Sales is the hare in the race to profitability – new logos start the race and accelerate strongly out of the gate. As startups and companies ScaleUp, sales success garners the most attention because new customers are the critical lever for achieving a company’s OKRs (including product validation, proof of market need and revenue growth).

But retention is the tortoise, and as we know from Aesop’s fable, the tortoise wins the race. Without retention, growth stalls because sales is constantly sprinting to replace lost customers with new ones. With strong retention, all new sales contribute to and accelerate a company’s growth. While the sales hare is out in front, the retention tortoise moves a company indefatigably forward as a critical, but often overshadowed, lever of success.

Retention is a critical growth and long-term value lever

In Insight Partners’ portfolio, high retention businesses have an enviable head start in hitting targets and these ScaleUp companies can thrive using far less sales & marketing investment. Simply put, all else equal, high retention businesses are larger with higher growth rates, and higher margin profiles. All 3 – size, growth, and margin – drive long-term value.

What is retention worth?

Fables aside, the numbers can easily demonstrate what a 1% or 5% uplift in retention is worth to a SaaS business. At Insight we simplify and quantify the value with two basic Retention Impact scenarios:

- Incremental Enterprise Value: In 5 years what is the incremental enterprise value (EV) a SaaS company can expect from a retention increase.

- Opportunity Cost of Churn (OCC): What is the sales & marketing investment required to offset churn with new customer sales? Without this spend, how much faster could a company grow, or how much more profitable could it be?

Let’s take a hypothetical example, “Fable Co,” and look at the impact.

The Basics

Fable Co is on track to achieve $20 million in Annual Recurring Revenue (ARR) in current year (i.e. Year 0)

- $10 million is new customer ARR

- $10 million is existing customer ARR

- The company has a solid product and adoption with a 95% net dollar retention rate1 and 90% gross dollar retention2

- Fable Co sells into a very large addressable market that is growing 10% annually

Want to know what a retention uplift is worth to your business? Plug in your numbers and run you own scenarios below using Insight’s Customer Success ROI calculator.

Calculate the ROI of Your Customer Success Investment

Incremental Enterprise Value Scenario

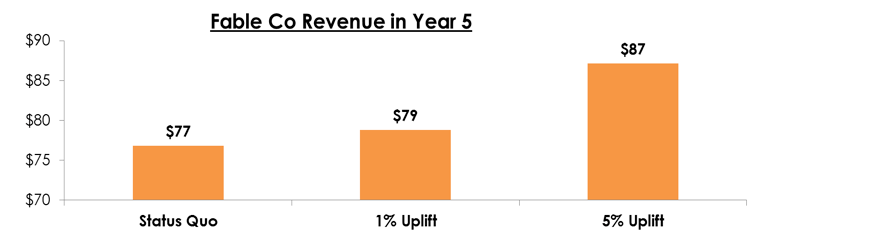

Assume Fable Co’s new logo business grows at the same market CAGR of 10% and net retention holds at 95%. The company will reach $77 million of ARR in 5 years (no small feat!).

However, if Fable Co can increase net retention by 5% from 95% to 100%, then ARR will hit $87 million.

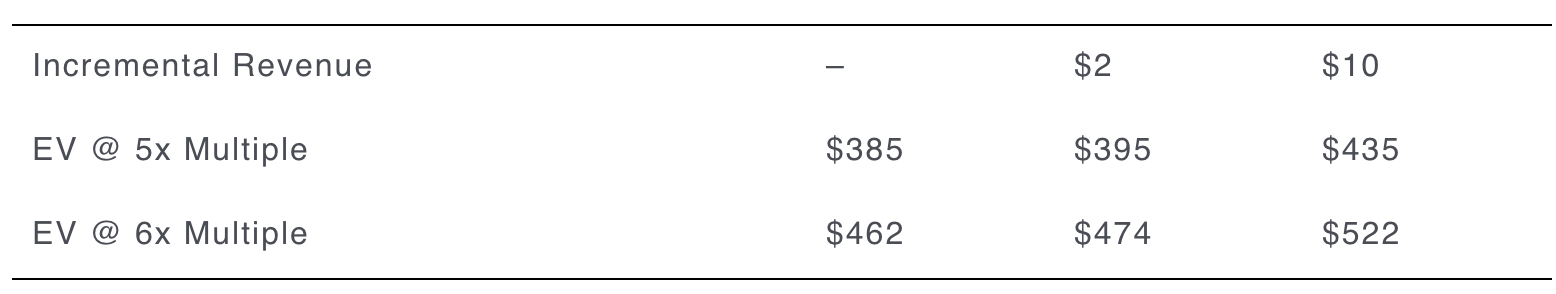

Each 1% uplift in net retention yields an incremental ~$2 million in Year 5 revenue. At 5x revenue exit multiples, this 5 point retention uplift equates to more than $50 million in incremental enterprise value, a number sure to make Fable Co’s employee and VC shareholders smile.

Bear in mind that the 100% retention business is $10 million larger and growing faster (34% CAGR vs. 31%), and as a result will command a higher revenue exit multiple. The incremental EV from an increase in revenue exit multiple (from 5x to 6x) is > $135 million.

