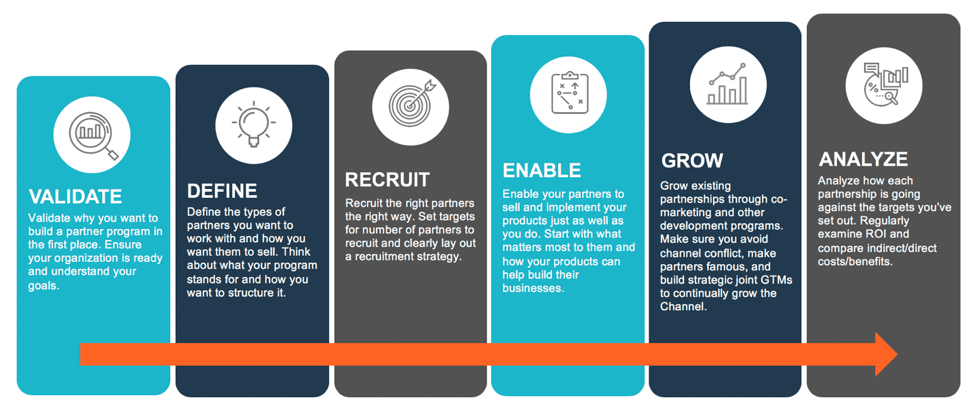

The Journey to Building a Successful Partner Program for Your Software Business – Step 2 of 6

Step 2: Define

The first post in this series dove into the first step in the 6-step journey to building a successful channel for your software business. In the Step 1 "Validate" post, we discussed the importance of validating your reasoning behind building a channel. Once you’ve established your goals and justified both your company’s readiness and the market’s readiness, you’re prepared to begin defining your channel strategy.

Define – lay the right groundwork

It’s time to start shaping your plans, identifying who your prospective partners are, and putting pen to paper on the type of channel operating model that will work best for your business.

Defining your channel strategy

Remember, what you do depends on what you want. As you begin planning, consider the following:

- Which type of partner should you pursue?

- What should the operating model look like?

- What benefit would partners get from you that they wouldn’t get elsewhere?

- How do you both make money?

Defining which types of partners

Defining which types of partners to prioritize should generally be an organic thought process stemming directly from your overarching goals for wanting to build a channel in the first place. You cannot choose the partners to go after until you have validated and clearly defined your goals. Choose wisely and adopt a wide view when searching for the right partners. Don’t just choose the largest. Make sure you are considering all factors, such as cultural fit, willingness to engage, industry, geography, and existing capability set.

Defining which products to sell through the channel

In order to build and design the right partner program, you must decide which of your products your partners will sell. It’s important to identify the synergies here. Is it your entire product suite? Do your partners offer services that wrap around some or all of your products? Which of your products are ready for partners to sell and implement?

Make sure you’re thinking partner first. Consider the following 3 questions:

- What can you offer a partner to strengthen/complement their services and ultimately bring them more business?

- Consider what’s happening in the market. Is there a product of yours that is selling especially well in the industry you are going after with a particular partner? Prioritize recruiting, educating, and enabling the partner on the benefits of that product.

- Which product would benefit your partners’ existing customers most?

- Think about both new bookings as well as upsell/cross-sell opportunities. Which products align with your prospective partner’s go-to-market strategy and sales pitch? Which of your products will help their case and ultimately facilitate winning new business and maintain stickiness and continued expansion with existing accounts?

- Last, but certainly not least, is considering the sales, marketing and technical expertise required to sell and implement your product. Are there certain capabilities needed for certain products?

- Make sure the products you sell with/through partners are learnable, meaning there is training you can put in place in order to get partners up to speed relatively quickly. If they need to acquire capability sets or resources or invest too heavily in order to even be able to sell the product, that’s probably not a great sign.

Defining your channel operating model

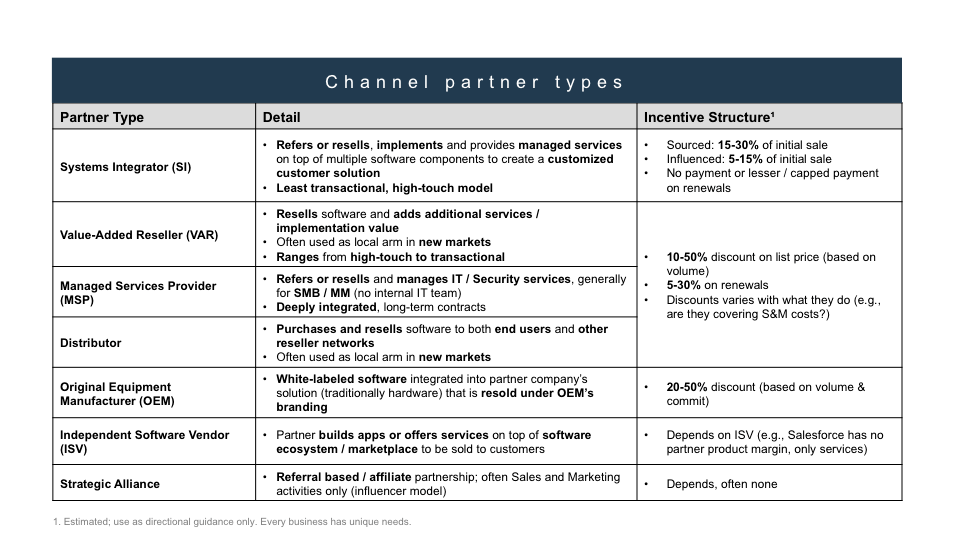

There are several operating models to pursue. Does it make sense to build a product or relationship-oriented partnership? Are you selling with your partners or through them? Maybe you’re selling for them? Below is an illustrative snapshot of the core software partnership models (along with examples) you could consider in your definition stage:

- ISV (Independent Software Vendor): Company that builds and/or sells integrated software application(s) that run on an existing program.

