AI hype, cybersecurity risks, and founder advice: 9 tech investors share predictions for 2024

2023 proved to be a year of adjustment and change in the tech industry. As Ryan Hinkle said in our 2023 predictions, “2023 is about more nailing it, less scaling it. 2023 should be a year where efficiency comes first and additional costs come second.”

As many companies felt the market adjustment, AI development continued at a breakneck pace. As Lonne Jaffe predicted, “Many had been operating under the assumption that manual labor and simpler knowledge work would be most disrupted by AI and automation, but with large foundation models like GPT-3 and DALL-E, we’re seeing AI systems make enormous progress in highly creative tasks like design, programming, music, and creative writing.”

A year after predicting this, Open AI has productized its GPT offering and is reportedly in development with GPT-5.

2023 was a busy year for Insight as well. Our team continued these key conversations while supporting our portfolio and engaging with builders and innovators at major tech industry events like RSA, Pavillion, and KubeCon, among many others. Insight also led the conversation in AI with a record-breaking second ScaleUp:AI conference featuring builders and enterprise leaders in the space.

What’s top of mind for nine of Insight’s managing directors this year? Read on, and don’t miss their advice for founders at the very end. If you’re curious, check how we did on our 2023 investor predictions.

You can also see some of these predictions discussed on our recent webinar.

AI hype isn’t going anywhere

“From experimentation to productization”

George Mathew: “2023 was very focused on the build: on what was necessary to put the parts and pieces in place for companies to have a generative AI embedded in how they build products and go to market. As we go into 2024, these builds are going to come out with really compelling value emerging, particularly in these systems of creation. That’s the biggest and most exciting thing because there’s going to be some significant productivity advances across software and non-software sectors.”

Ryan Hinkle: “2023 was the year of talking about AI. 2024 will be the year of seeing products in the wild, and we’re going to see some real winners and losers in the SaaS world. If you’re a workflow that can be obliterated by a generative AI engine, then you’re at risk. But if you’re a human-intensive process that can be made a lot more efficient, you stand to win.”

Praveen Akkiraju: “We’re about to see a move in AI from experimentation to productization, and productization will take different forms. You’ll find products both embedding AI to improve existing applications, as well as leveraging AI to totally reinvent a particular kind of task. As more AI applications get into production, the entire tool stack around developing, deploying, and operationalizing these applications will evolve — creating new opportunities for startups.”

Lonne Jaffe: “ChatGPT and image generators were like a spark that lit the fire of generative AI innovation, and 2023 was a year of brainstorming, hackathons, and initial product launches while working with language models and image generators. In 2024, we will likely see new developer-facing capabilities released by large foundation model players like OpenAI, and also generative AI features incorporated into existing widely-loved products that have distribution, data, and a product that both can use a foundation model as a tool, and in turn, be used as a tool.”

Thomas Krane: “Adoption of LLMs by cyber adversaries will cause a huge increase in cyber activity. Attackers will leverage low-cost LLMs to automate social engineering attacks at scale (e.g. WormGPT, FraudGPT) and leverage deepfakes and vocal synthesis to impersonate individuals. This will be magnified by heightened geopolitical instability.”

But the AI conversation is changing: From novelty to nuances, refinement, and automation

“The age of copilots is here”

Lonne Jaffe: “As the foundational technology matures, the discussion will likely shift from the novelty of AI to the nuances of its integration into existing products and services. The emphasis will be on how seamlessly AI can be woven into the fabric of daily business operations to enhance productivity and decision-making. Attention will turn to the refinement of AI outputs, reducing errors, managing legal and regulatory issues, and improving the user experience.”

Praveen Akkiraju: “The age of copilots is here, and it is redefining work as we know it. Everything from complex enterprise workflow automation to task automation for knowledge workers will be fundamentally transformed by GenAI. Leveraging natural language interfaces, AI agents, and LLMs for data extraction and inference, startups are building some exciting automation platforms.”

