The Journey to Building a Successful Partner Program for Your Software Business – Step 6 of 6

Step 6: Analyze

By now, you've validated, defined, enabled, and grown your partner program. Tremendous effort goes into each of these steps, as we've outlined, but channel sales are hardly a set-it-and-forget deal. To ensure the success of your partner program, you must continuously scrutinize performance data and trends. Insight and oversight are both crucial to success, whether measuring progress toward established sales goals or examining partner compliance in product messaging.

Welcome to Step 6: Analyze, the final step in the journey to establishing a partner program for your software business.

While we've previously walked through the stages of getting a partner program up and running, this final step is about cementing your program through establishing a testing mentality and integrating regular analysis of channel investments, program efficiency, and partner effectiveness. Every initiative needs to be tracked and assessed after implementation, and your program is no different. It's crucial to analyze performance at both the macro and micro levels —the program itself and your individual partner relationships. Every insight gleaned from the data or a conversation will be valuable in directing investments, recruiting new partners, refining goals, scaling your program, and generating return.

Many metrics, few KPIs

While partner sourced sales growth should be the primary motivator for establishing a partner program, it is not the only KPI that must be considered. There are several KPIs you should be measuring yourself against (and many more metrics), depending on where you are in your journey.

For example, closely measuring leads sent to and received by partners is an important metric that feeds the success of partner-sourced business. A full 360-degree view into program performance will help identify what is going well, what areas need improvement, and what opportunities exist. When considering timeline to ROI, it’s incredibly important to ensure there is top down agreement on the KPIs you will be measured on and when. It generally takes 9-24 months to get a partner program up and running. The first 2-4 quarter KPIs (depending on your sales cycle) should include a combination of sourced pipeline and sales plus milestones, such as number of new signed partners, or sales certifications and certified developers (per partner). KPIs should be limited to no more than three and measured on a quarterly basis (with regular status to target checks), while metrics should be looked at very regularly and exist across several components of your program.

Resources & Tech

Another important consideration is that partner operations is not something you can do in a spreadsheet on the side (at least not sustainably). If you aren’t in a place to hire a full-time partner operations FTE, you must ensure sales and marketing ops are carving out pieces of their time (and quarterly targets) towards supporting partner needs. As you scale your team, ensure you’re building out the right support functions: a partner marketing lead and a partner operations lead.

Partner Relationship Management (PRM) tools are critical to scaling and managing your partner business. I see a lot of partners complain about not understanding why they haven’t received leads or not having a firm handle of where the leads they have sent stand from a funnel perspective. PRM vendors can offer lead management tools to ensure you are passing leads to the right partners at the right time and also automate much of the conversation between you, your sales team, and your partners on where pipeline stands. We like Channeltivity when you’re just getting started because it’s modular in its offerings (right-sizes to your needs and your stage of growth) and offers the full gamete of end-to-end solutions. Allbound is another option to consider when your partner ecosystem is on the smaller side or in the first couple years of building out your program. If your business is running on Salesforce and you have built a larger, more sophisticated program with robust marketing and enablement, I would recommend considering Salesforce Community Cloud.

Program vs. partner level

The deeper your analysis is, the more robust the insights will be. To that end, it's important to conduct analysis that focuses on the program as a whole, as well as your partner types individually. Your partner program is essentially an ecosystem of diverse business relationships, each with their own intricacies, and your analysis must reflect that fact. Drilling down into the specifics at the partner tier/type/tenure/geo as well as at the account level (for your top tiers and those partners that merit a deep dive into pipeline, enablement, and marketing metrics) will help build the transparency you need to manage, improve, and ultimately work to make your program predictable.

Analyzing overall program performance

Let’s examine some of the KPIs and metrics you should consider, as well as tactics for pursuing high-quality insight and program transparency. In general, there a few categories of measurement you should be familiar with and have a data-backed point of view on:

- Effectiveness

- Partner sourced bookings*

- Partner influenced bookings

- Partner sourced pipeline

- Partner influenced pipeline

- Efficiency

- Cost per opportunity dollar/ARR dollar

- Sales cycle length

- New business average deal size

- Trends

- Deal volume/ASP over time by partner tier/geo

- Deal volume/ASP over time by # of sales/tech certifications

*Partner sourced should always be your primary KPI, however it is important to look at influenced as well (ensure there are clear definitions for what qualifies influenced that are understood across the organization).

Sales

Let's start with sales metrics and what your program analysis should be built on. To be fair, each business will have its own set of KPIs that matter most: Just be sure that these are codified and that partners are aware of the numbers by which they will be measured as part of your program.

At the partner level, some KPIs to consider include:

- Partner registered deals (#/$)

- New bookings (#/$)

- Expansion bookings (#/$)

- Average monthly/annual revenue per partner

- Churn per partner

- New bookings QoQ and YoY growth

Other measurements to look at include:

- Revenue by product/geo by partner

- Indirect ROI/Profitability: The net revenue impact of partner channels

- Indirect Win/Loss Analysis: Examining behaviors and patterns in wins and losses

- Predictive Analytics: Forecasting growth, markets and trends

Defining partner cohorts according to results or certain KPIs can help you visualize who your top-performing partners are, as well as those who could improve. This analysis should then flow into an annual tiering review with promotion and demotion according to the requirements you’ve set.