Opportunity Cost of Churn Scenario

The second Retention Impact scenario to consider is what Insight calls the Opportunity Cost of Churn (OCC). What additional sales and marketing investment is required to make up for the revenue lost to churn – or to use a common SaaS phrase, to offset the “holes in the leaky bucket?”

To calculate: Opportunity Cost of Churn (OCC) = (Churned Dollars + Downsell Dollars) x the Customer Acquisition Cost (CAC).

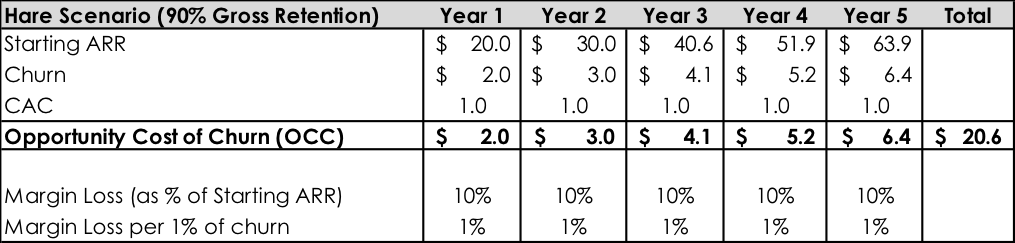

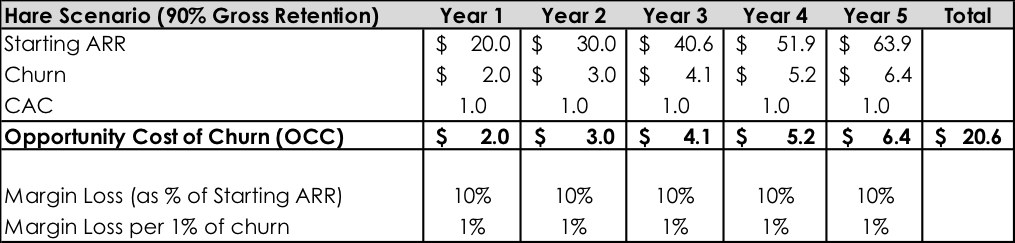

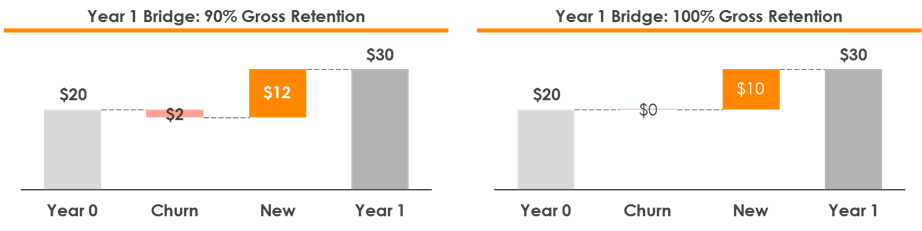

Let’s take the same $20 million Fable SaaS Co with 90% gross retention3 and assume customer acquisition cost (CAC) is 1. In other words, Fable Co gets $1 of first year ARR for every $1 it spends on sales and marketing acquisition.

What is the impact?

- In Year 0, Fable Co loses $2 million of starting ARR which will cost $2 million to re-acquire4

- In Year 5, churn loss is $6.4 million which will cost $6.4 million to re-acquire

- Over the 5 year horizon, the Total OCC is ~$21M

To summarize: At a CAC of 1, each percentage point of retention equates to approximately 1% of margin.

Higher retention businesses can grow faster, grow more profitability, or most likely pursue a combination of both.

Question: Are you backing the Tortoise or the Hare?

Answer: You should be backing both to finish the race

Companies need both the tortoise and the hare to win the race. Successful SaaS companies back both, and to help Insight’s portfolio companies calculate the value of retention, Insight Onsite has built a simple calculator to capture both scenarios. Plug in your numbers and run your own scenarios below. Or download the spreadsheet here.

Becoming a ScaleUp Success

Maintaining and increasing retention is hard but achievable. It’s slow and steady, takes time and needs focus. The Customer Success team is the steward of retention in SaaS businesses and a mission critical business process to fuel growth and maximize long-term value. A strong customer success function thwarts churn, specifically, by providing a clear, traceable workflow process for managing customer relationships and by creating visibility into the customer base with tailored metrics around usage, engagement, satisfaction and adoption.

Since customer success is a core component of growth acceleration and long-term value, Insight’s ScaleUp companies invest in customer success. Insight Onsite partners with emerging companies and guides teams on how to build best-in-class customer success organizations.

Are you motivated by the retention opportunity? Has your team attempted to improve retention in the past with unclear success? We welcome you to send us your questions to CSonCall@insightpartners.com.

Notes and definitions:

- Net retention includes upsells

- Gross retention excludes upsells

- Using gross retention in this scenario in order to capture all dollars lost from the business (churned logos and downsell). Upsell, which is included in net retention, is a cheaper way to offset lost dollars than new logo acquisition. CAC adjusted for the contribution from upsell would be lower and reduce OCC.

- $20 million * (1 – 0.9) = $2 million * CAC of 1