AI developer tooling parallels with cloud computing’s early days

“There are striking parallels between cloud in 2013 and AI today”

Michael Yamnitsky: “There are striking parallels between cloud in 2013 and AI today. AI developer tooling is in its infancy, with numerous tools that solve smaller parts of building an AI-powered application or deploying an LLM. The result is the same type of tool sprawl and complexity that persists in cloud-native development. Entrepreneurs should take a cue from what happened in cloud-native development and focus on building more unified toolkits for developers and data engineering teams to build AI software.”

“Hyperscalers are building up their AI capabilities, but there remains an elephant in the room. How will end-user applications interact with cloud-based inferencing engines without bloated egress fees? We think edge computing will play a role in AI-powered software development. Edge was a sleeper topic in 2023, but we expect to see more developments and buzz in this space in 2024 and 2025.”

AI emerges as a healthcare hero

“The biggest advances in generative AI in healthcare may emerge from unexpected places”

Scott Barclay: “AI in healthcare is in the second inning of a generational change that will remove costs, catch errors, and improve clinical medicine. What’s needed right now is better software infrastructure to test and validate genAI in a safe health context.”

“We are very excited to find more ambitious new companies that simultaneously impact clinical medicine and the business of healthcare.”

“The biggest advances in generative AI in healthcare may emerge from unexpected places. Not the high-flying 2023 funded startups, but from within health systems, or from outside of the mainstream, including from outside the U.S.”

Cybersecurity takes center stage

“The risks created by AI will only be combated with AI”

Stephen Ward: “In 2024, you’re going to see security try to fix AI risks with existing cyber solutions. It will be a painful year to try to do that. But, as we get toward 2025, we will see a dawn of new cyber security companies that are foundational AI companies that just happen to do security, and they are going to be very disruptive.”

“This is likely to happen in the latter part of 2024, as there aren’t many AI security companies at the moment – there are not enough founders, but there need to be so that we can properly protect AI with AI security. It’s going to be too difficult to protect AI applications with traditional security methodology, as some of the risks created by AI will only be able to be combatted with AI. AI security companies will be able to use LLMs to completely disrupt data protection, and identity management spaces will be created. Toward the end of 2024, we’re going to have a true AI identity access management company.”

Michael Yamnitsky: “New compliance mandates for scanning containers for vulnerabilities and use of CVE-riddled open-source software push the limits of enterprise vulnerability management programs. The problem might only get worse if large enterprises embrace open-source LLMs. Expect to see wider adoption of golden container images that lessen the burden on security teams by making software secure by default.”

Lonne Jaffe: “As AI systems process increasingly sensitive data, the risk of data breaches grows. Founders must ensure robust data security measures are in place, which can be complex and resource-intensive. This issue will become more challenging if language models are used by adversaries to ‘upgrade’ cyberattacks.”

Thomas Krane: “Attackers will benefit from an increase in weak or insecure software code due to the adoption of LLMs by inexperienced software developers, combined with decreases in experienced software engineering oversight capacity due to layoffs.”

“Despite the clear trend toward increased regulatory oversight on large-cap M&A, perhaps regulators will take a softer stance on cyber M&A if there is a plausible argument that such acquisitions will bolster national security.”

Unethical models of AI will present a cybersecurity risk

“There will be some terrible uses of generative AI in the context of cybersecurity”

George Mathew: “We’re going to be much more prone to cyber attacks, as there are unethical AI models like WormGPT that have been trained to do nefarious things. That’s something that will continue to come out in the spotlight as those attacks occur. We should be reasonably assured that there will be some terrible uses of generative AI in the context of cyber, and I don’t think there are enough people talking about that today.”

Thomas Krane: “Adoption of LLMs by cyber adversaries will cause a huge increase in cyber activity. Attackers will leverage low-cost LLMs to automate social engineering attacks at scale (e.g. WormGPT, FraudGPT) and use deepfakes/vocal synthesis to impersonate individuals. Unfortunately, this will then be magnified by heightened geopolitical instability. Attackers will also benefit from an increase in weak and insecure software code, due to the adoption of LLMs by inexperienced software developers – combined with a decrease in experienced software engineering oversight capacity due to layoffs.”

Cybersecurity isn’t thinking big enough

“You’re competing against customers doing nothing”

Stephen Ward: “One of the biggest problems in cybersecurity right now is lack of differentiation and messaging in the market. There are so many technologies in this space, and there’s a lack of differentiation in messaging. I tell our founders, you’re not competing against competitors; you’re competing against customers doing nothing. We have so many buyers out there that become so overwhelmed that they’re more inclined to do nothing if it’s not clear what the value proposition is.”

