2022: Year in Review at Insight

2022 is (nearly) a wrap! Insight Partners concludes 2022 with more than 750 investments over the firm’s history, over $50 billion in all-time commitments, and over 400 M&A transactions to date for the portfolio.

Notable 2022 Milestones

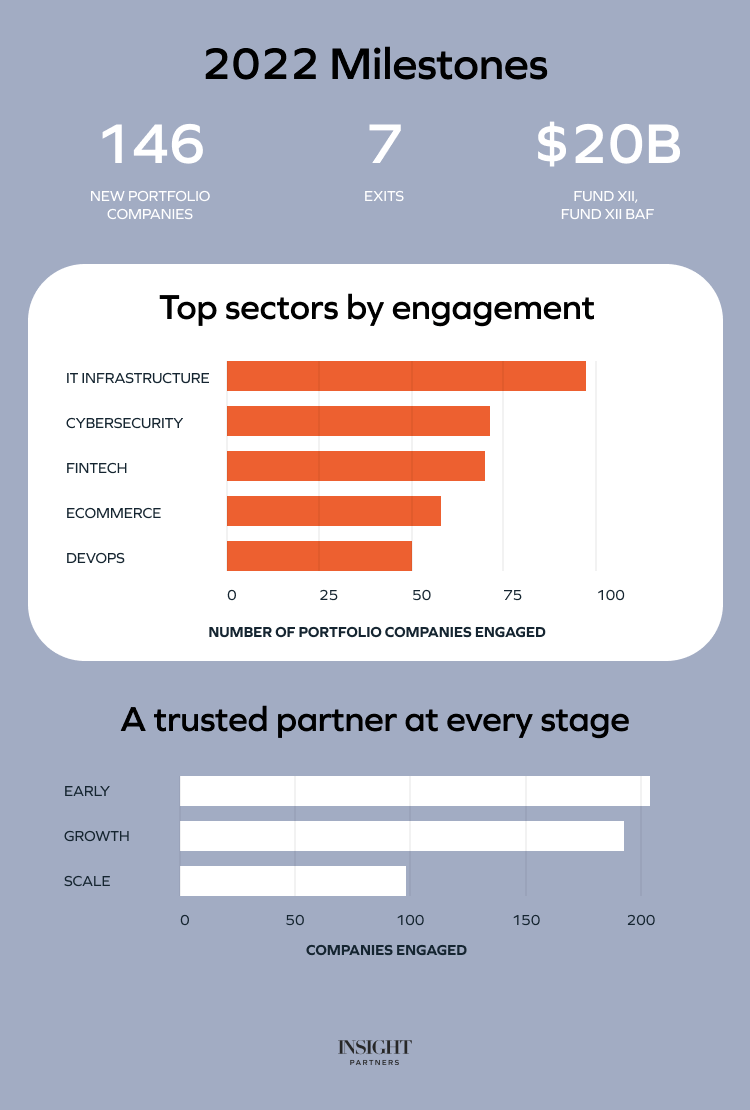

Additionally, in 2022 the firm announced its largest fundraise to date, with $20 billion raised in Fund XII (inclusive of the Fund XII buyout fund). This year’s fund represents one of the largest global fundraises to date dedicated to investing in high-growth technology and software companies driving transformative change in their industries.

2022 also introduced the first ScaleUp event from the firm, drawing over 1,700 registrants and featuring presenting partners Citi and Nasdaq. 2022’s event focused on the future of AI technology. Stay tuned for the announcement of 2023’s ScaleUp event.

Portfolio Company Engagement in 2022

Other 2022 highlights include a focus on portfolio company engagement with some of Insight’s key sectors, including IT infrastructure, cybersecurity, fintech, e-commerce, and DevOps. Especially notable is the engagement with early- and growth-stage companies focusing on scaling up.

2022 Awards and Recognition

Insight received multiple firm awards* showcasing individual investor and firm achievements, including:

- Best Workplaces | Inc

- Founder-Friendly Investors | Inc

- Venture Capital Journal Rising Stars

- Forbes 30 Under 30

- Top Growth Equity Firms of 2021 | GrowthCap

- Top 25 Healthcare Investors | GrowthCap

- Top Women Leaders in Growth Investing | GrowthCap

- Top 25 Software Investors | GrowthCap

- Top 40 Under 40 Growth Investors | GrowthCap

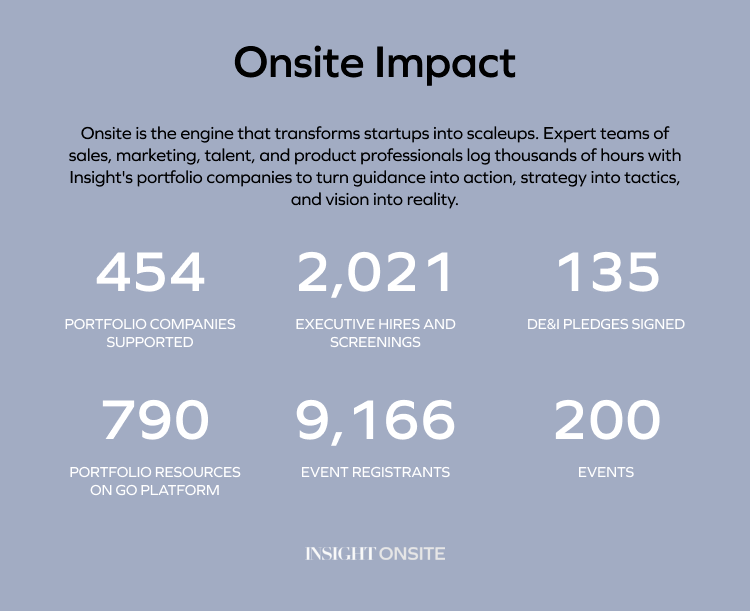

Insight’s Secret to Scaling

Finally, 2022 highlighted the impact of Insight’s Onsite team, a group of 130+ experts in sales, marketing, product, and talent dedicated to helping the Insight portfolio scale up. The Onsite and portfolio experience teams logged countless hours supporting over 450 companies, contributing nearly 800 guides, benchmarks, and handbooks to the exclusive Insight portfolio GO community platform, and hosting 200 digital and in-person events in 2022.

Read more: Here’s what makes Insight’s portfolio experience different.

*The awards referenced herein are the opinions of the parties conferring the awards and not of Insight Partners. These parties, which are not affiliated with Insight, issued the awards. For the awards given to individuals, Insight submitted nominations on behalf of certain of its personnel. The parties’ recognitions are not indicative of Insight’s future performance and were not based on evaluations of clients or investors of Insight. There can be no assurance that other parties would reach the same conclusion as the foregoing. Insight paid a fee in connection with its applications for Inc. award consideration, as well as to secure award receipt from GrowthCap after being notified of the selection of certain of its personnel for awards. In general, the receipt of compensation influences, and is likely to present a potential material conflict of interest, relating to any granted award. The time period upon which the Venture Capital Journal Rising Stars award was based was 11/21 – 11/22, and the award was given on 11/30/22. The time period upon which the Forbes 30 Under 30 award was based was 9/21 – 9/22, and the award was given on 11/29/22. The time period upon which the Top 40 Under 40 Growth Investors award was based was 1/22 – 12/22, and the award was given on 11/30/22.