Before the ChatGPT release, many had been underestimating the pace of progress in AI – its release was like a spark that lit the fire of innovation around generative AI technology, along with a renewed fundraising dynamic. From ChatGPT (also see ChatGPT plugins and Code Interpreter), to Anthropic’s Claude, to the new BloombergGPT, the pace of innovation in this space has been nothing short of remarkable.

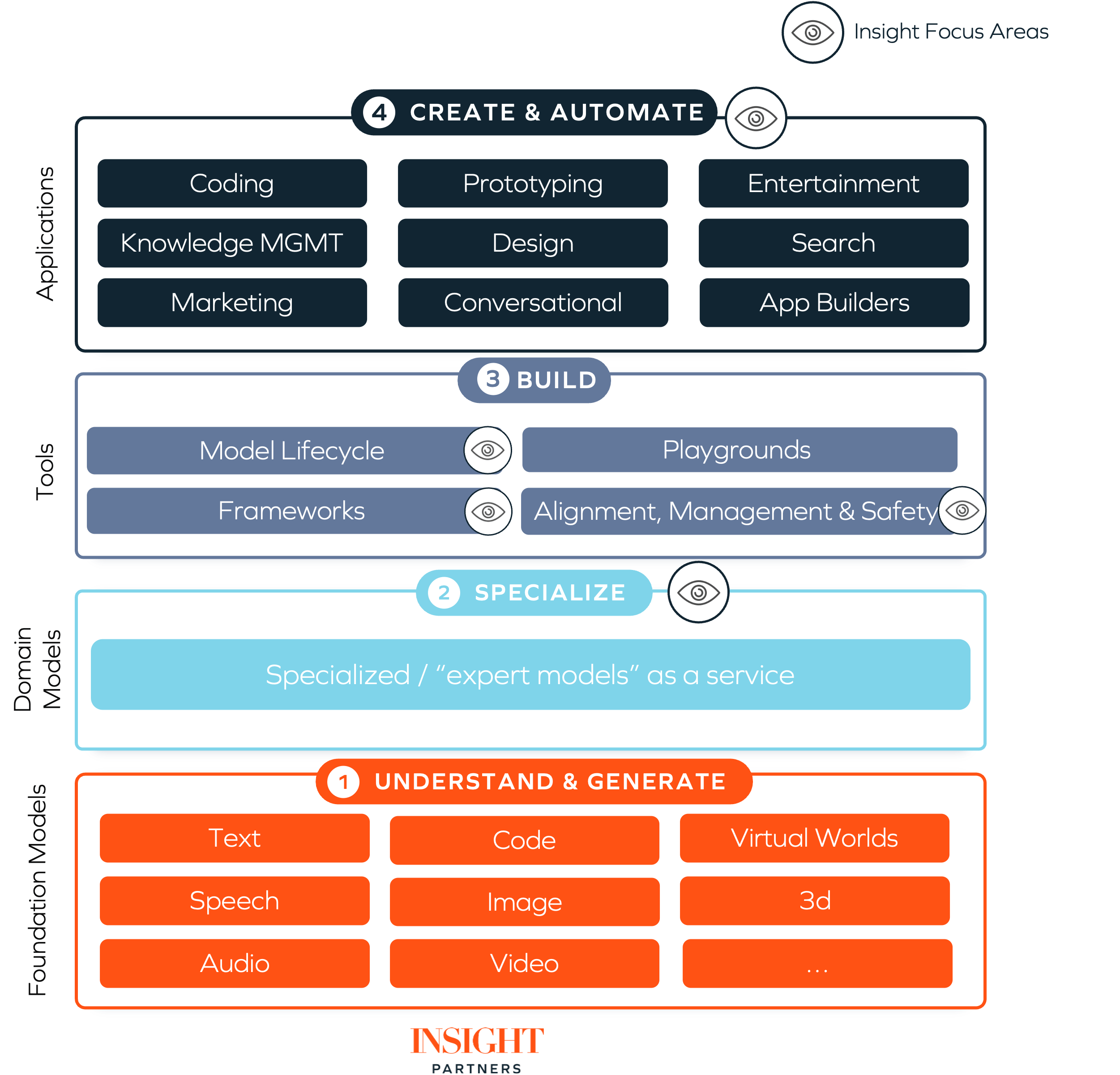

Swift technological progress is evident throughout the tech stack:

- foundation model layer, e.g., OpenAI, Cohere, Anthropic, Stable Diffusion, Adept, AI21, Aleph Alpha, Google, Hugging Face

- tooling/infrastructure layer, e.g., Weights & Biases, LangChain, Run:ai, Dust, Deci AI, Fixie, AssemblyAI

- application layer, e.g., Jasper, Harvey, Profluent, Hour One, and more mentioned below

Goals of generative AI

If you are new to generative AI, it refers to the use of AI algorithms to:

“autonomously generate novel, high-quality, and coherent content, data, or solutions by understanding and mimicking patterns, structures, and features found in existing input data, often with the aim of enhancing creativity, automating tasks, or solving complex problems”

– ChatGPT-4 answer for ‘What is the goal of generative AI’ on 3/28/23

Generative AI, for the first time, makes it so that AI not only analyzes existing data and finds patterns in such data but can also create entirely new content itself.

