Price elasticity may bring back memories of boring college lectures, but there’s a reason it’s a business school staple. For more than a century, the concept has been the go-to measure of pricing power, helping set the price of everything from a gallon of corner-store milk to a Ferrari. It’s remained largely unchanged since its inception -- but just because the method is tried and true doesn’t mean it’s always the right move for high-growth subscription ScaleUps.

The idea of price elasticity is that your demand decreases as your price increases. In other words: the higher the price, the fewer people buy. You can use an understanding of this dynamic to set the perfect price that will maximize revenue. If your product is price inelastic (like most luxury goods and B2B software), then to maximize revenue, you should increase the price until you reach the revenue optimal point. If it’s price elastic (like most commodities), then you should reduce the price to increase sales.

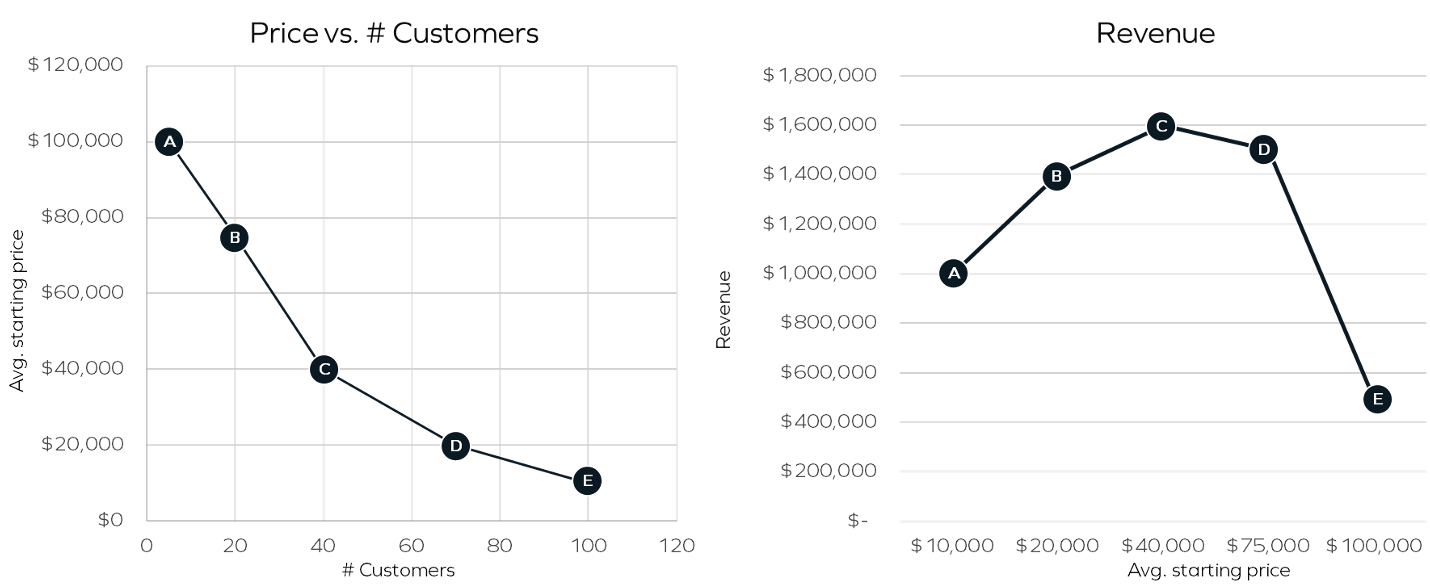

Let’s take a look at this software company example to see price elasticity in action:

The graph above shows that scenario C, with an average starting price of ~$40,000 across 40 deals, is best to maximize revenue. So far, so good, right? Well, not so fast. Setting prices according to this principle could actually hamper your long-term revenue growth.

Why are high-growth subscription companies different?

Subscription companies have the ability to land customers at a lower price and expand their spend over time as their product usage, loyalty, and willingness to pay to grow. One of the most important software metrics is a company’s net dollar retention, which is the average amount that your customers expand (or contract) their spend over time, including the impact of churned customers. Top SaaS companies such as Jfrog, Twilio and Zoom can report >130% net dollar retention, which means that they would be able to grow their revenue by 30% without signing a single new customer.

