Five sales leadership lessons from Insight Partners’ CRO Survey

Sales leaders are always looking for an edge. But in a market crowded with opinions, anecdotes, and recycled best practices, it’s increasingly difficult to distinguish what actually drives performance from what simply sounds right.

To ground the conversation in data, Insight Partners launched its inaugural CRO Survey, collecting responses from over 150 Chief Revenue Officers across our portfolio. The findings were presented by Insight Onsite’s Executive Vice President Jeremey Donovan and Senior Vice President Alea Kennedy.

We defined “top performers” as companies that self-rated their performance as much better than their closest competitor — a benchmark we’ve found correlates with stronger outcomes across key SaaS metrics.

As Donovan explained, “You’re very unlikely to say much better if you’re not much better. We found that companies that responded that they were much better perform significantly better on a number of SaaS KPIs, like the Rule of 40.”

This piece comes from Onsite Hour, a weekly virtual event series for portfolio companies, created by Insight’s 130+ in-house experts.

1. Focus beats breadth in GTM leadership

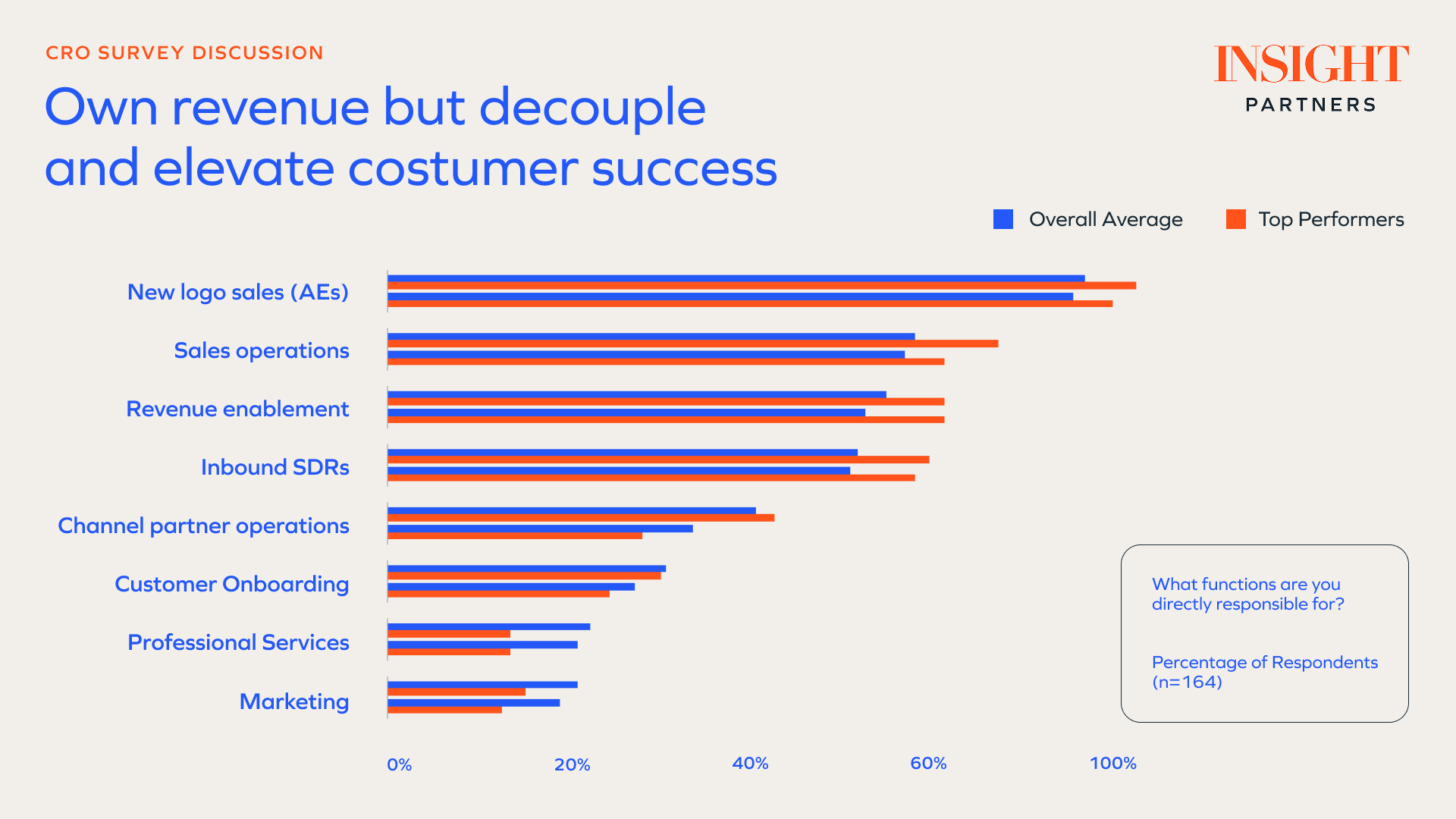

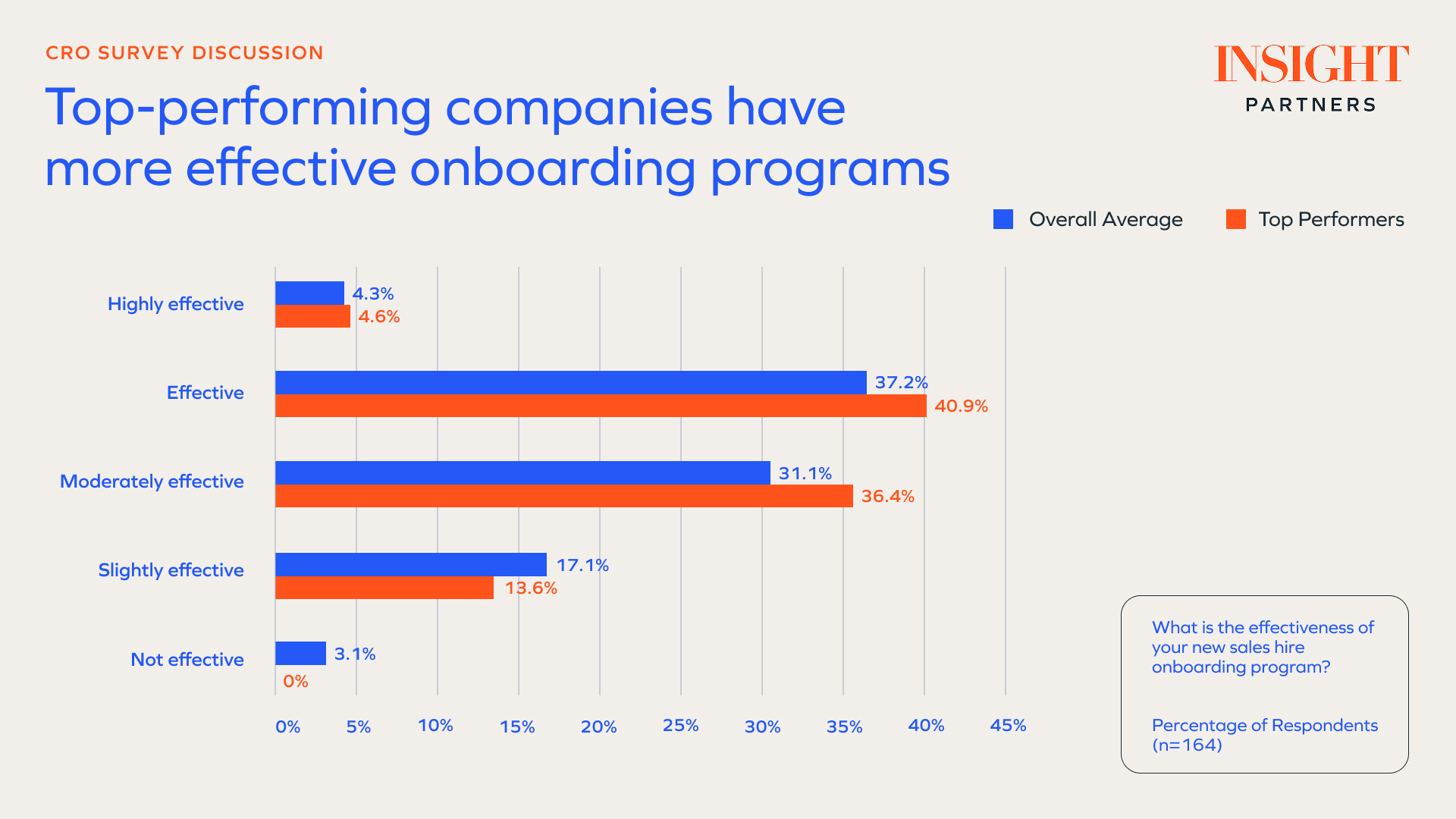

Over the past decade, the CRO role has steadily expanded to encompass the full customer lifecycle. Our data suggests top performers are moving in the opposite direction.