2024 will be the year of M&A

Stephen Ward: “2024 will be the year of M&A, especially for cybersecurity startups, and 2025 will most likely be the year of IPO. What we’re seeing is that companies are not being funded and are either dying off or bought up through M&A. But, the good companies that don’t go under and don’t get bought will IPO in 2025.”

George Mathew: “This is a solid landscape for consolidation and M&A because everyone that didn’t raise in the last 2-3 years that now has capital needs may not get financed due to where markets are right now. Founders are going to have to look at other opportunities to grow their companies, which could include consolidating and merging.”

Ryan Hinkle: “Many founders raised in 2021. Founders aren’t supposed to raise capital all the time. You get capital when you can demonstrate an ability to turn that capital into future equity value. Before, that was reasonably easy, but it’s becoming harder now. Unless you have evidence, the skepticism is higher.”

Whit Bouck: “Given the climate today is not what it was in 2021, money is not as inexpensive as it was, so I think we’re going to see quite a bit of market consolidation and an uptick in M&A. If you think about 2021, we saw a lot of investment across the VC community in fintech and so many startups coming out in fintech. Some of those are probably going to consolidate, and it will make sense to do so because they’ll be a more powerful player in the market when aligned with another company – either as a merger of equals or a home and a parent company that have better resource pools. I think we’re definitely going to see an uptick in M&A; we’ve already seen it to some degree, even toward the end of this year.”

A return to normalcy?

“2024 is a candidate for the first normal year since before the pandemic”