Read more: Our colleagues Ganesh, George, Nikhil, Jenna, and Sunny share some of the areas that excite Insight around the foundation model and tooling/infrastructure layer in The Next Stack: Generative AI from an Investor Perspective.

We are also seeing rapid innovation in generative AI across the application layer. The rest of this post will explore recent developments at the application layer (layer 4: ‘Create & Automate’ in the below graphic), highlighting areas that excite us and a few examples of how generative AI applications deliver substantial value to end users.

Parsing the generative AI application layer

We have seen an influx of generative-AI-native companies (meaning, new startups with generative AI at their core) arise in recent months. At Insight, we are tracking 350+ such companies today and have already made several investments in the broader space, including in Jasper (AI copywriter/content creator), Lightricks (AI-powered visual creative app), Mutiny (personalized website and marketing copy), DigitalOwl (AI-powered analysis and summarization of medical records), Writer (AI writing platform), Uizard (AI-powered design), Profluent (AI-powered protein design), Deepdub (AI-powered voice dubbing), and HourOne (video creation tool), to name a few.

We have found it helpful to break the application layer into three parts:

1. Horizontal tooling

Gen-AI-native platforms that seek to own a particular use case or workflow, such as Jasper (AI copywriter and content generator), RunwayML (AI-powered video creation and editing tools), and Tome (AI-powered presentations).

2. Vertical turnkey applications

Gen-AI-native platforms with a focus on a particular vertical or sector, such as Harvey (‘Copilot for law’), Cradle (AI-assisted protein design tools), and Wonder Dynamics (AI-powered platform for game studios/filmmakers).

3. Captive generative AI

Where the capability is so core to an industry that companies will want to build their own generative AI functionalities, either by leveraging foundation models and tooling or (like Bloomberg) training their own foundation models in-house.

These companies typically employ API-based foundation models to power their products, though some occasionally build the models themselves (as seen with BloombergGPT, for instance).

Applications that drive productivity, creativity, and automation

We’re seeing early-stage gen-AI-native companies emerge around horizontal- and vertical-specific applications. These startups can leverage generative AI to create a ‘wow’ experience that gets new users in the door, building out additional workflows around that generative technology over time to retain users and drive further stickiness.

In addition to the companies mentioned above, we are also seeing startups arise with generative AI at their core in many areas, for example:

Horizontal use cases

- Code – Companies like Bito, Adrenaline, Magic, Mintlify, and Tabnine are leveraging generative AI to drive better developer experiences.

- Design – Companies like Diagram, Galileo, and Alpaca are leveraging generative AI to enhance the workflows of designers and build ‘Copilot for design.’

- Cybersecurity – On the negative side, generative AI can increase threats as hackers use it to craft more sophisticated attacks and find vulnerabilities; in light of this, companies like Recorded Future are using generative AI to automate different stages of threat analysis/intelligence reports, helping to better mitigate/respond to threats.

- Productivity/Knowledge Management – Companies like Mem, Supernormal, and Fermat are driving enhanced user productivity through the use of LLMs.

- Creator – Companies like Captions and Lightricks are bringing generative AI technology to creatives, paving the way for new creative possibilities.

- Sales & Customer Success – Companies like Lavender, Regie, and Cohere are bringing personalization and enhanced workflows to GTM teams.

- Data – Companies like Hex, Akkio, and Seek leverage generative AI to drive enhanced workflows/capabilities for data analysts and SQL / Python lovers everywhere.

- Search – Companies like Perplexity, You.com, Andi, and Metaphor are hoping to change the way consumers go about search, with generative AI and LLMs at their core.

Vertical use cases

- Healthcare/Bio – Companies like Profluent, 310.ai, Xyla, and Latch Bio are leveraging generative AI to create new proteins/drugs and drive better patient outcomes.

- Legal – Companies like ContractPodAi, Harvey, Casetext, Lex, and Rally (Spellbook) are leveraging LLMs to drive efficiency for lawyers and law firms.

- Gaming – Companies like Kaedim, Inworld, Wonder Dynamics, Latitude (AI Dungeon), and Scenario are using generative AI to drive down the cost of game development and unlock new paradigms for gaming creativity.

- Construction/Manufacturing – Companies like Augmenta and Architechtures are leveraging generative AI to design buildings, materials, etc.

- Education – Companies like Iris.ai, Genei, and Scispace are enhancing the workflows of academic researchers through AI-powered summarization and other tools.

Not just for young upstarts

While upstarts are constantly emerging, many established software vendors are also retrofitting generative AI into their product suites. We are excited about the potential for generative AI to serve as a catalyst for users to adopt the latest leading vertical software platforms, especially in verticals with outdated, manual processes and legacy software solutions.

We think traditional scale advantages of vertical SaaS are further compounded in the age of generative AI with reinforcement learning and domain-specific data. We are also excited about application providers with fast-moving teams who continuously reimagine the way their products can work given the power (and limitations) of generative AI technology as it evolves and improves.