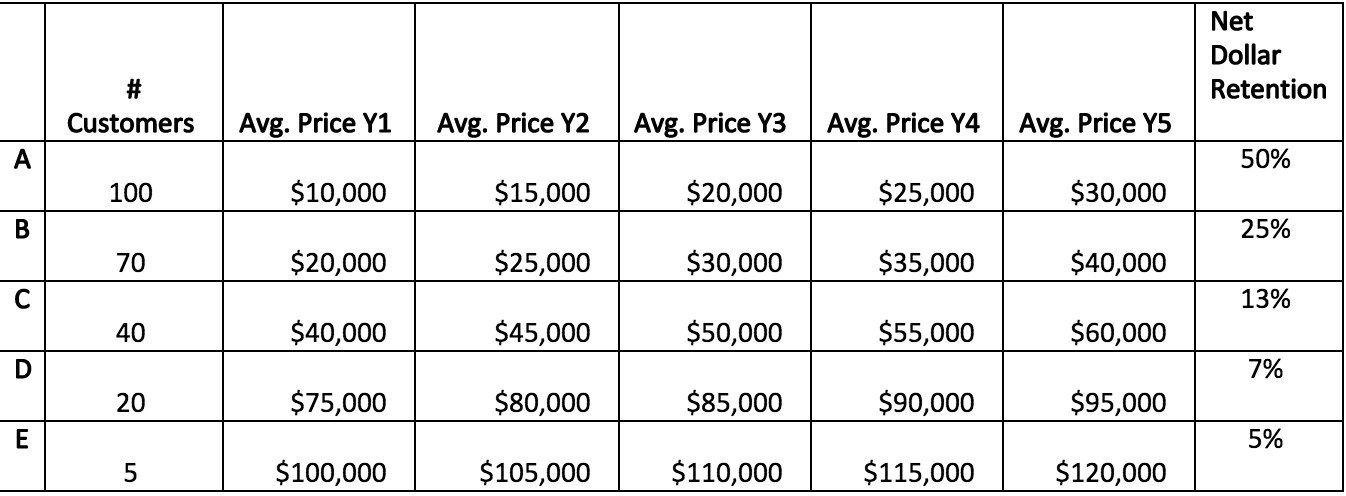

By contrast, price elasticity is a point-in-time exercise, so it doesn’t take into account this longer-term growth. Let’s assume in each scenario our customers grow their spend by $20,000 on average over five years, as outlined below.

It may appear strange that the scenarios where you are selling to more customers at a lower price are expanding at much higher percentage rates, but this is realistic because:

- The customers who started with a higher willingness to pay (e.g., the 20 customers who would have paid $75k in the first place) will grow up to these amounts over time and bring up the average price level.

- If you have more customers, there is a larger base to cross-sell new products and modules into.

- If you were able to effectively sell “less for less” in the first place, such as lower tiers or usage/license allowances, then your customers will hit their limits and need to upgrade earlier.

