Top insights

Investor POV

Investors and CEOs need a climate risk strategy now more than ever. Here are 5 reasons why.

Deven Parekh, Madeleine Goldberg

Insight Onsite

Hiring decoded: How top-performing companies hire their marketing leaders

Charlene Chen, Ally Baker, Dustin Zaloom, Pax Kaplan-Sherman

Thought Leadership

Tech valuations are at a 10-year low — but optimism should be at a 5-year high. Here’s why.

Ryan Hinkle

Investor POV

Investors and CEOs need a climate risk strategy now more than ever. Here are 5 reasons why.

Deven Parekh, Madeleine Goldberg

Insight Onsite

Hiring decoded: How top-performing companies hire their marketing leaders

Charlene Chen, Ally Baker, Dustin Zaloom, Pax Kaplan-Sherman

Thought Leadership

Tech valuations are at a 10-year low — but optimism should be at a 5-year high. Here’s why.

Ryan Hinkle

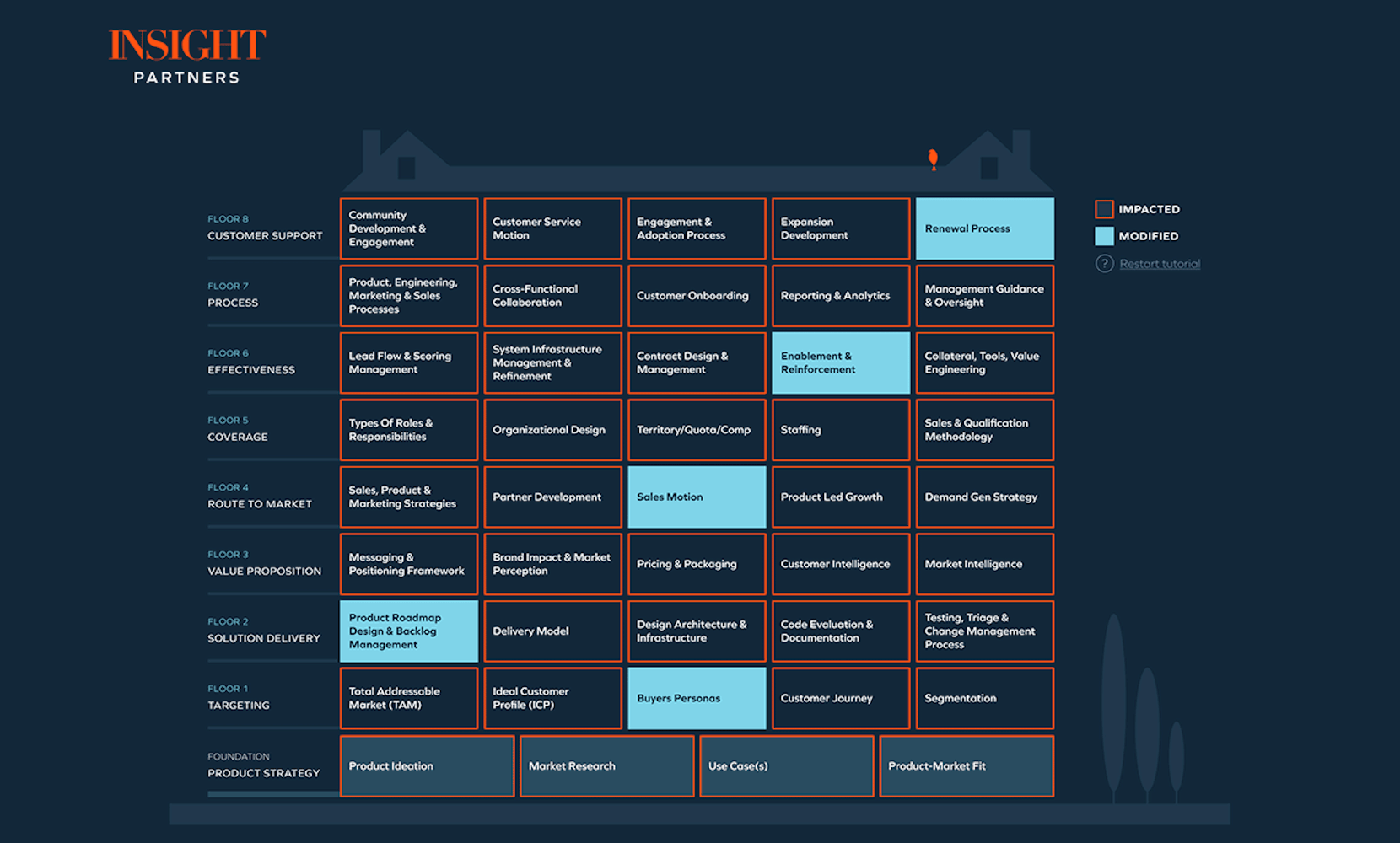

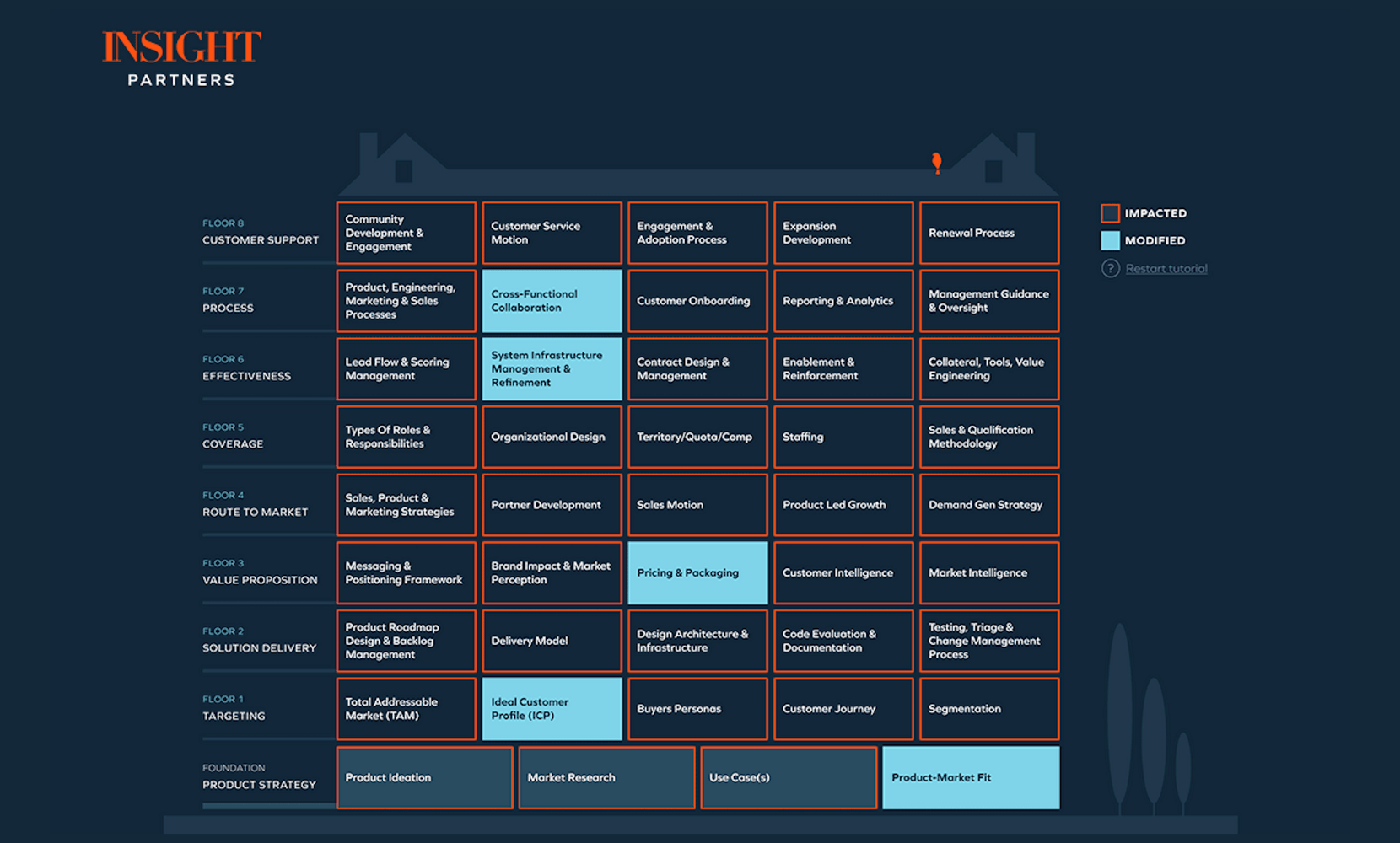