High-performing CROs are significantly less likely to own non-commercial, post-sales functions such as professional services, customer success, or onboarding. Instead, they remain tightly focused on core commercial motions: new logo acquisition, account expansion, and the operations and enablement that support those efforts.

“Focus matters, and focus drives effectiveness.”

This shift reflects a broader rethinking of GTM leadership structure. As Kennedy noted, “What we’re seeing is a little bit of a change…actually, it’s commercial versus non-commercial. That’s the nuance versus this broader end-to-end, because focus matters, and focus drives effectiveness.”

The takeaway is clear: Focus matters. Rather than centralizing everything under one role, top performers often enable tight partnerships between commercial leaders and non-commercial counterparts — without diluting accountability.

2. Outbound is becoming more deliberate

Despite frequent claims that outbound is no longer viable, the data tells a different story. Compared to the broader sample, leading companies were more likely to report that they had either expanded or newly established a dedicated outbound SDR team. That said, outbound success is increasingly context-dependent. It works best when ASPs exceed $40K and unit economics justify the effort.

“Outbound is very much alive…but it is definitely getting harder.”

As Donovan put it, “Outbound is very much alive…but it is definitely getting harder. Reply rates have declined year after year. AI has made emails feel very cookie-cutter, so it’s really hard to distinguish yourself.”

For companies where outbound does make sense, fundamentals still matter. Across our broader CRO conversations, roughly 70% of outbound-sourced opportunities are booked via phone, reinforcing that even as tooling evolves, human connection remains central.