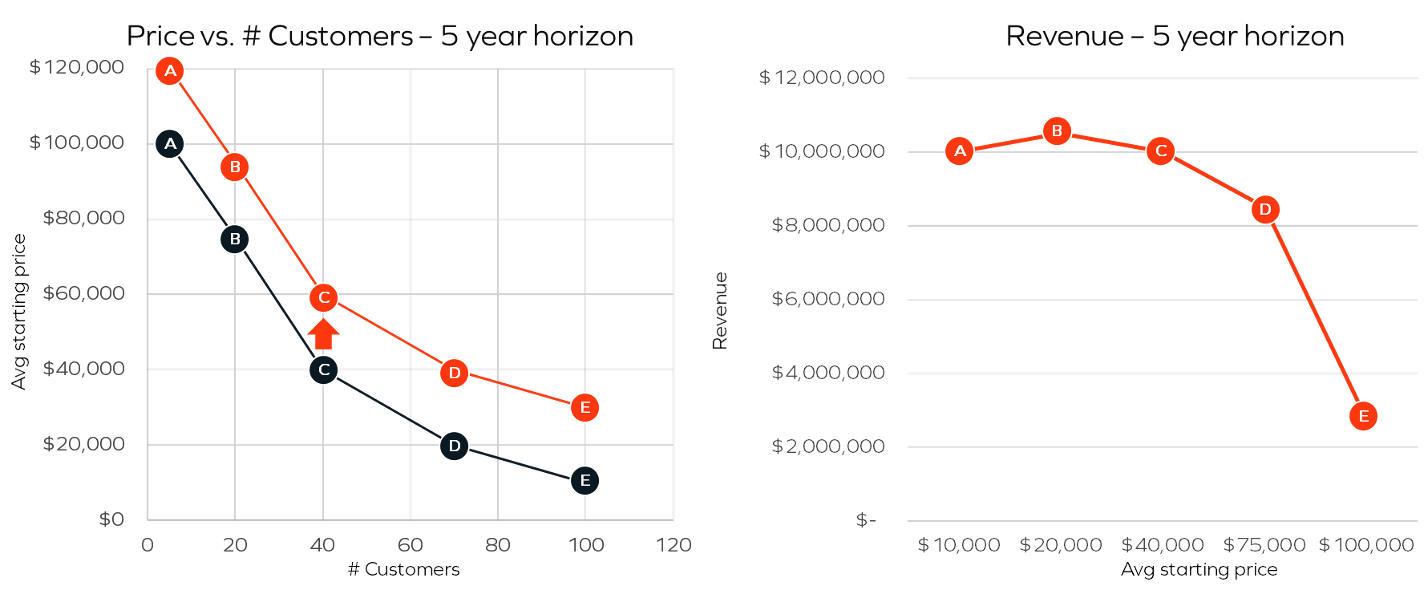

As you can see, the best option in this example is to price lower from the outset and allow for customer growth to optimize your revenue over the long term. In this example, option B ($20,000) provides the most revenue, and if you were to expand the time horizon even further, it would be option A ($10,000). In addition, you will get several benefits from having a larger, more diverse set of customers:

- More opportunity for product testing and case-study development

- Better revenue protection from individual customer churn

- Improved customer satisfaction (as they are getting the product they need at a better price)

What does this mean in practice?

This does not mean that companies should just slash prices to win deals. Cognitive bias from price anchoring means that customers will benchmark any expansion of their contract against the value and price of their current one. If you sell them the same contract for a lower price, it will be much harder to achieve the net-dollar retention you need. Instead, the goal for most customers is to land more logos with smaller deals and expand those contracts more quickly. As a rule, customers are typically most price-sensitive before they have started implementing and feel more comfortable paying higher prices down the line once they’ve started to see a return on their investment.

“The goal for most Scale-Ups is to land more logos with smaller deals and expand those contracts more quickly”

Getting customers to spend more is no easy feat – it requires excellent customer health to prevent churn and a revenue model that can enact significant upsells as your customers realize more value from your solution. Here are some key tactics that will help:

- Think about LTV when chasing leads and developing your ideal customer profile – good deals are customers who will be paying you large amounts in five years’ time rather than those who will be paying you the most now. Some Enterprise deals will still pay a premium to give themselves the flexibility of high contract limits, but for others, you should be prepared to be patient and offer customers the option to start smaller and grow at their own pace (in doing so, you also reduce the risk of churn). Atlassian’s bottoms up business model has relied on selling small contracts to hundreds or thousands of individual teams at large Enterprises and consolidating them into high LTV deals at a later date – enabling them to grow subscription revenue at ~50% per year.

- Product-led growth allows you to improve both land and expand. Freemium / free trial-based acquisition can reduce the sales and marketing costs associated with developing and qualifying leads, while self-service selling and product-led sales motions can reduce friction and improve efficiency when expanding accounts. Prior Insight portfolio company Alteryx allows customers to start for free using a trial, before expanding their usage across teams into large dollar deals.

- Usage-based pricing can lead to much faster usage-based upsell, and it’s the primary reason why companies such as Snowflake are able to achieve over 150% net-dollar retention.

- Product differentiation adds another way of expanding accounts, in addition to your main pricing metric. Customers can opt to purchase new tiers or modules that offer more functionality as their needs develop. Veeva has sold an average of 3.8 products to it’s earliest customers, which has allowed them to increase average revenue by 20x.

- Scaling your customer success by using tech-touch for long tail customers and focusing on self-service documentation will be a valuable tool to serve more customers efficiently without spiraling costs.

By focusing on a land-and-expand motion, you can maximize your revenue growth sustainably over time, but it requires patience and a coherent strategy – from customer acquisition to expansion – to ensure that customers grow at the rates required. If you have any questions about developing your revenue model to support land-and-expand, Onsite is here to help at pricingoncall@insightpartners.com.