IPO windows: Why they exist, and why they will never go away

In my training as an associate at Insight over 20 years ago, someone said, “Any deal takes a minor miracle to get closed.” They were not talking about IPOs. IPOs are closer to a major miracle — as taking a company public requires resolutions to a series of paradoxes.

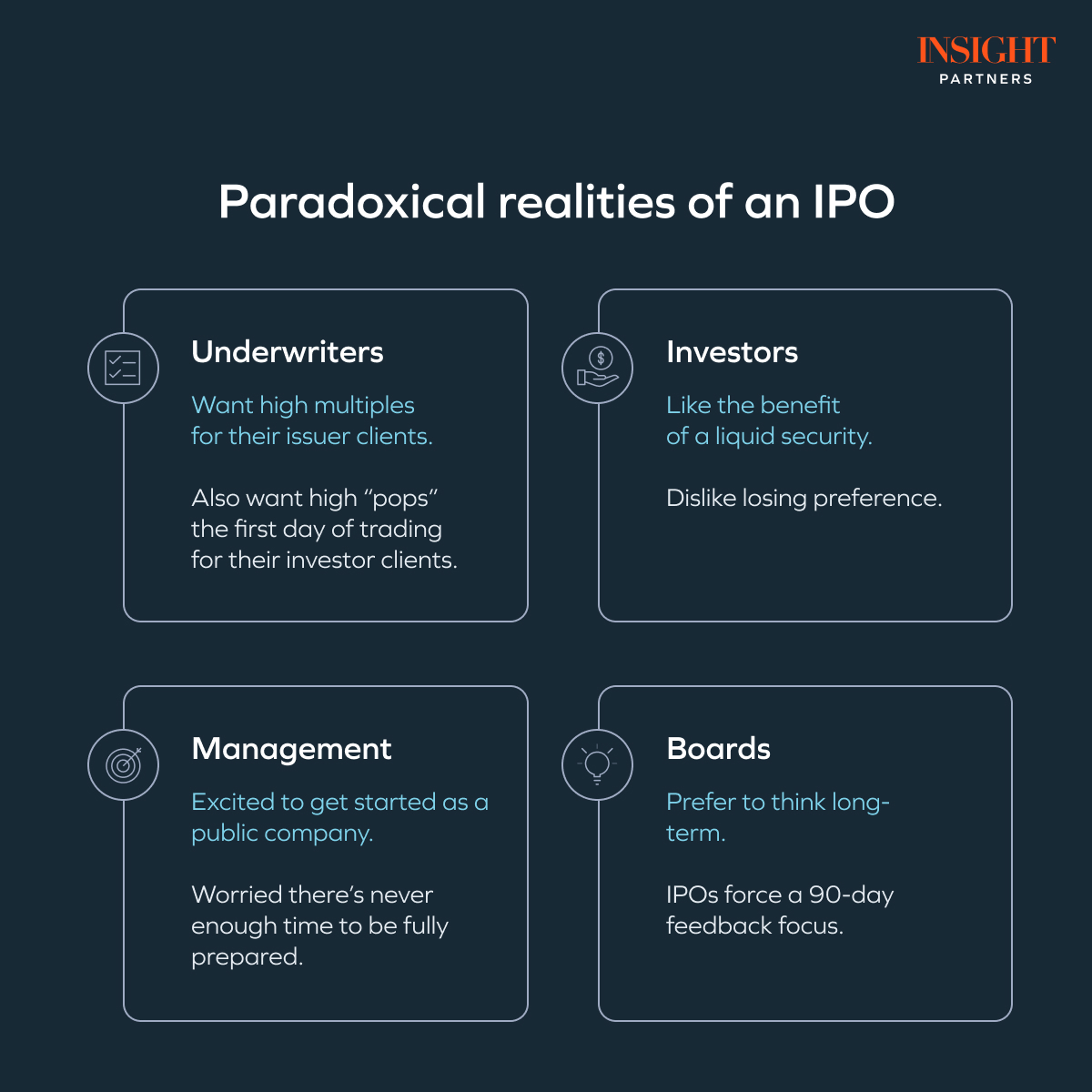

I count four critical parties, each with their own paradox to wrestle with: underwriters, investors, management, and boards.

