As 2021 strategic planning is in full swing, one thing is certain: no one can predict what will happen next year. The pandemic complicates business planning like few crises ever have. Despite the economic uncertainty and the twists and turns of the pandemic, you and your board have locked on an ambitious ARR growth target.

One of the most critical components of planning is knowing precisely what sales roles to hire and when to hire them such that you have enough selling capacity to achieve that growth target. Leaders often assume that, with a $5M target for next year and $1M quotas, they can hire 5 reps on Jan 1st and then hit their number. In reality, they will have perhaps less than half of the $5M planned for in that example. The often-neglected factors, such as hiring delays, ramp times, and attrition are to blame. You need to plan and begin hiring several months before you need those bookings to actually come in – or you’ll need to add additional headcount to make up the difference.

A sales capacity planning model is the best tool to avoid these common mistakes, and this article will show you how to build one. (Looking to determine your customer success capacity needs? See Capacity Planning for Customer Success). Using a set of simple but thoughtful inputs, such as yield per sales rep, ramp time, and attrition, you can quickly project your bookings for next year under various hiring plans and assumptions. The model projects how many quota-carrying sales reps you need, as well as the corresponding support roles such as first line managers, BDRs, and sales engineers.

Inputs: what you need to plug into the sales capacity model

Using four simple inputs, a sales capacity model adds up the yield of each rep, one by one, each month, to forecast your bookings for the year. If you have multiple sales teams (e.g., mid-market and enterprise), you differentiate some of these assumptions for each team.

For each input below, we provide a definition, analysis to inform it, and some of the key underlying drivers.

- Yield per fully-ramped rep is how much ARR you expect a tenured rep to produce on an annual basis. This input is the most sensitive, has the most drivers, and thus requires the most analysis in order to be accurate, so be particularly thoughtful here. First, examine historical rep productivity. Regardless of quota, what were our historical annual bookings per rep once they were fully ramped? Then look to next year. How has the sales potential of territories changed? If we’re adding reps, are territories smaller? Are we more refined on what accounts to target, so we can expect sales cycles to shorten and win rates to improve? Are deal sizes increasing or decreasing? Is there more or less pipeline for each rep to work? Are there more existing customers to sell into, suggesting a higher contribution of upsell bookings vs. new logo bookings?

- Time to full ramp is how long it takes a rep to be 100% productive, i.e., yielding what tenured reps produce on a monthly/quarterly/annual basis. ScaleUps often underestimate ramp times; again, this is time to full productivity, not time to first sale. Sales cycle and complexity are the biggest drivers. Without considering your business specifically, it is safe to assume benchmarks of 6-9 months in SMB/mid-market and 12 months in enterprise; however, each business is unique, so analyze your historical ramp times by charting monthly bookings for each rep since their first month in role.

- If you are not pleased with ramp times, there are several levers you can pull. First is onboarding and enablement: identify the skills and knowledge a rep needs to be successful – from qualification, pitch, and objection handling to negotiation and product knowledge – and create a rigorous onboarding plan that accelerates your new hires towards those requisite skills and knowledge. Devise playbooks to make it crystal clear how to successfully execute even if you are new to the company. Another is pipeline: if a new rep walks into a ‘warm’ territory with existing customers and/or opportunities, they will ramp more quickly, and vice versa. To that end, consider deploying BDR and marketing support specifically for the new reps’ territories. Last is coaching: ensure first-line managers set clear expectations and can effectively show new reps how to be successful.

- Hire date is when the rep will start, an obvious but sensitive determinant of sales capacity next year. Depending on your space, it might take several months to recruit the right rep, and of course, they may need to provide notice to their current employer. To accelerate hiring, clearly define the traits and profile of a successful rep. If you have a recruiting team, consider their bandwidth (e.g., average capacity is 5 open reqs per recruiter). Be careful assuming you can hire 15 reps between now and the end of January if you only have one recruiter, for example.

- Attrition accounts for reps leaving, voluntarily or involuntarily. Regardless of company maturity, it is safe to assume the industry average of 20%. There are several drivers, both internal (e.g., OTEs, opportunity to achieve and exceed quota, culture, performance, etc.) and external (e.g., competitor ‘poaching’, personal reasons, etc.). To determine your expected attrition, examine your historicals, or anchor on the 20% benchmark.

In the current environment, you may not be able to simply use your historical data without modification. You may need to look at March through year-end as a proxy and make the appropriate adjustments.

Example: how many reps do we need to hit our $10M target next year?