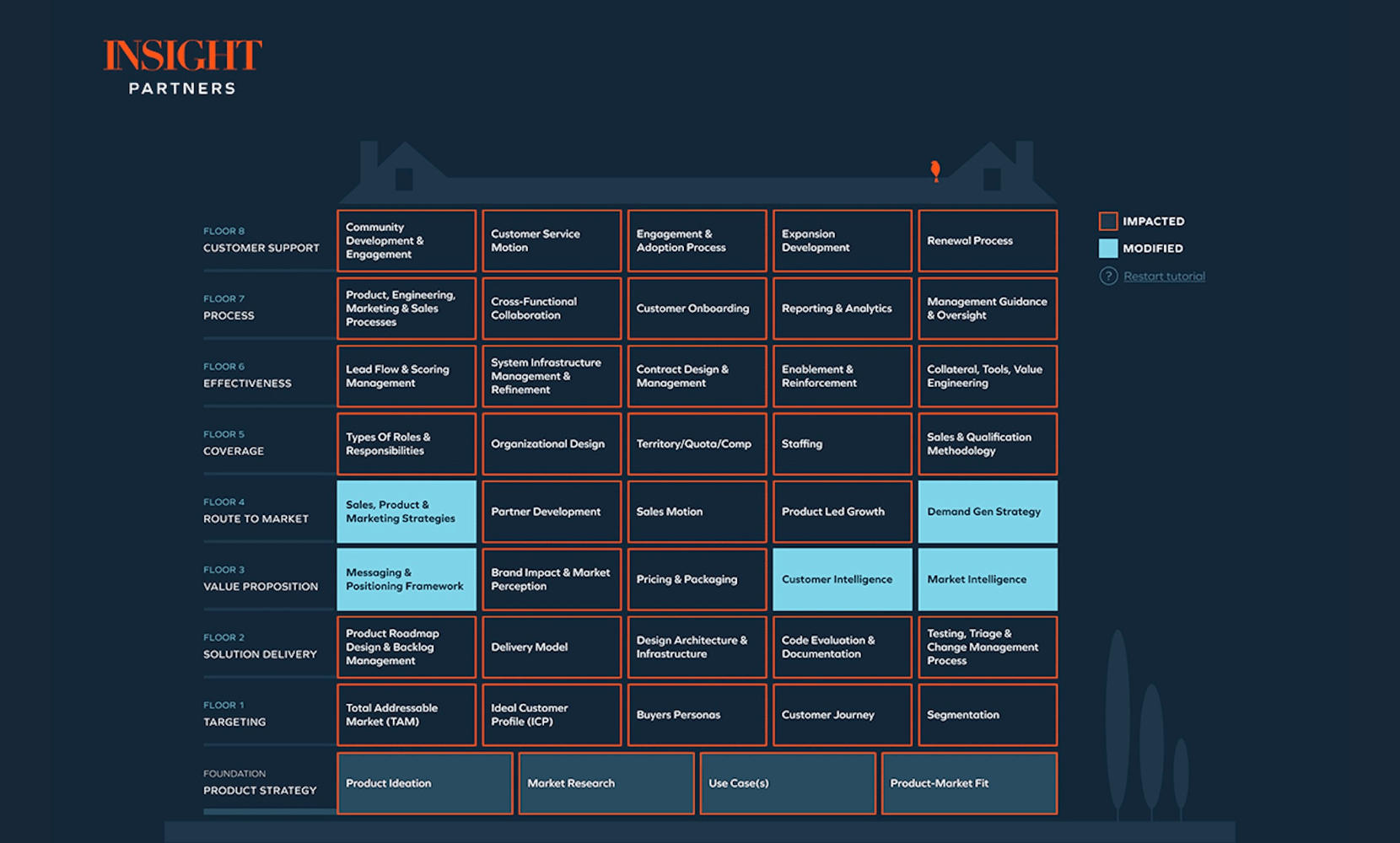

ScaleUp blueprints for business growth

Some critical events in a ScaleUp's journey shake the foundation of your full go-to-market strategy, requiring tight cross-functional alignment. This series of articles illustrates the deeper implications of some of the most commonly encountered "seismic events" software leaders ask our advisory group, and how you can use the framework to address them.

