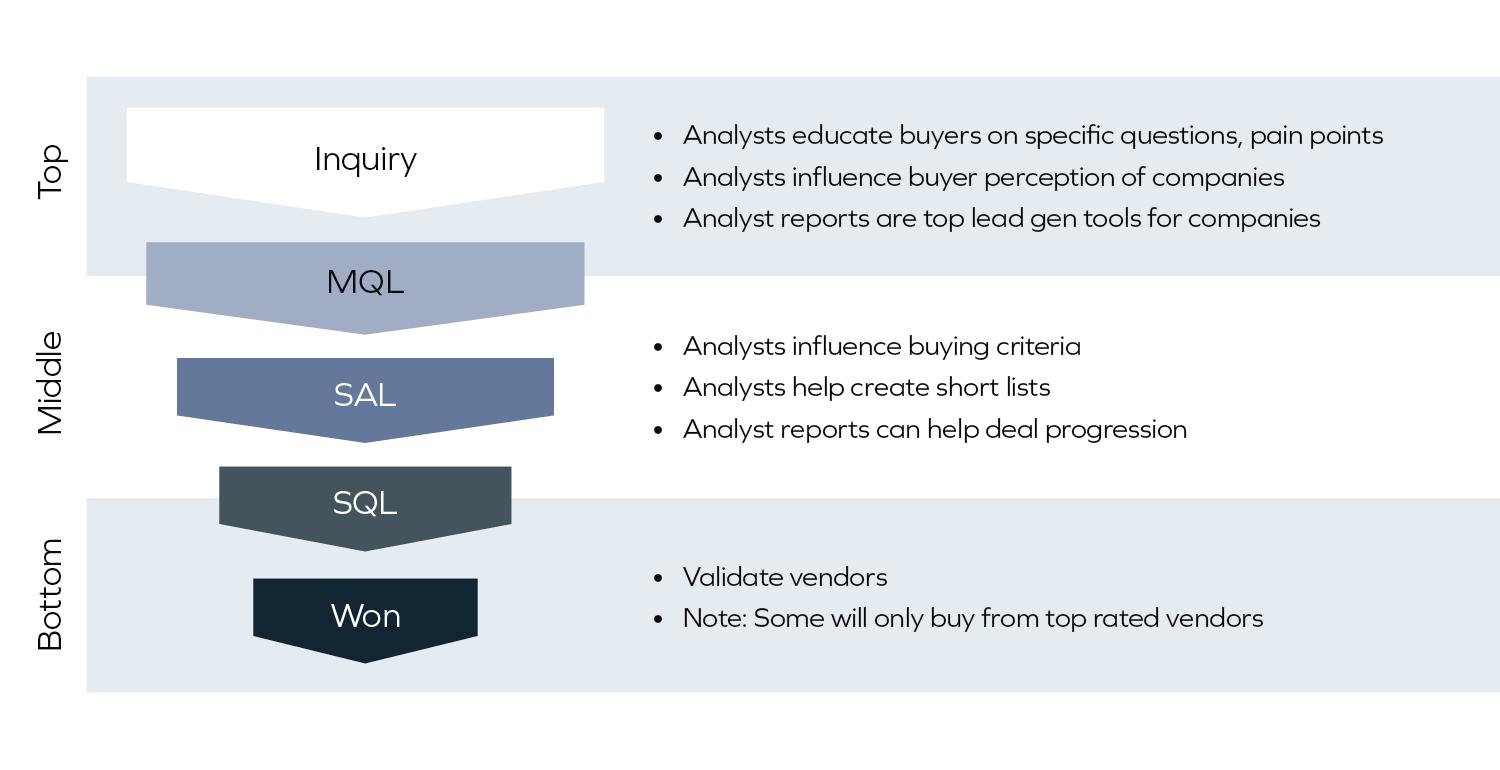

Taken together, industry Analysts impact all parts of the Enterprise IT sales funnel.

