[REPORT] How top banks are experimenting with generative AI and how it’s reshaping financial services

This post is a special feature of Insights Distilled, a weekly tech-focused email briefing read by 1,000+ financial services executives. Learn more and sign up here.

We’re on the brink of an AI revolution.

Generative artificial intelligence – or AI models trained on enormous datasets that can create new content resembling human output – is set to disrupt financial services as we know it.

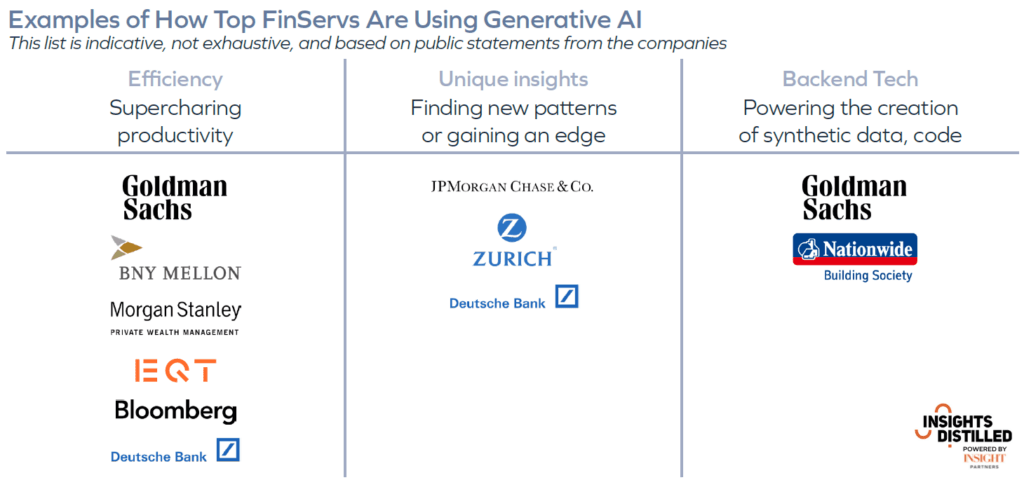

There’s been a whirlwind of news, experiments, and progress over the past year that has shown how this technology could help FinServs increase operational efficiency, improve personalization to serve customers better, and uncover unique insights hidden within gobs of data in record time.

Based on close coverage of the topic, Insight Partners’ $4 billion investment in artificial intelligence since 2014, and interviews with execs, analysts, and experts, Insights Distilled has compiled the top areas of potential for financial services – and how those use cases are already being explored by innovative firms.

For example, Morgan Stanley, JPMorgan, Goldman Sachs, and Zurich Insurance are already experimenting with ways to use GenAI in wealth management, customer service, code creation, and more.

“There’s a mad scramble right now to figure this out,” as the CEO of Evident AI, Alexandra Mousavizadeh, put it, including pressure from board members and senior leaders.

But the process isn’t easy.

Evident created an index earlier this year that ranks the 23 largest banks on their AI preparedness, and Mousavizadeh warns that firms eager to use generative AI need to deal with their fundamentals, first.

“If you don’t have your content management really squeaky clean, it’s really hard to run a large language model on it,” Mousavizadeh said. “You may be able to identify lots of use cases, but if your content management isn’t in order, if your data isn’t labeled and tagged appropriately, if people aren’t trained correctly, it’s very hard.”

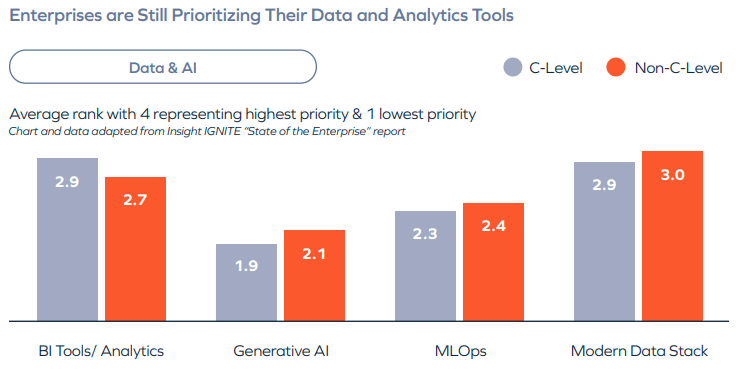

To that point, an Insight IGNITE survey of more than 300 execs from earlier this year found that generative AI ranked below other artificial intelligence and data categories.

To take advantage of the enormous potential, executives should lay out a clear technology strategy to prepare for generative AI that includes data engineering and pipelines, MLOps tools, and finding (or upskilling) the right talent.

For much more context on how FinServs like Deutsche Bank and BNY Mellon are experimenting with generative AI, download the full report here.