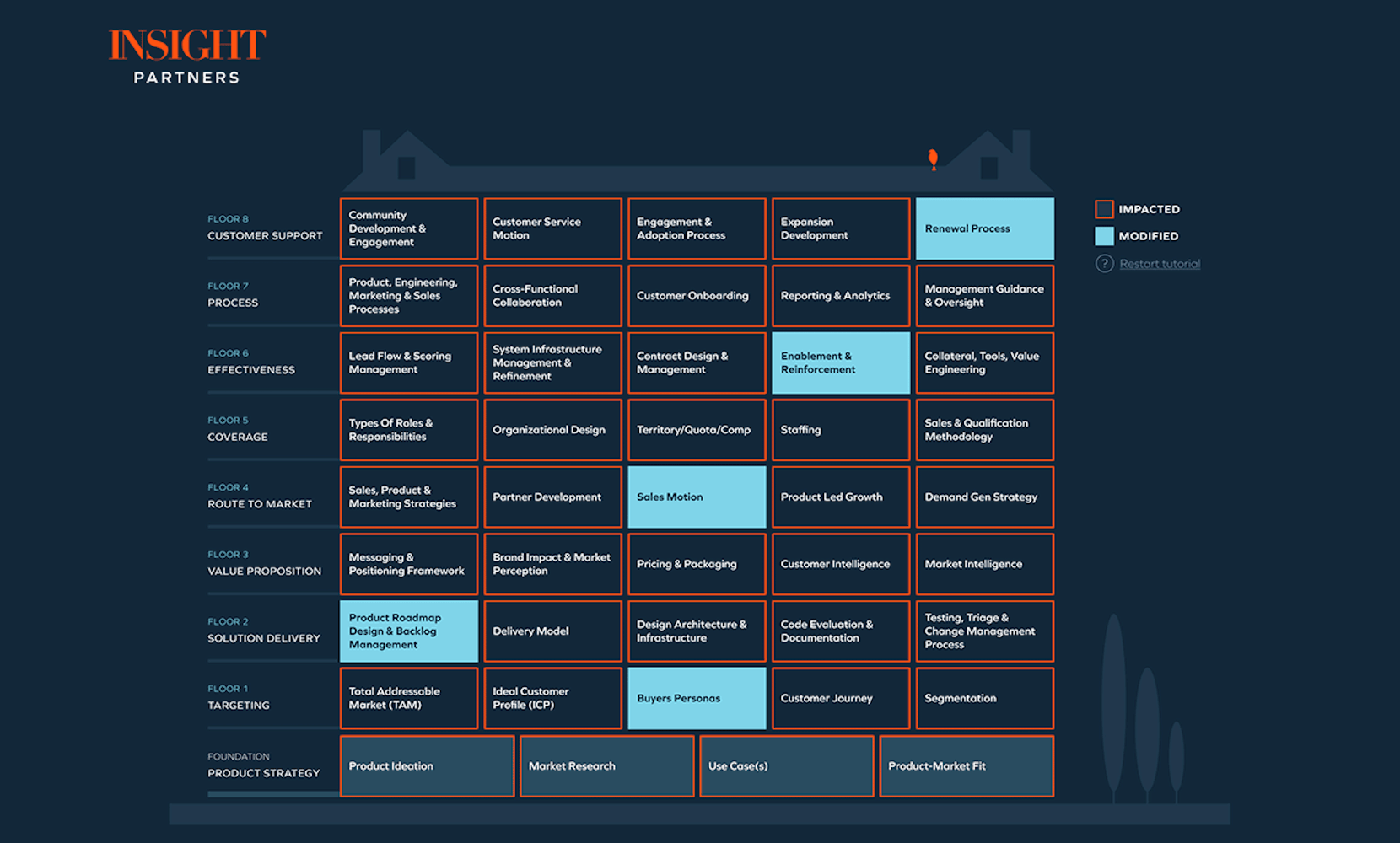

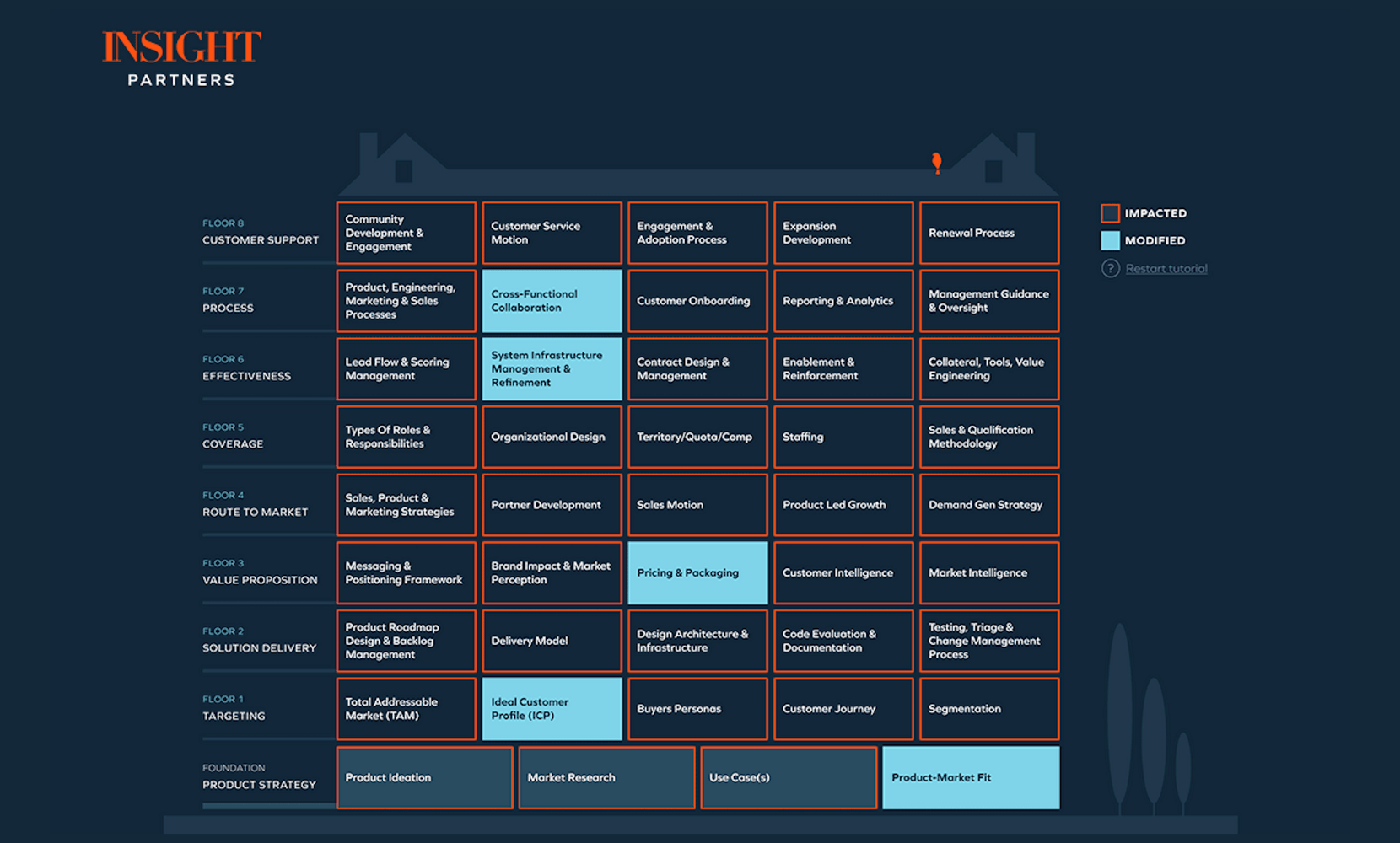