How Analysts Impact Leads, Pipeline and Deals

At the top of funnel, when buyers are first learning of possible solutions, Analysts provide education on the category, help identify key pain points, and advise on how to solve them. This is especially true for emerging technology categories where buyers are seeking expert guidance to help define and solve their problems. Analysts also influence awareness and perception of specific vendors, whether through their published reports or the calls they have every day. More tactically, Analyst reports are top lead generation tools for favorably reviewed vendors. These reports contain valuable information that prospective buyers will trade their contact information for.

In the middle of the funnel, when buyers start to evaluate specific vendors, Analysts can influence the buying criteria being used. They can also help define shortlists through direct conversations with buyers – or many buyers will simply shortlist top performers listed in the reports. Tactically, Analyst reports are also used for deal progression, whether in Marketing email campaigns or in Sales outreach.

At the bottom of the funnel, when buyers are ready to make a purchase decision, Analysts can influence whether the deal closes by validating the vendor as a good choice, stopping the deal by suggesting alternatives, or raising red flags. Some Enterprise IT Buyers won’t purchase from vendors that aren’t listed as a Leader or Visionary in a Gartner MQ. There are tales of vendors getting dropped in an evaluation process when they slip into the bottom left Niche following an unfortunately timed new MQ release.

In short, Analysts are critical to the Enterprise IT buying process, with one survey of Enterprise IT Buyers concluding that Analysts influenced over 80% of purchase decisions. Analysts are also critical to market and investor perception of company value – nothing says “market leader” like being named a market leader by Gartner or Forrester.

Analyst Relations for ScaleUps

For ScaleUp companies, Analysts play an even more pivotal role. Analyst endorsement is a fast track to gaining legitimacy with Enterprise IT Buyers, increasing brand awareness, and driving Enterprise leads, pipeline, and deals. Analysts provide ScaleUps with the ability to amplify their message and influence a large audience of Enterprise IT Buyers whether it’s by positioning them highly on a Gartner Magic Quadrant or Forrester Wave, designating them a Gartner Cool Vendor, or favorably mentioning them on an inquiry call with a client.

However, as we’ve heard from a former senior Gartner Analyst, Analyst recommendations are “opinion masquerading as fact.” Just having a strong product and business doesn’t mean that Analysts will advocate for you. Getting Analysts to understand when and why they should advocate for you – and having confidence that you will deliver – is hard and requires a well-defined strategy with consistent and effective engagement.

This is a challenge for ScaleUp companies.

For many ScaleUp Founders, CEOs, CTOs, CPOs, CMOs – Analyst Relations is an unknown. They don’t know when to invest in Analyst Relations or how to get started. Often, they are slow to engage, allowing competitors to shape Analyst perception of the market and bend it towards their product and vision. Others may think that the $50K-$100K in annual subscription fees paid to Analyst firms is enough to win their attention. It’s not.

When ScaleUps do invest in Analyst Relations, it’s often someone’s side hustle, the last item on their list of to-dos. ScaleUps often don’t invest the necessary time or resources to create and maintain a proactive Analyst Relations program. Critically, there is also a lack of knowhow. Whether creating a compelling Analyst briefing deck or navigating an assessment like the Gartner Magic Quadrant, ScaleUp teams often don’t know what to expect or what good looks like. Even for ScaleUps that create strong initial traction with Analysts, there is almost always an opportunity to better tell their story or optimize how they engage to drive greater advocacy. This is especially the case for ScaleUps that straddle categories or are trying to create their own.

The result? A gap in the go-to-market strategy, leading to missed opportunities and lost deals.

Best Practices for ScaleUp Analyst Relations

Insight Onsite’s Marketing Center of Excellence works closely with portfolio companies to close this gap in their go-to-market strategy. From our experiences working with portfolio companies and our conversations with Analysts and other experts, we’ve identified our top 10 best practices for ScaleUps looking to drive effective Analyst Relations. Download the guide by completing the form below to learn more.

The ScaleUp Guide to Analyst Relations

Download our guide to learn our best practices and to start driving effective Analyst Relations today.