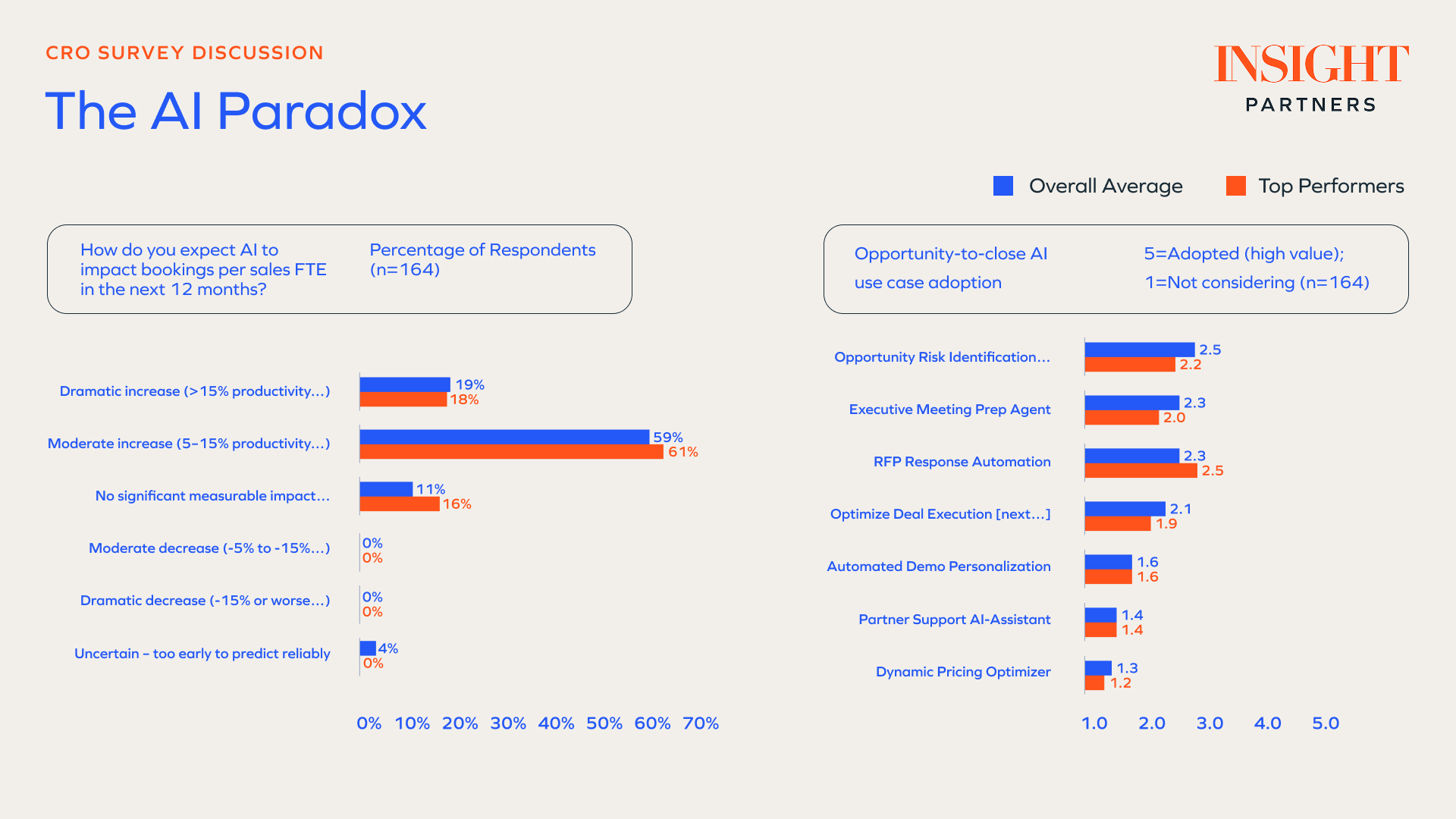

3. The AI paradox: Augmentation works, automation waits

AI dominates nearly every GTM conversation, and CRO expectations are high. Of the leaders surveyed, most anticipate a 5 to 15% productivity lift from AI investments. But the data reveals a divide.

AI can deliver tangible impact when it augments human workflows — helping reps prepare for meetings, personalize outreach, and prospect more effectively. Where it’s underperforming is in the full automation of core sales tasks.

Donovan summarized the pattern succinctly: “AI is clearly helping with augmentation — prospecting, meeting prep, tuning emails — but we’re just not seeing consistent success yet with full end-to-end automation.”

This reality is shaping how companies invest. Rather than buying off-the-shelf tools, many are building internally. As Kennedy observed, “We’re seeing the vast majority of portfolio companies focused on building AI internally, tailored to their own processes, rather than buying at least for now.”

4. When hiring, outcomes matter more than pedigree

When evaluating sales talent, CROs are clear about what they value and what they don’t.

In the classic debate between grit and pedigree, grit consistently ranks higher. But an even stronger signal emerged around experience. A proven track record of quota attainment was by far the most important hiring criterion, outranking vertical expertise, deal-size familiarity, or experience at a similar-stage company.

As Donovan emphasized, the data shows that a proven track record of quota attainment consistently outranks vertical expertise or company-stage experience.

5. Top performers compete on value, not price

In competitive markets, price can feel like the easiest lever to pull. Top performers resist that temptation.

When asked to identify their primary differentiators, leading companies emphasized product capability, customer experience, and brand — not pricing. Only 9% cited competitive pricing as a primary differentiator, compared to nearly 20% of the overall sample.

As Donovan cautioned, “This is correlation, not causation. It’s probably the effect, not the cause.” That confidence is earned through superior execution, not discounting.

There is no silver bullet — only disciplined execution

When we asked CROs which part of their revenue engine matters most, the data didn’t point to a single tactic or tool. It pointed to something more fundamental: the system.

As Donovan put it in closing, “This was a trick question. What matters most isn’t any single tactic — it’s the consistent execution of the entire revenue system.”

*Note: Data from this blog comes from Insight Market Research. This post contains forward-looking statements and predictions regarding the future of AI. These statements are based on our current expectations and assumptions, and actual results may differ materially from those expressed or implied in these statements. The information provided in this post is for informational purposes only and does not constitute financial, investment, or professional advice. This post should not be considered as a recommendation to buy, sell, or hold any particular investment or security. Investments in AI and related technologies involve inherent risks, and past performance is not indicative of future results.