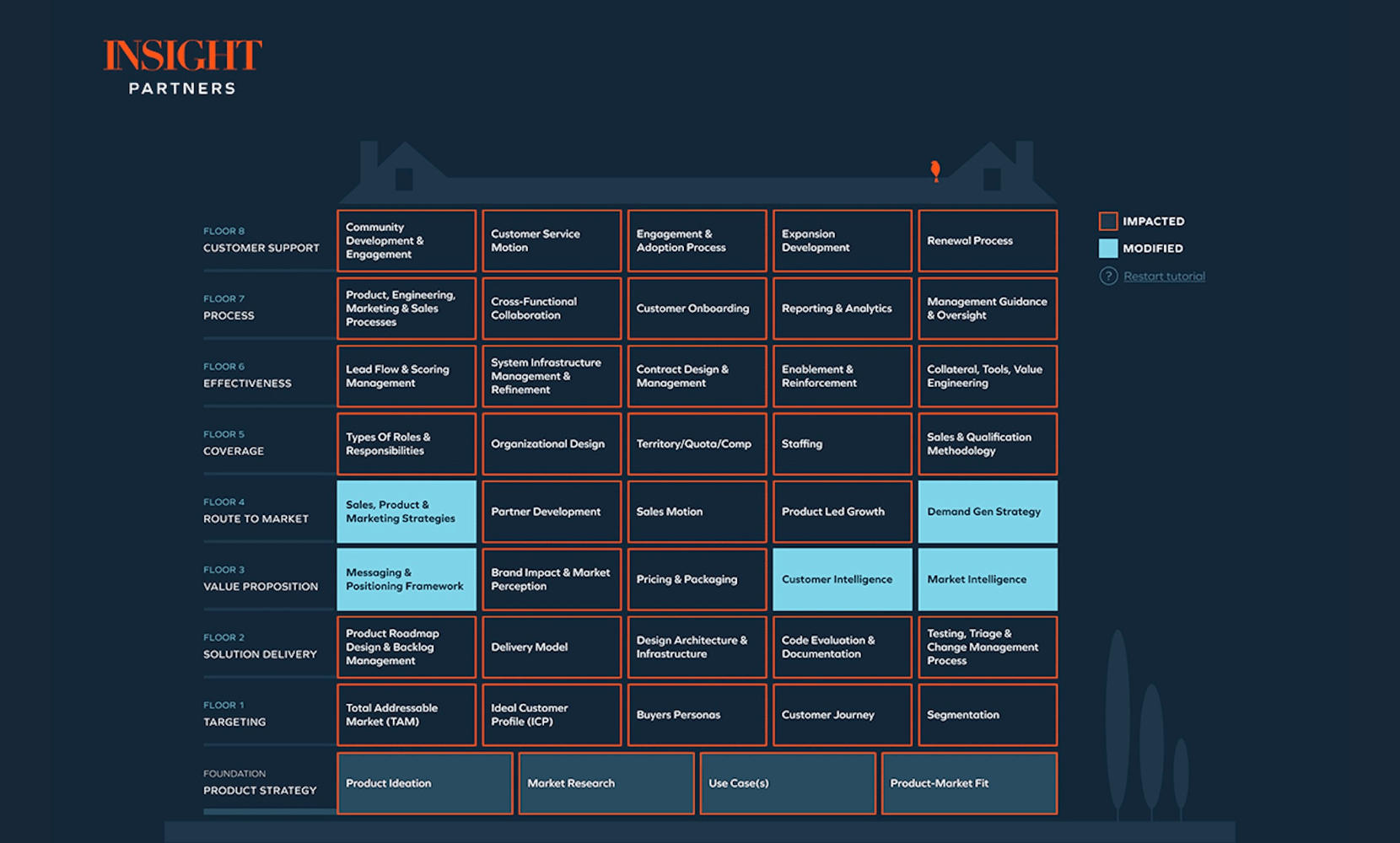

SaaS Growth Acceleration Framework

Growth Acceleration Framework

[ScaleUp Blueprint] How to navigate mergers and acquisitions to scale your SaaS business