When analyzing sales performance, you will also want to look outside the partner program. Comparing indirect sales generated via the partner channel to direct sales can help contextualize performance and investment justification. Make sure you look at efficiency here. Generally, partner deals are more qualified when they come in the door (if you’re operating a referral model), so they tend to have faster sales cycles. Examine ASP as well. Often because the partner is already in business with the customer, the deals are larger (especially with services partners). It may also help reveal, for instance, partner effectiveness in selling a particular product and whether it exceeds, or lags, internal teams, and is therefore an area for improvement.

In the early days, it’s crucial to establish a collaborative indirect/direct selling culture. Ensure you are publicly celebrating wins when direct reps work with partners and enabling the rest of your sales force on the tactics that made the collaboration so fruitful. It’s important to highlight the value of working with partners. There are ways to incentivize friendly partner behavior from reps even when they aren’t getting paid on the full deal value (net partner commissions). I would recommend exploring spiffs and enabling reps on the network effects of establishing partner relationships in their territories over double paying, though this decision depends heavily on the situation.

Marketing

Marketing effectiveness and sales effectiveness go hand in hand. It's critical to have alignment between the two. Analyzing marketing performance among partners can help provide further insight into what works, what doesn't, and how to better position partners to achieve revenue goals.

Marketing metrics to focus on may include:

- MQLs, pipeline and business through co-marketing programs

- Marketing development fund (MDF) program utilization and effectiveness (e.g., sourced business and pipeline per dollar allocated in MDF programs)

- Partner SEO performance (e.g. click-throughs, impressions, organic traffic to joint partner pages or partner contributed content)

When engaging in co-marketing with partners, ensure you have clear roles and responsibilities laid out in advance of the program kick-off. Clearly define lead attribution as well as routing and follow up protocol before you start marketing.

Another channel performance measurement your business should look at is net promoter score (NPS). NPS is a customer loyalty metric that gauges how willing a customer would be to recommend your product. Often measured on a 10-point scale with 1 being the least likely to recommend and 10 the most, NPS can deliver insight into how well partners are retaining accounts, creating satisfied customers, or marketing the value proposition of your product. Compare NPS for accounts with ongoing partner activity and those without.

Enablement

Enablement is so important to the success of your channel sales that it justifies its own step in the journey to a successful partner program. As such, there are assorted enablement-related metrics to watch, as they can expose gaps that stunt marketing and sales effectiveness.

Certification attainment is a necessary metric to monitor. Depending on your program model, the sales certification and/or courses you offer or require directly influences the success of a partner relationships. Be sure to track which partners have earned which certifications. You may want to track, for instance, the spread of specialty certifications across partner tiers, and whether more could be done to enable smaller partners on training and certifying their teams on a specific product or industry solution you offer. Also track technical/developer certifications and continuing education that's required as part of certification if your partners are delivering services. Make sure you look at how sales and technical certification impacts performance.

Reviewing the steps to success

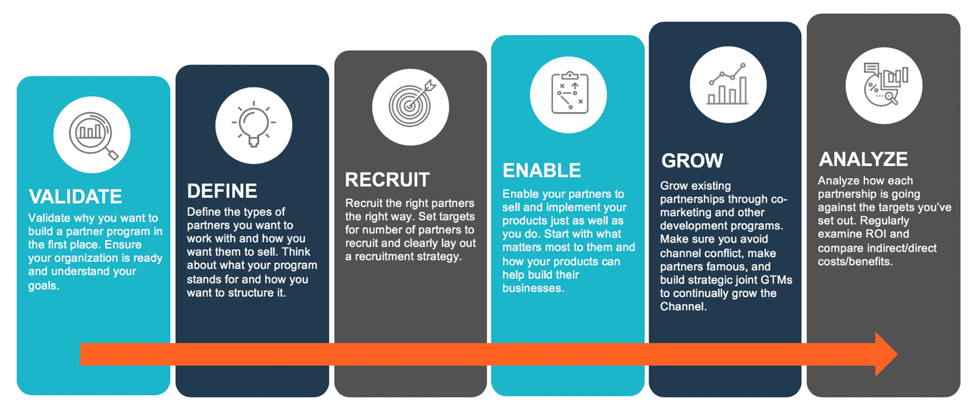

Analysis may be the final step on the journey to establishing a successful partner program and achieving that partner flywheel we all want, but it's not the last step. You must continually analyze metrics to fuel a virtuous cycle of enablement and growth in your program. In concert with the other steps of validation and definition, these stages of constructing a partner program represent a blueprint. I hope these fundamental tactics, strategies, and best practices are helpful as you embark on the journey.

Take a look at Step 1, Step 2, Step 3, Step 4 and Step 5 if you haven’t yet, and please reach out with any questions.