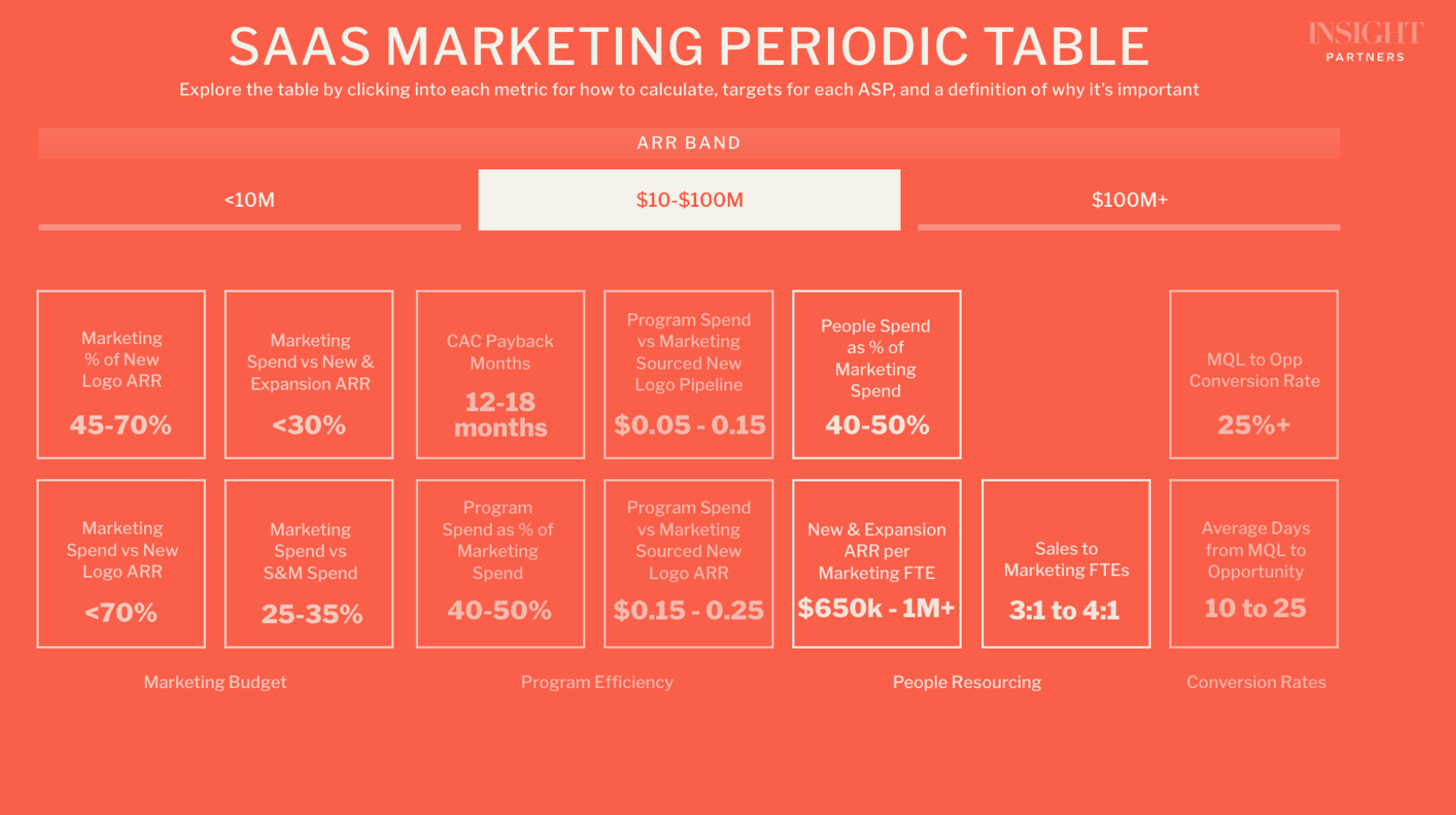

Whit Bouck: “I think we’re all hoping that this is a year that we see some return to normality, particularly in the marketing teams in companies around the globe. When we go into financial retraction, the first budget that ever gets cut is marketing, because they have the most dispensable cash, and you don’t want to cut jobs if you don’t have to. And I think we’re starting to see that companies are starting to come back a little bit and re-invest in some of the more modern marketing and sales technologies.”

Ryan Hinkle: “2024 is the best candidate for the first normal year in a stable market since before the pandemic. We’ve had nothing close to normal in five years. Buying behavior should return to normal, as they overbought in 2021 and spent 2022 and 2023 underbuying.”

“But regardless, 2024 will be the closest to normal we’ve had in the past four years in general buying habits, predictability, and sales cycles. I’m looking forward to good news meaningfully outnumbering bad news for the first time in a while. In 2019 and earlier, you’d have a four-to-one ratio of good news to bad. For most of the past seven quarters, it’s been the opposite, if not worse.”

Advice for founders

“Every dollar is precious, at every stage”

Ryan Hinkle: “Pretend the cash you have is the only cash you can get. If you absolutely need more cash, take the best partner, not the best price.”

Praveen Akkiraju: “The only thing that matters at this point is whether your product is delivering value for customers, and it is indispensable. Your customer metrics are fundamental to a lot of key things like your growth, churn, and competitiveness. Keep it very simple. Obsessively focus on your customers — what problems are they trying to solve, how are they evaluating your product, how are they using your product and go build it.”

Scott Barclay: “Every dollar is precious, at every stage. Only move to scale once you’ve truly built the better solution and repeatedly proven retention, extension, and repeatability.”

Whit Bouck: “Look for your best opportunities for growth. Find signals for where you can grow and pour the gas on.”

Thomas Krane: “Be proactive enough to create options for yourself, especially if you are down to less than 12 months of runway. Is it possible to get profitable on current revenues and cash? If so, you should strongly consider that approach. If not, start speaking to your inside investors about a bridge/follow-on or a potential sale/merger. It’s much better to have these conversations and take requisite action while there is still time to have a plan.”

George Mathew: “Continue to build good ecosystems around you as a founder — maintain good partnerships and become friends with folks larger than you in the space. Strategic opportunities almost always arise from pre-existing relationships.”

Disclaimer: This post contains forward-looking statements and predictions regarding the future of AI. These statements are based on our current expectations and assumptions, and actual results may differ materially from those expressed or implied in these statements. The information provided in this post is for informational purposes only and does not constitute financial, investment, or professional advice. This post should not be considered as a recommendation to buy, sell, or hold any particular investment or security. Investments in AI and related technologies involve inherent risks, and past performance is not indicative of future results.