Pablo Dominguez, Travis Kassay

Growth Acceleration Framework

[ScaleUp Blueprint] Launching a new SaaS product

Pablo Dominguez, Travis Kassay

Growth Acceleration Framework

[ScaleUp Blueprint] Prioritizing what’s important when entering a new market or segment

Pablo Dominguez, Travis Kassay

Growth Acceleration Framework

A blueprint for scaling Go-to-Market: Insight Partners’ SaaS Growth Acceleration Framework

Travis Kassay, Pablo Dominguez

Growth Acceleration Framework

[ScaleUp Blueprint] How to navigate mergers and acquisitions to scale your SaaS business

Pablo Dominguez, Travis Kassay

Growth Acceleration Framework

[ScaleUp Blueprint] Launching a new SaaS product

Pablo Dominguez, Travis Kassay

Growth Acceleration Framework

[ScaleUp Blueprint] Prioritizing what’s important when entering a new market or segment

Pablo Dominguez, Travis Kassay

Growth Acceleration Framework

A blueprint for scaling Go-to-Market: Insight Partners’ SaaS Growth Acceleration Framework

Travis Kassay, Pablo Dominguez

SaaS Growth Acceleration Framework

AI topics we're talking about

Investor POV

Investor POV

AI coding will unlock the next wave of developer productivity and reshape the software supply chain

Michael Yamnitsky, Michael Spiro

Investor POV

Investor POV: Parsing the generative AI application layer

Lonne Jaffe, Michael Spiro, Ashley Hong

Investor POV

The new generation of cloud providers: Why some programmers are moving away from megaclouds

Michael Yamnitsky

Investor POV

The next stack: Generative AI from an investor perspective

Ganesh Bell, Nikhil Sachdev, George Mathew, Sunny Singh, Jenna Zerker

Investor POV

AI coding will unlock the next wave of developer productivity and reshape the software supply chain

Michael Yamnitsky, Michael Spiro

Investor POV

Investor POV: Parsing the generative AI application layer

Lonne Jaffe, Michael Spiro, Ashley Hong

Investor POV

The new generation of cloud providers: Why some programmers are moving away from megaclouds

Michael Yamnitsky

Investor POV

The next stack: Generative AI from an investor perspective

Ganesh Bell, Nikhil Sachdev, George Mathew, Sunny Singh, Jenna Zerker

Founder and leadership stories

Leadership

May Habib is challenging a $13 billion incumbent with Writer — and it looks like she’s winning

Insight Partners

Leadership

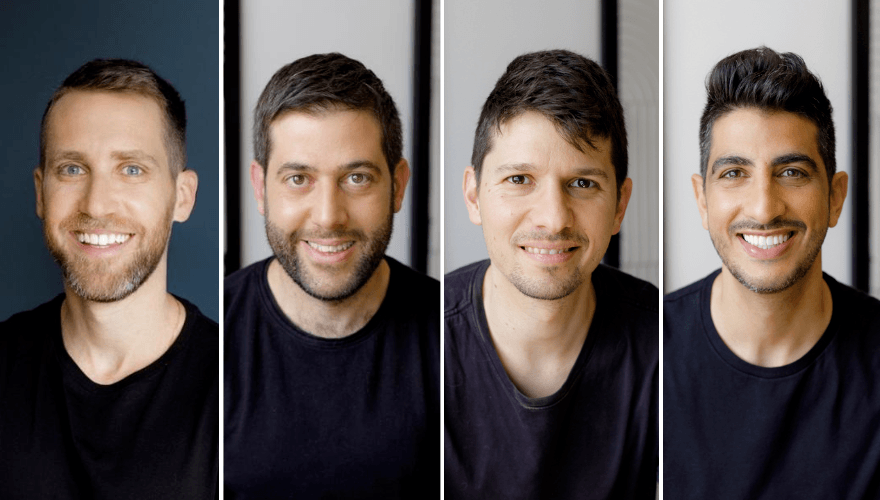

How the Wiz cofounders turned a longstanding friendship into a revolutionary cybersecurity company

Insight Partners

Leadership

May Habib is challenging a $13 billion incumbent with Writer — and it looks like she’s winning

Insight Partners

Leadership

How the Wiz cofounders turned a longstanding friendship into a revolutionary cybersecurity company

Insight Partners

Trending topics in talent