- Underwriters want high multiples for their issuer clients, but they also want high “pops” the first day of trading for their investor clients.

- Investors want the benefit of a liquid security, but they don’t love the idea of losing preference.

- Management teams love the idea of being public, but there’s never enough time to be fully prepared.

- Boards want to think long-term, but IPOs force a 90-day feedback focus.

These are just a few of the paradoxical realities of an IPO. Yet underneath all of this is the biggest paradox of all. The best outcomes for founders and investors require an IPO, but a stumble post-IPO can leave you in a worse position than never going public at all. I can’t name a trillion-dollar private company, but there are many, many examples of take-privates at or below IPO prices.

Yet underneath all of this is the biggest paradox of all. The best outcomes for founders and investors require an IPO, but a stumble post-IPO can leave you in a worse position than never going public at all.

Tech media does not tend to discuss paradoxes in this way. They talk instead about the IPO window. While many of us know the sentiment, I don’t think the imagery is well captured using a metaphorical “window.” It’s really a series of Venn diagrams representing each of the four paradoxes. The tiny slivers of overlap on any single Venn diagram exist only where there is common ground between both sides of the paradox. Each set of circles is subject to market forces that determine if the circles are moving closer together or farther apart. If there is overlap across all four, then the IPO window is open. But, if any single one has no overlap, the window is closed.

The point is that the IPO window is an observed output: We can see IPOs happening or not happening. The paradoxes in this article are the inputs.

As a company, you cannot predict how these opposing circle forces will move in the future. One Fed decision, one inflation print, one job data release, or one geopolitical flareup can disrupt the behavior of these circles — and that’s just to name a few. There is no point in trying to predict IPO windows. You cannot control them.

What you can control is your preparedness. And, part of your preparedness is understanding which paradox will be the biggest obstacle in your IPO journey.

What follows is a deeper discussion of the four main paradoxes. We will not spend time here on IPO prep mechanics like hiring bankers, board recruiting, financial preparedness, SOX, etc. We concentrate instead on the emotional considerations for each paradox. In the end, it should be clear why these windows slam shut so quickly — and why it takes a really long time to pry them back open.

Paradox #1: Underwriters

The investment banks soliciting companies to take public all want to tout success with valuations and outcomes in prior deals. League tables are prepared to show all the reasons why one bank should be selected over another. But that’s only part of the story.

On the other side of the transaction, there are investors who buy stock at IPOs. Those investors want the lowest possible price. If the investment bank prices too high, they will have upset investor clients who may walk away entirely. If they price too low, then it will affect their league tables.

It’s a very precarious balance.

When markets are booming, there is more absolute value to work with. A discount to a hot market can still feel like a great price. The stronger the market, the more likely there is a balanced point where company-clients and investor-clients find common ground. When the markets are weak, the lower absolute value makes a company-client feel like they would be taking a discount on top of a discounted market. Meanwhile, the investor-clients worry about additional volatility in the market. They probably seek additional return premiums which further increases the necessary discount.

This is the primary reason you see IPOs evaporate whenever bear market conditions arise. If you cannot find common ground in price, there is nothing more to solve for. But, the markets have raged back and stabilized over the past six months, and IPO activity has not yet picked up. At this point in the cycle, the other three paradoxes are more likely the reasons why.

Paradox #2: Investors

For most of the past 15 years, I never understood an investor’s reluctance to go public. Post the global financial crisis, most IPOs had no secondary. If you are raising primary, the IPO price has almost no effect on the end-of-time value of the company.