We have already started to see this.

- Microsoft is bringing ‘Copilot’ to the Office 365 suite. This particular three-minute segment (timestamped here) shows the ability to automatically convert a Word doc into a Powerpoint presentation and the auto-analysis of spreadsheet data in Excel.

- Google introduced new generative AI features to Google Workspace.

- Salesforce recently announced the first generative AI for CRM, Einstein GPT.

- As of February 2023, GitHub’s AI-powered coding assistant, Copilot, had 1M+ users and generated 46% of its users’ code(!)

- Quora’s chatbot, Poe, lets users ask questions and get answers from the Quora platform.

- LexisNexis released Lexis+ AI, which summarizes and generates brief and includes a conversational interface.

These are just a handful of the incumbent companies that have incorporated generative AI and are leveraging existing distribution, relevant products and users, and strong, adaptable engineering teams to maintain a competitive edge.

Examples from Insight’s portfolio

Many companies in the Insight portfolio are also integrating generative AI into their product suites to drive higher ROI and build even better product experiences for customers. Insight is working on programs to help existing portfolio companies to incorporate these capabilities into their offerings in a way that is safe, privacy-preserving, and compelling.

- Code documentation company Swimm’s AI-powered code documentation frees up time and effort for engineering teams.

- Code intelligence company Sourcegraph’s LLM-powered coding assistant, Cody, is helping drive further developer productivity.

- AI-powered GI company Iterative Health’s generative healthcare documentation drives time and cost savings, along with higher accuracy.

- AI-support company Espressive’s recently announced Barista LLM Gateway enables companies to use LLMs such as ChatGPT safely.

- Database company SingleStore launched an extremely fast and scalable vector database capability that lets you safely and securely incorporate private corporate data into large language model responses.

- Cybersecurity company Recorded Future, as mentioned above, is using generative AI to automate different stages of threat analysis/intelligence reports.

- Workflow automation company Bardeen’s AI-powered automation tool, Magic Box, uses LLMs to generate automations for users.

- Synthetic data company Tonic uses generative AI to create the strongest possible synthetic datasets for customers.

- Conversational AI company Cognigy’s LLM-powered contact center automation drives enhanced ROI for customers.

- AI infrastructure company Landing AI recently announced ‘Visual Prompting,’ which allows users to build computer vision workflows with natural language prompts.

- Last week at RSA, SentinelOne unveiled a novel threat-hunting platform that incorporates various layers of AI technology to provide exceptional security capabilities and an immediate, self-governing response to attacks throughout the whole enterprise.

- Observability company Honeycomb recently announced the launch of a natural language powered querying, making it possible for developers to ask questions and gather insights around code observability and performance in plain English.

Numerous other portfolio companies will be announcing generative AI functionality in the next few weeks and months, so stay tuned.

These companies can capitalize on their existing ownership of users’ workflows to foster robust user adoption, enhanced user experiences/outcomes, and increased stickiness, which over time, can compound into a strong business/product moat.

Building defensible moats

It will be very interesting to watch where the pools of value will accrue and where economic moats will be the deepest with these new generative AI technologies, if anywhere.

Some believe that companies building large foundation models will reap the most due to the significant investments of time, technical expertise, money, and resources required to create them.

Others argue that companies fine-tuning models for specific use cases will have the deepest economic moats due to the demand-side economies of scale resulting from proprietary training and feedback data. Using the Embeddings APIs to turn datasets into prompt enhancements is another powerful way to leverage private datasets as an advantage to enhance results.

Generative AI could also democratize access to powerful tools in a way that makes it easier for non-AI incumbents to retrofit existing products since many generative AI capabilities are provided as an easy-to-use service from foundation model players.

Given the accelerating pace of innovation in the space, it is likely that by the time you are reading this, there will already have been major new advances on the application layer and throughout the generative AI stack. As adoption increases, safety concerns will shift to the forefront. We are closely following the evolution of generative AI. As with any new technology, there are many nuanced issues, opportunities, and dangers on which businesses and governments should be focused.

Efficient runtime infrastructure, a strong focus on user experience stemming from an understanding of user workflows, and domain-specific data are showing promise as sources of economic power.

In the end, usage may be the most enduring moat. As AI systems benefit from more use, we expect value to accrue on the application layer for companies who truly understand their users’ pain points and needs and build phenomenal product experiences around this.

If you are a founder or exploring ideas in this space, we’d love to hear from you at ljaffe@insightpartners.com, mspiro@insightpartners.com or ahong@insightpartners.com.

Disclosure: Weights & Biases, Run:ai, Deci AI, Profluent, Hour One, AssemblyAI, Jasper, Lightricks, Mutiny, DigitalOwl, Writer, Uizard, Deepdub, Recorded Future, Swimm, Sourcegraph, Iterative Health, Espressive, SingleStore, Bardeen, SentinelOne, Honeycomb, Landing AI, ContractPodAi, and Cognigy are Insight portfolio companies.