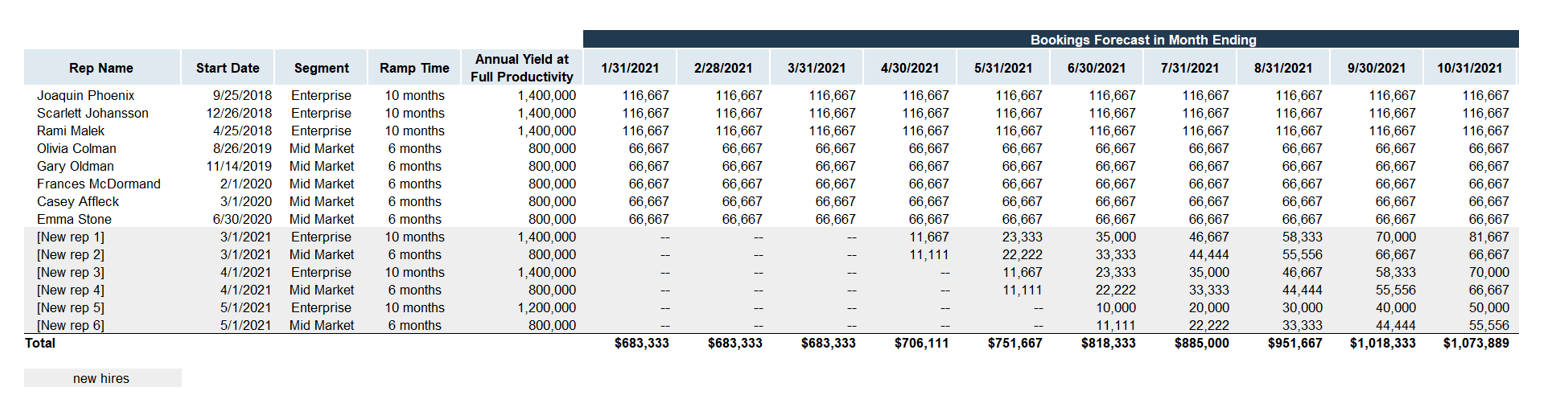

Now let’s take a look at an example model. SaaSCo is a subscription software business that sells to the enterprise and mid-market.

Assumptions:

- Yield: once fully-ramped, SaaSCo can expect enterprise reps to product $1.4M annually and mid-market reps to produce $800K annually

- Ramp: SaaSCo expects a rep to be fully productive in 10 months in enterprise and 6 months in mid-market

- Hire date: SaaSCo has 3 enterprise reps and 5 mid-market reps in place today. SaaSCo thinks they need 3 more enterprise reps and 3 more mid-market reps, and they can hire them by May

- Attrition: SaaSCo isn’t sure what to expect, so they’re assuming 20%

- Target: $10M in 2021 bookings

Schedule: 2021E bookings forecast (before attrition) by month

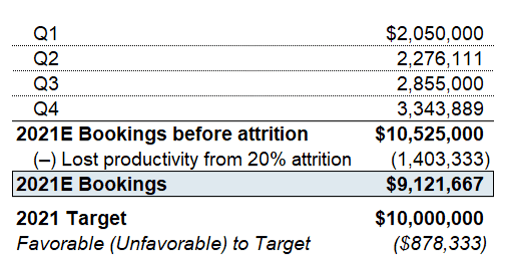

Summary: 2021E bookings forecast vs. target

The sales capacity model forecasts $9.1M in bookings, short of the $10M target. To adjust, SaaSCo needs to hire more reps, hire them earlier, ramp them more quickly, assume they can be more productive, and so on. SaaSCo can use the model to tweak assumptions to ensure they have enough selling capacity to hit the $10M target. Alternatively, they can consider more realistic targets under the various budget constraints SaaSCo faces.

Taking it to the next level: consider sales support and pipeline

Now that you know how many quota-carrying AEs you need, you need to ensure you have the proper supporting roles in place. Define your support ratios (e.g., 2:1 AE:BDR, 8:1 AE:AE manager, 3:1 AE:sales engineer, etc.) and, based on the model’s hiring plan, schedule out when you need these supporting roles to be hired.

The final step is ensuring that your reps have enough pipeline. To determine how much pipeline your reps need to hit their number, use a reverse funnel math analysis based on conversion rates and bookings targets.

Conclusion

Facing next year’s uncertainty is onerous, but with simple arithmetic and careful foresight, you can reduce that uncertainty just a little bit and set your sales team up for success next year. With a sales capacity model, you will know just how many heads to hire, and when you need to hire them, so that you can achieve and exceed your number next year. If you don’t get ahead of your capacity needs now, you might find yourself scrambling to hire more reps in June, and there won’t be enough time for them to ramp and contribute bookings in-year. There is enough uncertainty today to keep revenue leaders up at night, but with this simple yet thoughtful capacity model, rest assured you’ll have the team in place to execute next year.