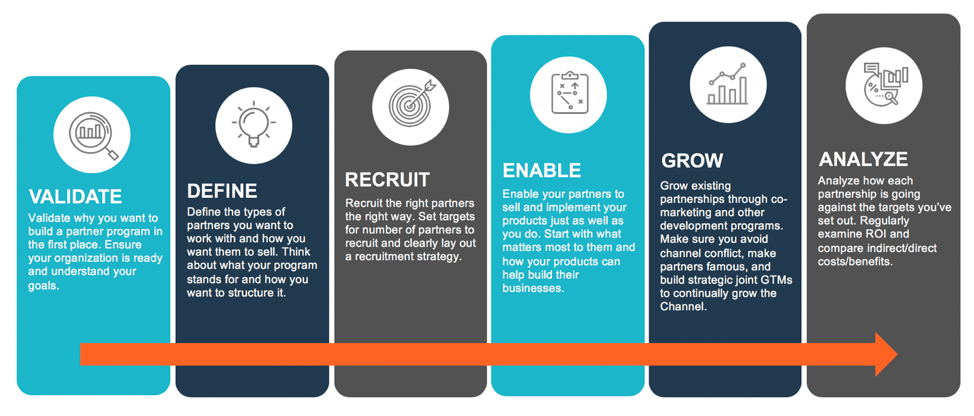

The Journey to Building a Successful Partner Program for Your Software Business – Step 3 of 6

Step 3: Recruit

The first post in the series dove into the first step in the 6-step journey to building a successful partner program for your software business. In Step 1: "Validate", we discussed the importance of substantiating your reasoning for building a channel in the first place. In Step 2: “Define”, we focused on defining your program and operating model. Once you’ve validated the opportunity and defined what your program will look like, it’s time to begin mapping out your recruitment strategy.

Recruit – The “OPP” (Optimal Partner Profile)

We spoke briefly about defining the right types of partners to recruit in Step 2. The bottom line is that putting the upfront work into evaluating your recruits and ensuring that you are going after the right partners is key. Your team should be investing in a uniform “OPP” assessment process before diving into the actual recruiting. Consider evaluating potential partners on 1) Fit and 2) Willingness to engage.

- OPP “fit” characteristics include: industry expertise, geographic coverage, go to market model, competing/complementary technologies and partners, existing/target customers, corporate culture, existing capability sets, etc. Your team should be aligning with direct sales on the relative importance of these traits to your organization’s success. Each trait should be mapped and scored for each recruit your team is considering.

- Willingness to engage is another important factor that is often not appropriately considered. Consider mapping and scoring your recruits list by priority (based on fit) as well as willingness to engage. This exercise will enable you to not only know what to look for when compiling your recruit list but also help diversify your efforts across low, medium, and high input.

It’s recommended to score your existing partner ecosystem in the same way. Of course, you can integrate additional factors, such as sourced business and certified developers, into the existing scorecard. This process should be built into either a quarterly or bi-annual review of partner tiers and commitments

Recruit – Hold the right people accountable

With competition in the software space continuing to heat up and buyer needs constantly evolving, it’s important to actively recruit new partners on an ongoing basis. Having a pipeline of new recruits will keep your partner ecosystem fresh and diversified. To do that effectively, you must have channel managers incentivized (read: paid) on recruiting new partners. If there is not clear focus and accountability devoted to recruitment, your team will naturally gravitate towards working existing partnerships.

Additionally, the two activities (growing existing partnerships and recruiting new partners) require very different skill sets and timelines.

This leads me to my next point: consider defining separate roles for partner management/development and partner recruitment (SiriusDecisions does a great job at breaking down the differences between the Channel Account Manager and Channel Development Manager roles). Ultimately, the person who’s perfect for building and strengthening a relationship over time is not necessarily the same person who succeeds at finding and successfully engaging a new recruit. If you don’t have the budget for separate roles, there should be clear distinction between recruitment vs. development targets and how those align with compensation for each member of your team.

Recruit – Ensure you have the right marketing support

If you have a Channel Marketing resource in place, you are golden. This person/team should be ready and willing to support both: 1) “Market To” and 2) “Market With” activities to make partner recruitment as efficient as possible and get new partnerships up and running effectively. If you don’t have someone devoted to Channel Marketing, it’s important to get top-down support on allocating a piece of your Direct Marketing team’s time to partner. Ensure that this commitment is officiated through OKRs. I would recommend the following:

1) Market To Partners

Messaging:

- Your messaging to partners needs to be segmented by partner type (e.g., SIs have different needs than creative agencies). Not all partners are created equal. Just as you would with a prospective customer, go through the exercise of creating persona templates by type and invest in understanding and articulating the differentiated value your product offers each persona.

- Keep the following questions top of mind when crafting your partner messaging. Ensure you are clarifying how and why your product (over your competitors’) helps them diversify their capability set, differentiate their pitch, and ultimately win more business.

- Why should they partner with you?

- How are your products going to help their pitch?

- How are your products going to help them win more business and expand existing business?

- What marketing/enablement/support benefits do you offer that competitors don’t?

Webinars/Events:

- Education-based webinars and events are a good way to enable partners at scale. Try to include a partner-customer success story to illustrate how your product has made a customer super successful while also helping the partner win business.

- Make it clear that adding your product to their suite of partner products will offer them more (and “stickier”) access to customers.

Newsletter:

- Keep your products top of mind and highlight relevant feature updates and/or recent customer wins through a monthly partner newsletter. This will build community and ensure that your brand doesn’t get lost in the mix.

Keep it simple:

- Don’t overengineer it. Simply show partners why they should partner with you. That’s the end (and only) goal. Demonstrate that you are a partner-first organization and that there are tangible business benefits to investing in a partnership with you. Consider mapping out a typical partner services revenue model. Show (monetarily and operationally) how a partners’ services wrap around your technology in Year 1 (what can they expect in terms of revenue for that initial subscription sale?) and then Years 2-5 (what is the expansion services opportunity?).

2) Market With Partners

Self-service marketing for lower tier partner recruits:

- Add top-performing white-labeled marketing collateral to your portal for easy partner access (e.g., a killer eBook that a partner can easily co-brand for selling purposes). You could also test demand generation “campaigns in a box”, but ensure that you are providing segmented messaging across buyer and industry. Otherwise, your joint campaigns will come across generic and irrelevant (not ideal, especially when you aren’t in control of the final send).

“Partner GTM packs” for middle tier partner recruits:

Create core marketing assets to build foundation with new recruits:

- Joint PR announcing momentum around the partnership

- Joint customer case study

- Web messaging

- Joint pitch deck articulating the value add of the partnership

Joint GTM solutions for top tier partner recruits:

- Pitch a joint GTM motion with your most strategic recruits. This could entail developing IP or simply investing in sales and marketing collateral/enablement around a niche value-add. Potentially you and your partner want to go after a specific vertical (e.g., regional banks) or horizontal use case (e.g., personalization and channel insights). In order to do this well, you must research what will be attractive to the partner. Look at their current customers and partners. Where’s the white space? Go after that. Leverage your own product’s secret sauce and offer it as a high value-add benefit that complements and strengthens the partner’s pitch.

Conclusion

Once you’ve validated your reasoning for wanting to build a channel, defined your goals and program structure, and figured out your recruitment strategy, you’re ready for Step 4: Enable.