- VAR (Value-Added Reseller): Company that resells another company's product with added value, delivering a "full-service" or "turnkey" solution.

- Strategic Alliance: Company that formalizes a relationship with another company to achieve more joint business.

- Systems Integrators (also known as GSIs/Global Systems Integrators): Company that provides services and specializes in bringing together component subsystems into a whole, ensuring all software functions together.

- Original Equipment Manufacturer (OEM): Software designed by OEM company to be white-labeled & customized under another company's brand to sell into their own markets.

- Managed Service Provider (MSP): Provide IT services capabilities (often for SMB/MM organizations without own IT teams).

Defining and designing your program

This section deserves an entire series to itself, but I will cover the basics and a framework to get your thoughts rolling on the ingredients needed to build a thoughtful channel program. Keep in mind that this skims the surface. We will go into more detail on several of the areas below in future posts. Here are some areas you should play particular attention to when getting started:

- Channel Team Structure

- Your channel sales team structure largely depends on your goals and how your broader sales team is set up. In general, you want to work towards a model that creates predictable and consistent coverage across all of your major sales territories as well as global scale and strategic new market entry. This strategy will evolve as your program matures. You may gradually work your way towards more of a managed partner model where each channel manager has a list of partners they “own” and formulate strategic plans with on an annual basis. There are several ways to structure your team. Regardless of how you define it, make sure you are aligning incentives to both avoid channel conflict (internal and external) and incentivize the right behavior to achieve your goals.

- Commission/Compensation Structure

- Partners: The way you compensate your partners largely depends on the operating model and the maturity of your channel organization. You can see general reference point ranges for partner commission in the chart above. Generally speaking, you want to be competitive on what you’re paying out to partners. Understand how your competition is incentivizing their channel and adapt/maintain accordingly.

- Internal: You should do everything you can to avoid internal channel conflict between your direct and channel reps. We would generally recommend paying direct sales reps fully on channel-sourced revenue in their territory. This way, your direct team is incentivized to cooperate (not compete) and collaborate on target account strategies with your channel partners, which means all around greater likelihood the deal will close. Depending on the maturity of your channel program and what your priority goals are, you may also decide to compensate your channel managers on channel-influenced bookings or even qualified pipeline in order to encourage the right behavior. A lot of this comes down to channel team roles and responsibilities and the KPIs that help each of those roles meet their targets most effectively. For example, if you are set on recruiting partners, attribute at least part of your rep’s target around recruitment quota attainment. Or, if you’re looking to strengthen large, globally focused GSI partnerships (budget 6-18 months to begin seeing pipeline on these), set targets around partner influenced or qualified pipeline instead of solely sourced bookings. Ensuring you have the right skillsets aligned to the right overarching goals is key. Bottom line: having strict targets around sourced business is not going to inspire reps to work on building out longer-term strategic partnerships or recruit new partners. Know your priorities and know your teams’ strengths.

- Program Tiering

- Many partner programs have tiers based on annual sourced business among other commitments (e.g., commitment to enablement, number of developer certifications, participation in a partner advisory boards, etc.). This can be viewed as a measure of loyalty and determination to build a successful, lasting partnership. The goal here is to incentivize partners to move up the ranks and want to commit more to building their businesses with you. The flipside is that they will also receive more program benefits (e.g., access to product roadmap previews, customized enablement, additional marketing support, invitations to your partner advisory board, etc.).

- Channel Marketing

- Channel marketing is the function that supports all of the marketing and program management for a channel sales organization. It is an important function that liaises between channel sales and direct marketing, creating synergy across your company’s go-to-market. Generally, channel marketing reports into marketing, but will have a very serious dotted line to channel sales. You can boil it down to the following:

- Marketing to Partners: Recruiting new partners via generating awareness in the partner eco-system around the benefits of your program as well as nurturing and reactivating existing partners through marketing programs.

- Marketing With/Through Partners: Teaming up with your existing partners to develop a joint GTM message in order to generate customer demand. An example of this could be writing an eBook and putting on a webinar around your joint solution for a specific target industry or use case where the partnership thrives. Both of your marketing teams will promote these assets to their prospect databases and share the generated leads. We will cover more on channel marketing in “Step 5: Grow”.

- Channel marketing is the function that supports all of the marketing and program management for a channel sales organization. It is an important function that liaises between channel sales and direct marketing, creating synergy across your company’s go-to-market. Generally, channel marketing reports into marketing, but will have a very serious dotted line to channel sales. You can boil it down to the following:

- Channel Enablement

- Enablement is hugely important when it comes to making the channel successful. Without a partner targeted enablement program (both sales and technical/product enablement), you won’t get very far. Ensure you have the appropriate resources dedicated to this early on. We will devote an entire post to “Step 4: Enable” to this, so stay tuned.

After you’ve validated your reasoning for building a channel in the first place and worked out some of the key defining factors, it’s time to move on to Step 3: Recruit.