For example, if you are selling 10% of the company at IPO, the difference between a $2B price (scenario A) and a $2.5B price (scenario B) is $50M more on your balance sheet. At the end of time, even if the company reaches $2.5B, scenario B is only $50M better. IPOs are always shares limited. Less price means less cash on the balance sheet. No secondary means there is no cost to selling shareholders because there are no selling shareholders.

That sentiment is still 100% true in my head, but a new wrinkle has emerged from the tech valuation comedown that followed the COVID-era euphoria. Investors paid extremely high prices at the height, and they often negotiated for liquidation preference. In an IPO, even if there are make-whole provisions to replicate liquidation preference at pricing, the moment after IPO, investors end up with common stock with no liquidation preference. Combined with choppy markets, investors know that any bumps post-IPO could leave them substantially worse off than if they retained private company liquidation preference. The prevalence of high prices with liquidation preference followed by a big drop in valuation multiples will continue to force a longer-than-usual reopening of the IPO window.

Paradox #3: Management

This paradox exists in all market conditions, and it will exist for all time. Aaron Skonnard, a founder/CEO and dear friend, once told me about a speech he gave. The title of the speech, and the main punchline, was “It’s never a good time.” In the speech, he was talking about life events like having your first kid, changing your job, or getting a tough diagnosis. Nothing life-changing is convenient in our overscheduled lives. For management teams considering an IPO, this sentiment is all the more true, and it can trigger substantial anxiety.

At Insight, we have invested in hundreds of ScaleUp software companies. There is one unalienable truth that we have witnessed time and time again. While growth is the best financially, it can also be the worst operationally. When companies are in hypergrowth, they tend to outgrow the systems as quickly as the systems are implemented. It’s really hard to grow fast and get all of the operational “stuff” right along the way.

While growth is the best financially, it can also be the worst operationally.

That can leave a CEO a bit unsettled, particularly when all the IPO literature says, “Make sure you have eight quarters of high predictability.” Do you know what’s really hard to predict when you have a lot of growth? High growth. Do you know which companies are likely to have systems behind revenue scale? High-growth ones. And, do you know which companies are bullseyes for IPO candidacies? High-growth ones.

It’s axiomatic. Management teams of high-growth companies have a wish list of things they want to do before IPO — but not all of that is practical or tenable. Finding comfort in spite of the knowledge that you will never be all the way perfect is the key to this paradox. This is an important one because CEOs must lead the IPO charge. An investor group cannot demand a company go public. It’s too hard. This must come from a place of deep personal conviction. Anything an investor group can do to help get scale-ready systems in place will help minimize this paradox as a journey obstacle.

Paradox #4: Boards

The final hurdle is overcoming the necessary reality that public companies are held to a simultaneous standard of not only hitting targets each quarter but also hitting a multi-year arc of performance. Many of us with public board service understand the pressures of a quarter, the challenges of being placed in the penalty box, and the perils of short-term optimizations at the expense of the longer term.

Alignment across the board is key. Clarity of instructions to management is key. Communication is key. I believe this paradox is best overcome with explicit board-level discussion on tradeoffs — if a quarter is $1M light, unless $2M of future is “mortgaged” to hit the current quarter, there needs to be open communication about it. The best boards are able to keep an eye on the long game while delivering predictable and understandable short-term results. Total alignment before the IPO process even starts is the best way to manage this paradox. That alignment will serve boards well long into their tenure as public boards.

What this means for IPOs in 2024

So, what does this all mean for IPOs in 2024? In late 2022 and all of 2023, paradox one precluded any activity due to the valuation dislocation. Now we are entering a period where IPOs are possible from a value perspective. But, I would not expect any rush of companies to launch IPOs.

Paradoxes two, three, and four remain the problems to be solved. My best advice if you are a CEO is to speak openly and candidly about all of these paradoxes on a 1:1 basis with each constituent. The better you understand the contours of how everyone is thinking, the better you will infer where there is Venn diagram overlap. And you will know that once you see overlap across all four groups, your window will be open at last.